Introduction: ADGM Stock Price Surge

Adagio Medical Holdings, Inc. (Nasdaq: ADGM), a prominent name in the field of cardiac arrhythmia treatment technologies, has witnessed a remarkable surge in its stock price, climbing by an astonishing 103.64% to $1.78. This surge is not just a numerical achievement but a reflection of significant developments within the company. The recent breakthrough involves the U.S. Food and Drug Administration’s (FDA) Breakthrough Device designation for Adagio’s vCLASTM Cryoablation System.

FDA Breakthrough Device Designation: Catalyst for ADGM Surge

On April 17, 2025, the announcement of FDA’s Breakthrough Device designation for the vCLASSM Cryoablation System provided a substantial catalyst for the stock’s growth. This designation highlights the system’s potential to offer a more effective treatment for drug-refractory ventricular tachycardia, a condition posing significant challenges to cardiac health. As Todd Usen, CEO of Adagio Medical, stated, this recognition emphasizes not only the technological innovations but also the unmet needs in cardiac treatment, significantly enhancing the company’s credibility and investor interest.

Company Overview and Industry Trends

Adagio Medical Holdings operates at the cutting edge of catheter ablation technologies, aiming to enhance the safety and effectiveness of treatments for cardiac arrhythmias. The company’s proprietary Ultra-Low Temperature Cryoablation (ULTC) technology underpins its product offerings, positioning it as a leader in medical innovations for cardiac health. In the broader context, the medical devices industry is experiencing accelerated growth, fuelled by technological advancements and increasing prevalence of cardiac and chronic diseases. The global market size for medical devices is projected to continue expanding, presenting a ripe landscape for Adagio’s innovative solutions.

Insider Trading and Stock Buybacks: Missing Elements

Despite the significant surge in stock price, it is crucial to mention that there is no available data pointing towards recent insider trading or stock buybacks in relation to ADGM. Generally, the absence of insider trading can be perceived as a balanced indicator—it avoids potential conflicts of interest where insiders might unduly benefit from proprietary knowledge. Similarly, the lack of immediate buybacks could indicate financial prudence, possibly keeping resources available for further development amidst regulatory breakthroughs.

