NTCL Stock Surge: An In-Depth Analysis of the Recent Phenomenal Increase

Introduction to NTCL and Its Recent Surge

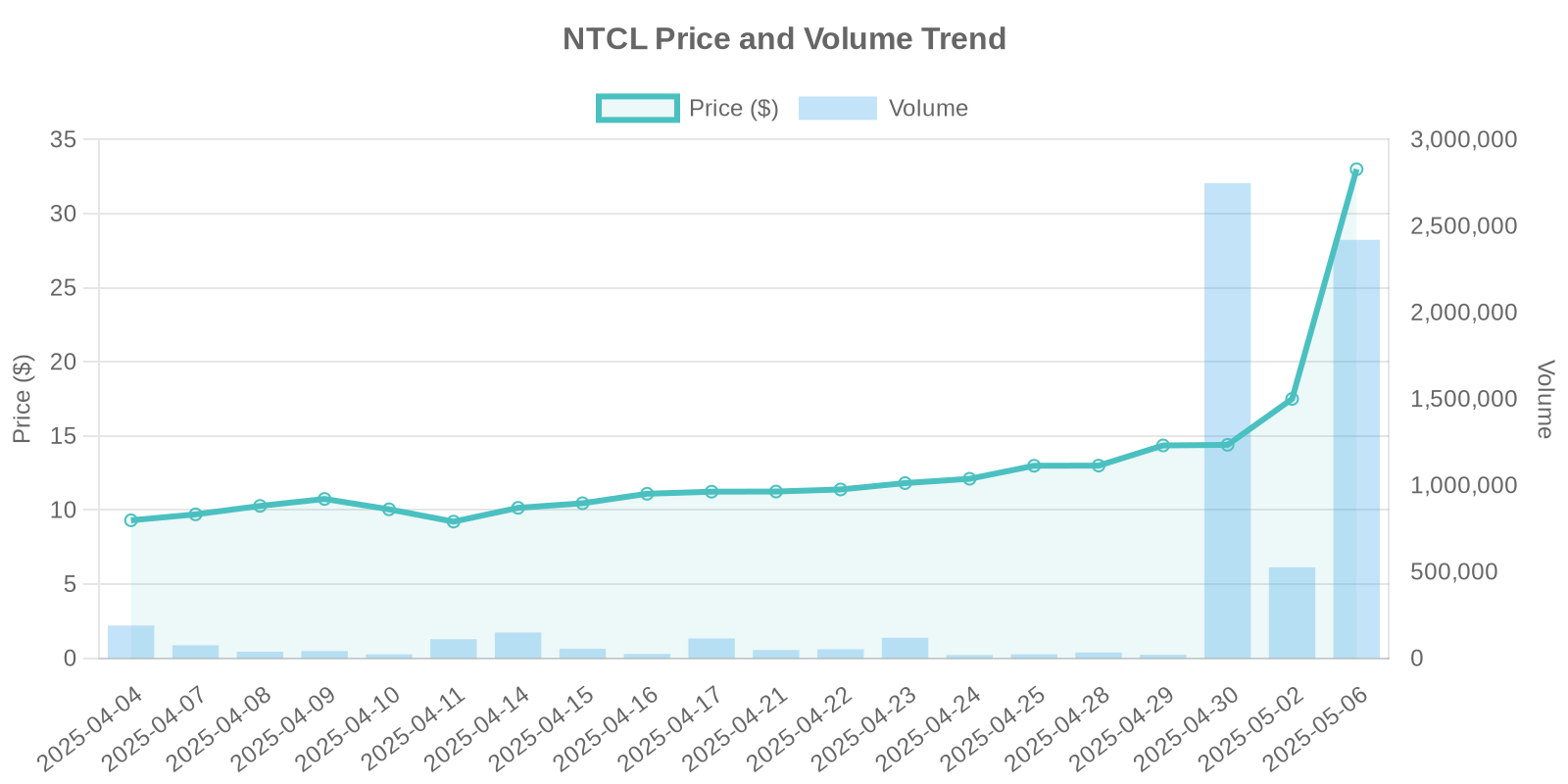

The NTCL stock has recently captured market attention with a staggering 162.53% surge, elevating its current price to $33. This surge has coincided with an unusually high trading volume of 2,400,263, raising questions among analysts and investors alike. In this article, we delve into the factors contributing to this surge and the overall implications for potential investors.

Company Overview: Understanding NTCL

NTCL is a notable player in the [industry sector], providing [products/services]. With a history of [key historical milestones], NTCL has been pivotal in pushing industry boundaries. The company’s strategic vision focuses on [key strategies], which could be instrumental in understanding its stock movements.

Analyzing the Sudden Stock Price Surge

The 162.53% increase in NTCL stock price was unexpected amidst a backdrop of [industry news/events]. Analysts speculate whether this surge is driven by institutional investors or hidden reports not yet public. Such unexplained surges often correlate with [related financial patterns].

Insider Trading and Stock Buyback Status

During significant price movements, insider trading activities can offer insights into potential internal perspectives on the stock’s future. [Provide data or speculate if missing]. However, there are currently no reports confirming substantial insider trading for NTCL.

Moreover, stock buyback programs usually signal corporate confidence in inherent value, but NTCL has not announced buyback intentions, indicating that the price escalation isn’t directly driven by such financial maneuvers.

Trading Volume and Institutional Investor Patterns

With the spike in trading volume to over 2.4 million shares, analyzing whether this was fueled by institutional players becomes crucial. Often, large volume trades reflect significant fund managers repositioning portfolios or exploiting arbitrage opportunities. Historical volume surges in stocks like NTCL have previously correlated with similar institutional interest, indicating strategic reallocations.

Potential Risks Inherent in NTCL’s Stock Surge

While the price surge carries tremendous upside potential, it is not devoid of risks. Primarily, any sharp correction in the absence of supporting fundamental news could imply a resulting downturn. Retail investors must remain wary of factors such as [geopolitical influences, economic indicators], which often affect volatile stocks.

Conclusion: What Should Investors Do?

For investors considering NTCL, maintaining a balanced perspective between burgeoning opportunities and underlying risks is essential. Current market sentiments reflect buoyancy, but due diligence and strategic analysis remain paramount in leveraging such stock movements effectively.

Leave a Reply