Analyzing the Remarkable Surge in DEVS Stock Price

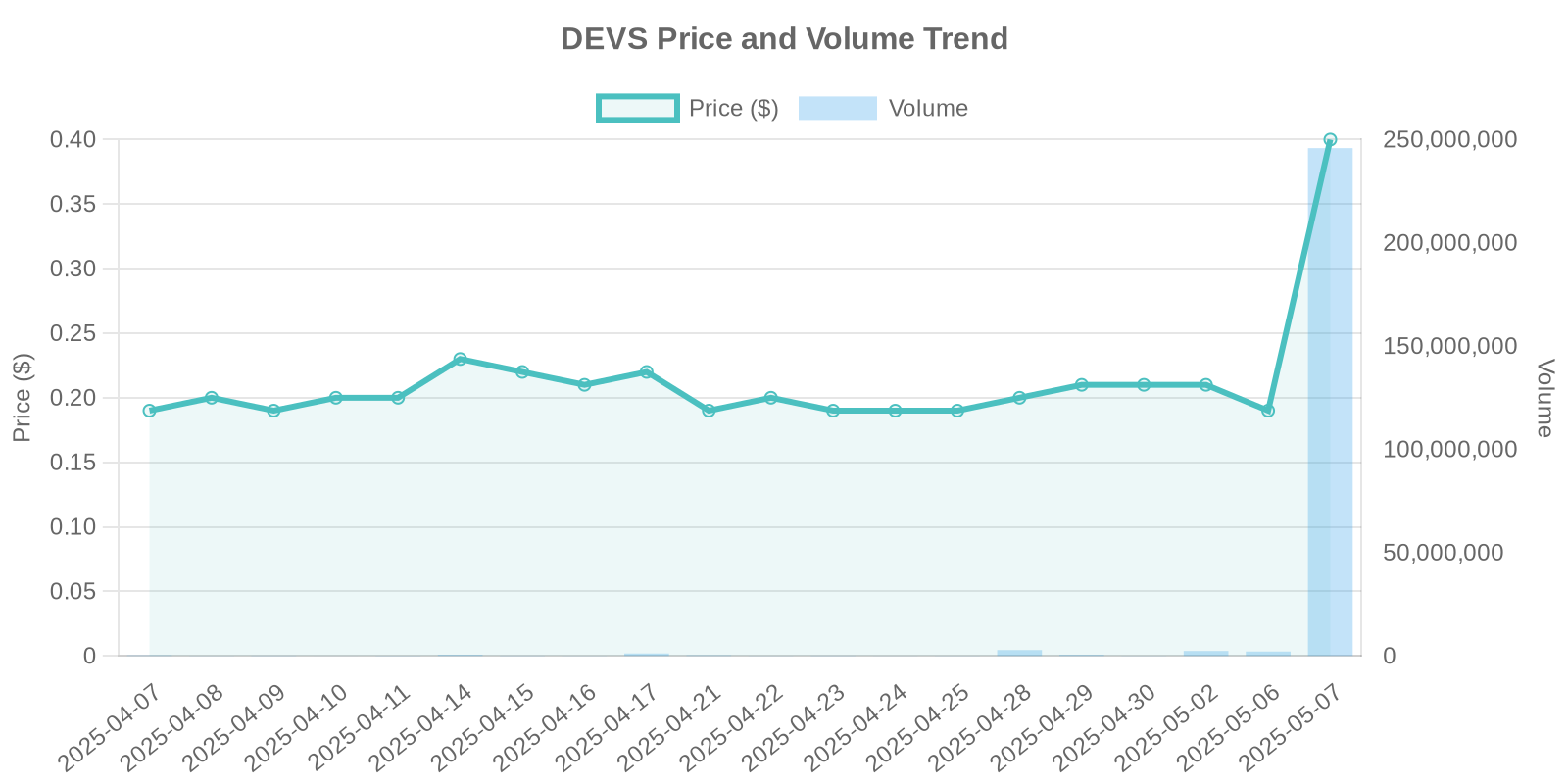

In recent trading sessions, DevvStream Corp. (NASDAQ: DEVS) experienced a significant surge, with its stock price increasing by 107.77%, reaching $0.4 per share. This unexpected leap has stirred interest among investors and market analysts, prompting a closer examination of the factors contributing to this surge.

The News Behind the Surge

On May 7, 2025, DevvStream Corp. announced a Memorandum of Understanding (MoU) with Fayafi Investment Holding, aiming to create a joint venture named Fayafi x DevvStream Green Ventures. The partnership signifies a major step towards accelerating global sustainability investments, focusing on decarbonization and climate infrastructure projects. The venture is capital-light, strategically combining DevvStream’s technical expertise with Fayafi’s financial resources. This collaboration is anticipated to unlock high-impact opportunities, fueling investor optimism and contributing to the stock’s recent climb.

Understanding DevvStream Corp. and Its Market Position

DevvStream Corp., a leader in carbon management, specializes in the development, investment, and sale of environmental assets. The company’s focus on sustainability and environmental impact aligns with the increasing global emphasis on ESG (Environmental, Social, and Governance) investing. The MoU not only strengthens DevvStream’s operational capacity but also positions it as a key player in global environmental initiatives, providing shareholders with the promise of long-term growth and stability.

Industry Trends and Market Dynamics

The carbon management industry is poised for notable growth as companies worldwide aim to reduce their carbon footprints. With heightened awareness and regulations surrounding climate change, industries are increasingly investing in green technologies and sustainable practices. DevvStream’s strategic initiatives align perfectly with these industry trends, potentially offering it a competitive edge in a rapidly transforming market.

Analyzing the Surge: Institutional Trading Patterns

While the MoU announcement presents a clear news catalyst, the dramatic 107.77% surge in DEVS stock also suggests possible institutional trading patterns. Analyzing the volume of 239,394,579 shares traded, significantly higher than average, indicates strong institutional interest. Such trading volumes often reflect large-scale transactions by institutional investors, who may see the MoU as a strong growth indicator and an opportunity to capitalize on DevvStream’s future potential.

Insider Trading and Stock Buyback Analysis

Currently, data on insider trading and stock buybacks for DevvStream is unavailable. Without clear disclosures, it is crucial for investors to approach such surges with caution. The absence of insider trading activity and stock buybacks might indicate that the surge is largely driven by external market factors rather than internal corporate maneuvers.

Risk Assessment for Potential Investors

Despite the promising news and surge, potential investors should consider associated risks, such as market volatility and economic uncertainties that could impact DevvStream’s projects. Additionally, while partnerships amplify growth potential, the execution risks and the dependency on external partnerships should not be overlooked.

Conclusion: A Balanced Perspective

The recent surge in DEVS stock presents an enticing opportunity driven by strategic industry alignments and partnerships. However, investors must weigh this against potential risks and look beyond current trading patterns to make informed decisions. As always, a diversified portfolio approach is recommended to mitigate individual stock volatility.

Leave a Reply