Institutional Trading Patterns and Investor Sentiment

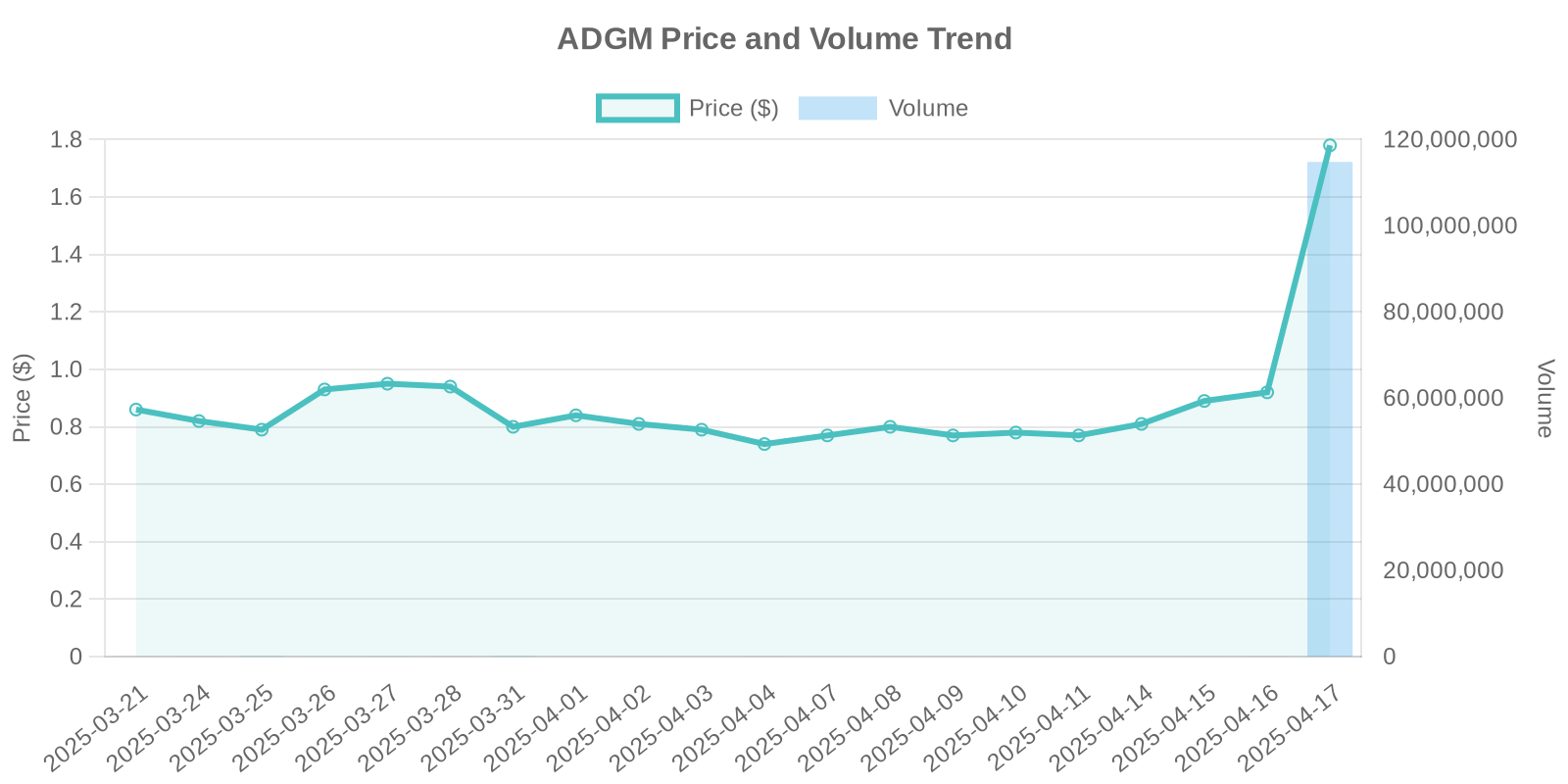

In scenarios where stocks witness sudden upticks without explicit insider activities or buyback programs, institutional trading patterns often play a pivotal role. The spike in ADGM’s volume to over 114.6 million shares suggests the potential involvement of institutional buyers responding to the strategic significance of FDA’s designation. Such trading patterns might imply a positive long-term outlook perceived by large investors, amplifying retail investor sentiment and market momentum.

Analysis of Potential Risks for Investors

Despite the optimistic developments, investors must remain cautious. Regulatory designations like the Breakthrough Device status, while promising, bring with them the scrutiny of stringent follow-up requirements and ongoing regulatory compliance costs. Furthermore, while the designation promotes expedited review processes, actual market entry and adoption are contingent on successful trials, pricing strategies, and competition in the sector. Consequently, there’s inherent risk should any of these elements not align with current plans.

Trading Volume, Historical Patterns, and Market Implications

Beyond the price surge, the trading volume reaching 114,615,840 shares underscores an amplified market interest and strong liquidity. Historically, similar patterns of rapid volume increase following advantageous regulatory announcements have led to sustained price adjustments. However, investors should scrutinize subsequent trading days for consistency as excessive short-term volumes might retract post initial euphoria.

Conclusion: Strategic Considerations for Investors

The impressive rise in ADGM’s stock price highlights the significant impact of strategic regulatory achievements on investor perception. As Adagio Medical continues to navigate the post-designation landscape, stakeholders must monitor how it capitalizes on FDA’s recognition to achieve operational milestones. While the stock’s prospects appear favorable, balanced diversification and vigilant risk appraisal remain pivotal for potential investors eyeing entry or expansion in this promising sector.

Leave a Reply