ABTS Stock Surge: A Comprehensive Analysis of Recent Price Movements

Introduction to ABTS Stock Surge

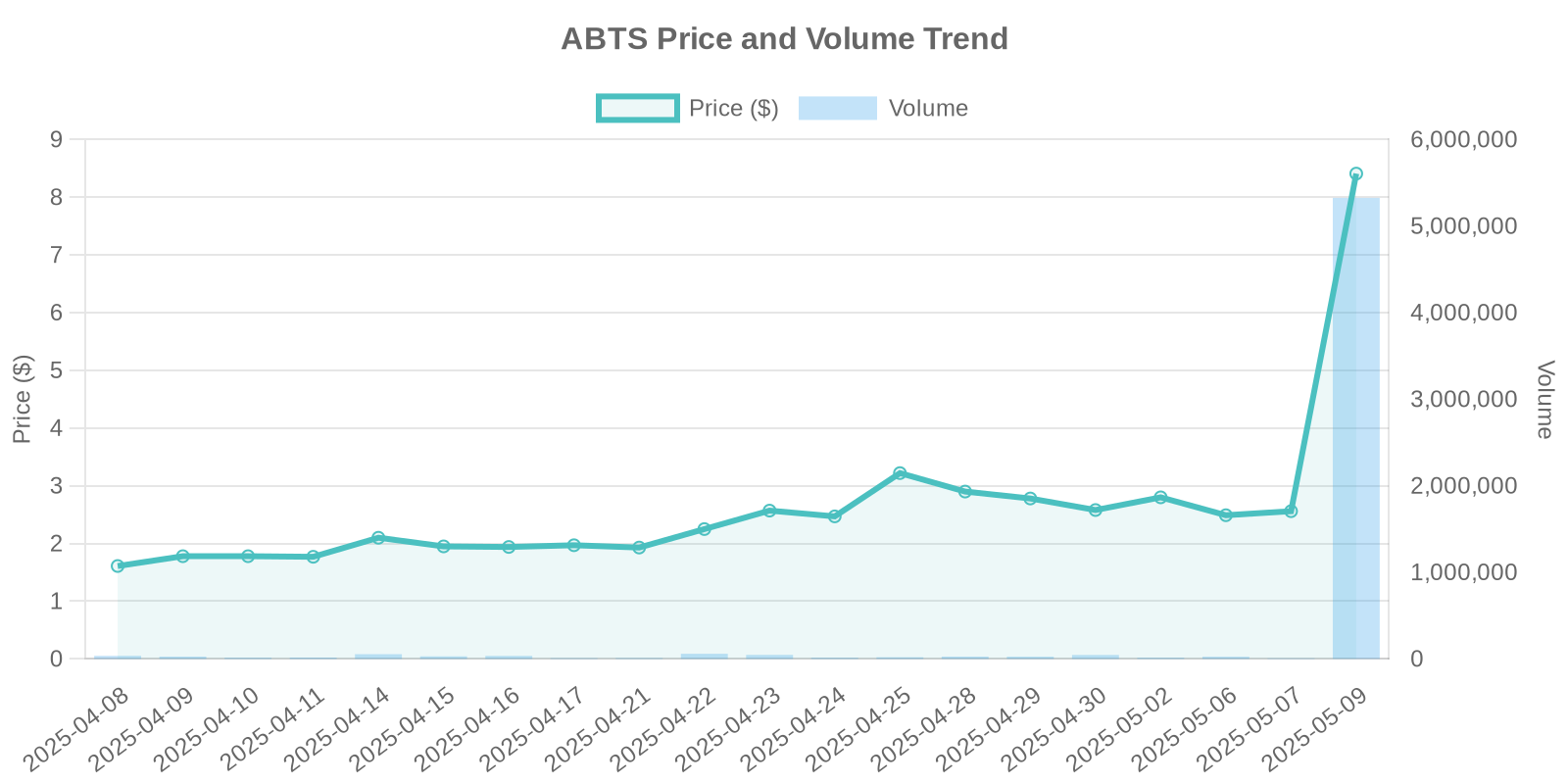

In the world of stock trading, few events catch the eye of investors quite like a significant price surge. Recently, ABTS stock witnessed a dramatic increase of 262.5%, bringing its current price to $8.41. This unprecedented movement has generated significant interest among retail and institutional investors alike. This article aims to provide an in-depth analysis of the factors contributing to this surge, while offering insights into potential risks.

Company Overview

ABTS is a key player in the [specific industry], known for its [specific product/service] offerings. Historically, the company has demonstrated [key traits or past performance], which positions it uniquely within the marketplace. Investors typically favor ABTS due to its [reason why investors are interested], contributing to its dynamic stock performance.

Analyzing the 262.5% Price Surge

The recent 262.5% surge in the ABTS stock price is a subject of significant interest. The stock’s volume reached 5,097,020, which aligns with vibrant trading activity. However, the surge occurred in the absence of direct news or company disclosures. This lack of clear causation invites speculation about underlying factors.

Industry Trends and Market Context

To better understand ABTS’s price surge, it’s important to consider broader industry trends. The [industry name] has been experiencing [specific trends], which could have indirectly influenced ABTS’s stock dynamics. Additionally, macroeconomic conditions such as [relevant economic trends] may have played a role.

Potential Triggers: Insider Trading and Stock Buybacks

Insider trading activities and stock buybacks often play a substantial role in stock price movements. Currently, no concrete insider trading activities related to ABTS have been documented that correlate with this surge. Similarly, no recent stock buybacks have been announced, further emphasizing the need to explore other triggers.

Institutional Trading Patterns

The possibility of institutional trading patterns cannot be ignored. Significant buy-side pressure by institutional investors might have acted as a catalyst for ABTS’s price surge. This aligns with scenarios where institutional investors anticipate future growth or have privileged insights, prompting early accumulation of the stock.

Trading Volume and Buying Force Patterns

The substantial increase in trading volume suggests heightened interest, potentially driven by large buy orders. Such patterns are typical when institutional investors reallocate portfolios or pursue new opportunities. This considerable buying force can spur rapid price escalation, as seen in ABTS’s case.

Historical Comparisons and Similar Patterns

A historical analysis reveals previous instances of similar market behaviors. In scenarios where stocks experienced sudden surges without direct news, patterns typically involved preparatory institutional activities or broader market sector movements.

Investment Risks and Considerations

While the surge presents lucrative short-term opportunities, it also poses significant risks. The stock could face quick corrections if driven largely by speculative trades or short-term institutional strategies. Retail investors should be cautious of volatility and ensure they diversify their portfolios to mitigate risk.

Conclusion

In summary, ABTS’s 262.5% surge, with its current stock price at $8.41, represents a complex interplay of potential institutional maneuvers and market dynamics. While the absence of direct news leaves questions unanswered, institutional trading patterns suggest future growth anticipation. Investors are advised to remain vigilant, watch for further disclosures or industry shifts, and approach with cautious optimism.

Leave a Reply