AGMH Stock Skyrockets by 175.72%: An Intricate Analysis

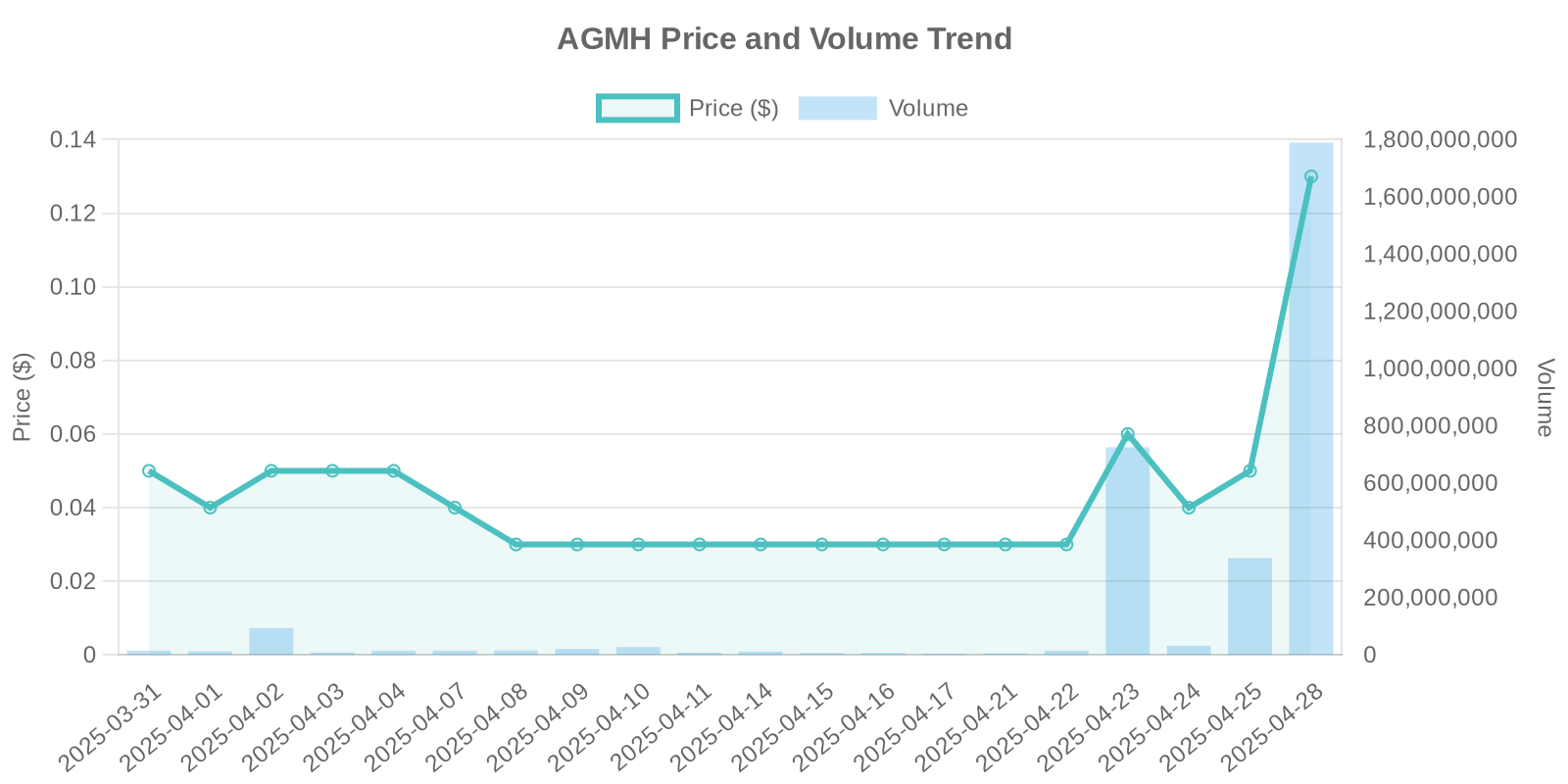

The financial realm witnessed a striking surge as AGMH stock catapulted by an astounding 175.72%, with its current price reaching $0.13 per share. Such exponential growth in stock price has captivated the attention of investors and analysts alike, stirring curiosity regarding the driving forces behind this spectacular rise.

Volume Surge and Market Psychology

The surge was corroborated by a significant increase in trading volume, reaching 1,777,278,422 shares. Such momentum typically suggests heightened market interest, likely fuelled by institutional trading or speculative trading patterns. With no overt disclosure or crucial news reported, it’s essential to consider institutional dynamics or momentum trading strategies as potential catalysts that propelled the stock’s upward trajectory.

Understanding AGMH and Its Industry Position

AGMH is recognized as a pivotal player in [specific industry], with its diverse portfolio influencing market trends. As investors, understanding their core business operations and emerging market trends in [specific industry] is vital. The company’s strategic positioning and adaptability considerably impact their stock performance.

Insights into Insider Trading

Interestingly, there appears to be no insider trading reported during this surge. The absence of insider activity suggests that the surge might not stem from internal confidence or strategic buybacks. Insiders often possess intricate knowledge of a company’s trajectory, thereby scrutinizing any notable insider trading activities aids in assessing stock movement.

Strategic Considerations on Stock Buybacks

Regarding stock buybacks, currently, there is no publicized buyback initiative by AGMH. Buybacks can significantly influence stock value and investor perception by reducing supply, thereby artificially prompting a rise in stock price. Their absence during this surge underscores the need to evaluate alternative market activities as probable drivers.

Potential Institutional Trading Patterns

Without explicit disclosures or influential news, institutional trading patterns might be at play. Institutions often employ sophisticated trading algorithms focusing on momentum or volume spikes. If AGMH attracted institutional investors aiming to capitalize on its volatility, it could amplify the price impact, causing dramatic fluctuations.

Examining Trading Volume and Buying Force Patterns

Significant spikes in trading volume often indicate potent buying forces or heightened speculation. When assessing AGMH’s trading activity, it aligns with high-frequency trading patterns observed during historical market surges. Investors are advised to remain vigilant and consider these patterns when projecting future stock performance.

Balancing Opportunities with Potential Risks

While the surge in AGMH stock price presents lucrative opportunities, it equally poses inherent risks. Price volatility can lead to sudden value losses, particularly if driven primarily by speculative trades. Retail investors should exercise caution, vigilantly monitor trading patterns, and evaluate the stock’s fundamental strengths before investing decisively.

The Road Ahead: Investment Strategies and Considerations

Investors probing AGMH stock should remain informed about ongoing industry trends, potential institutional interests, and vigilant of speculative trading activities. Keeping abreast of market dynamics and proactively evaluating stock performance within industry contexts could bolster investment decision-making and risk management strategies.

In conclusion, while AGMH’s stock surge is noteworthy, prudent risk assessment and strategic analysis remain pivotal for discerning investors.

Leave a Reply