AGMH Stock Surges 93.33%: Detailed Analysis of the Unexpected Price Increase

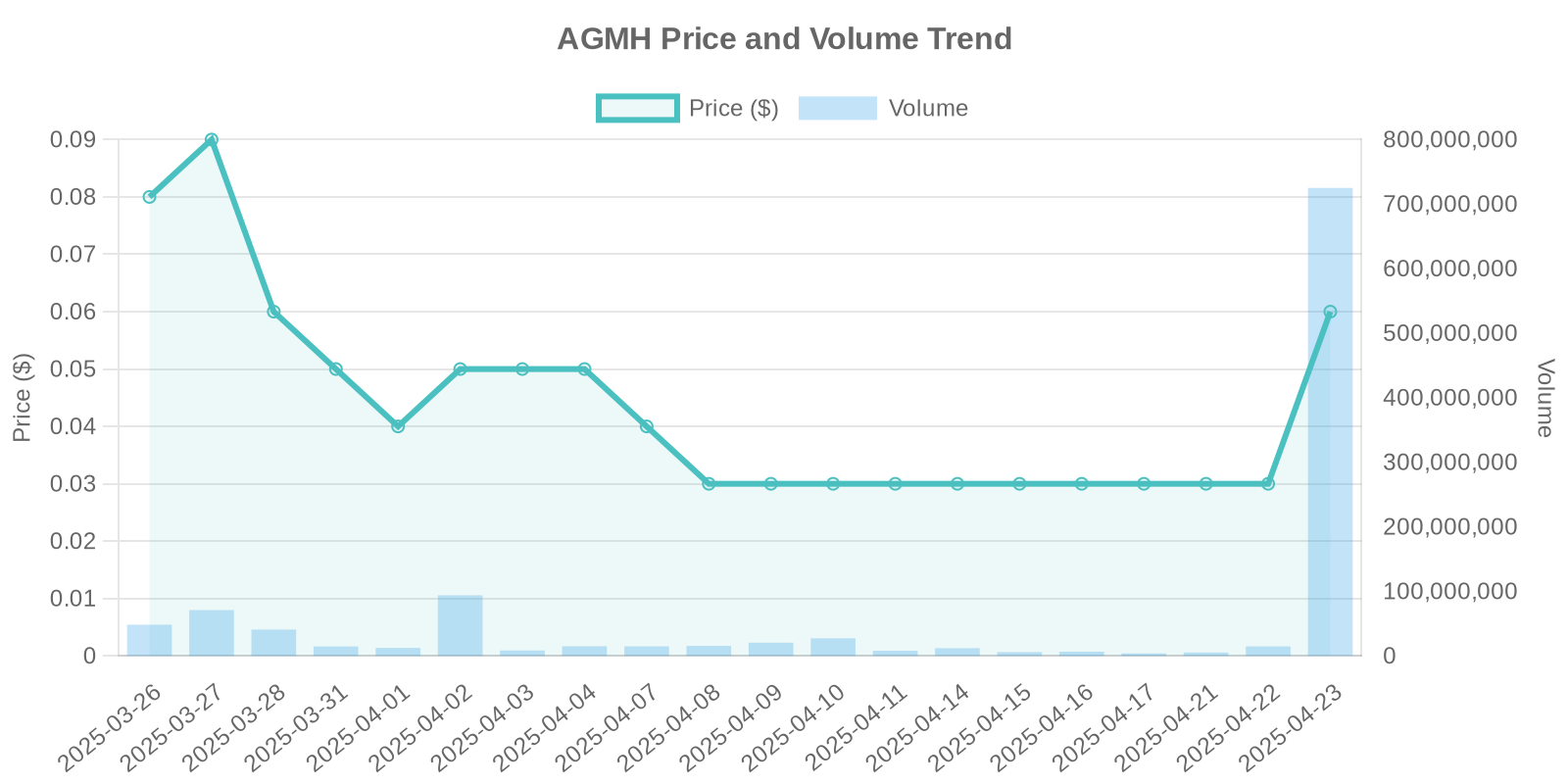

The AGMH stock recently witnessed a staggering 93.33% surge, with its current price standing at $0.06 and an impressive trading volume of 724,367,097. This sudden increase has left many investors curious about the driving factors behind this substantial uptick. In this article, we explore potential causes, examine trading patterns, and analyze the broader market context.

Understanding AGMH: A Brief Company Overview

AGMH, known for its technological services within the financial sector, operates in a highly competitive industry characterized by rapid innovations and strategic alliances. The company has been actively seeking to expand its footprint in blockchain technology and financial equipment manufacturing, potentially offering ample growth opportunities.

Analyzing the Stock Surge: Unveiling Potential Institutional Patterns

The 93.33% surge in AGMH stock is particularly noteworthy due to the lack of significant news or public disclosures. In such scenarios, investors often speculate about institutional trading patterns. Large hedge funds and institutional investors might initiate sizable trades that trigger a domino effect, causing the stock price to inflate quickly.

Several institutional trading patterns can contribute to such surges. For instance, a sudden inflow of investments from funds betting on turnaround stocks might drive the price exponentially without any publicly visible catalyst. Evaluating historical trading volumes and examining unusual spikes can reveal clues about institutional activity.

Impact of Trading Volumes: The Driving Force Behind the Price Increase

During the surge, AGMH’s trading volume reached an astounding 724,367,097, a significant deviation from its average volume. Such increases often indicate heightened investor interest and can amplify the effects of large buys. Increased volume generally signifies robust buying pressure, contributing to rapid price escalation.

In similar historical patterns, surges without explicit news have sometimes hinted at insider knowledge leaking into wider professional circles, prompting preemptive buys. Nonetheless, without concrete insider trading disclosures, this remains speculative.

Industrial Context: Evaluating Trends in the Tech and Financial Services Sector

AGMH operates at the intersection of technology and financial services, sectors prone to volatility but rich with potential. Given the increasing adoption of blockchain technology and digital financial services, companies in this space might experience speculative trading activities, driving unpredictable stock movements.

Potential Investment Risks: Balancing Opportunities with Caution

While the AGMH stock surge presents potential profit-making opportunities, it also comes with its share of risks. The lack of tangible news to support the rise could imply a speculative bubble driven by short-term trading interests rather than fundamental improvements.

Investors should remain cautious about high volatility and ensure they diversify their portfolios to manage exposure to potential downtrends. Historical trends lack a consistent pattern of sustained upward movement post such surges, thus raising caution flags for potential investment.

Conclusion: Navigating the AGMH Stock Landscape

The AGMH stock’s recent spike underscores the complexity of market movements influenced by unseen institutional strategies and speculations. While the current trend may attract potential traders keen on capitalizing on rapid fluctuations, careful analysis and risk management remain essential. Understanding the broader market dynamics and staying informed on industry advancements can provide a competitive edge in making well-informed investment decisions.

Leave a Reply