OMEX Stock Surge: A Comprehensive Analysis

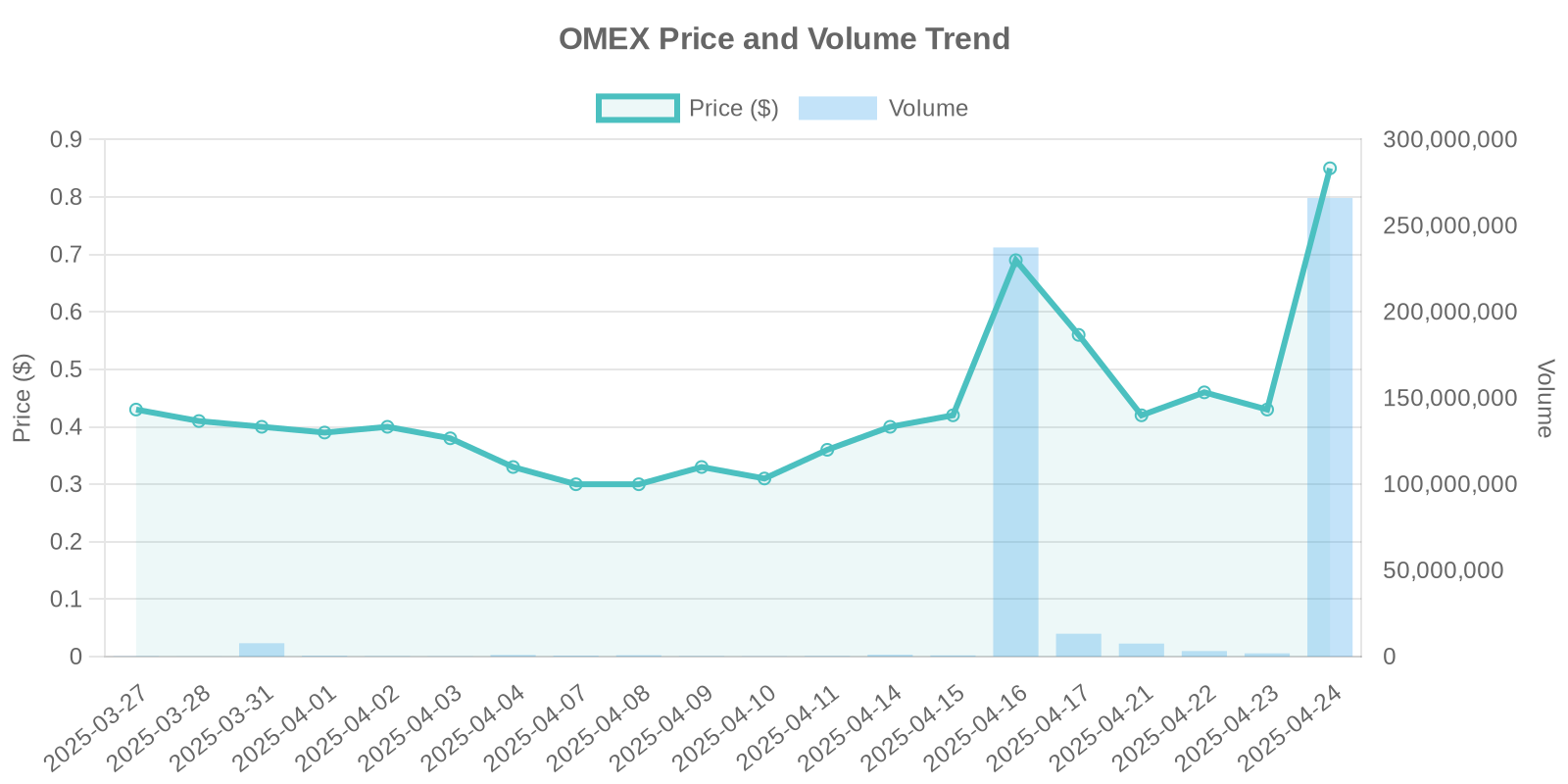

On an intriguing trading day, OMEX stock experienced an unprecedented surge, rising by 100.07% to a current price of $0.85. This surge was accompanied by a remarkably high trading volume of 263,269,028 shares. This article provides a detailed exploration of this phenomenon, analyzing the dynamics of OMEX’s stock price increase, potential insider activities, possible institutional trading patterns, and associated investment risks.

Understanding the Context of OMEX’s Surge

OMEX, or Odyssey Marine Exploration, is a deep-ocean exploration company that specializes in recovering shipwrecks and conducting seafloor exploration. Historically, the company has captured interest due to its involvement in high-stakes, high-reward ventures. However, the recent surge in its stock price has prompted a closer look at underlying factors, particularly in the absence of significant news events or corporate disclosures.

Trading Volume: A Telltale Indicator

The extraordinary trading volume exceeding 263 million shares indicates a robust buying force, significantly above OMEX’s average day-to-day trading activity. Historical patterns suggest that such a surge could be fueled by large institutional trades or speculative trading phenomena, absent clear disclosures or news that typically drive retail investor actions.

Exploring Institutional and Retail Dynamics

In this scenario, it’s viable to explore potential institutional trading patterns. Institutions often have access to advanced analytics and may initiate trades based on sophisticated models predicting price movements. Furthermore, trading algorithms could be reacting to distinct signals, directing substantial capital flows into OMEX stock. Retail investors should be cautious, recognizing that institutional moves can influence short-term price fluctuations without longer-term sustainable growth indicators.

Insider Trading and Stock Buybacks: Status Check

As of the latest filings, there are no significant insider trading activities reported that might elucidate the stock’s recent performance. Similarly, OMEX has not announced any stock buyback programs. Absence of insider trading suggests that the price surge might not be directly linked to top management actions, potentially pointing more towards external market influences.

Potential Risks and Considerations for Investors

High volatility, as evidenced by a 100% price surge, inherently carries investment risks. While the potential for quick gains is enticing, retail investors should weigh this against the absence of grounding news. Historically, sudden surges can precipitate equally sharp declines once initial speculative trades taper off. It’s prudent for investors to assess their risk tolerance and consider whether current market conditions align with their investment strategy.

Peer Comparisons and Industry Overview

Comparatively, fluctuations within the marine exploration sector are not uncommon, given the speculative nature and dependency on explorative outcomes. Peers within the industry have experienced similar fluctuations, often in alignment with licensing announcements, successful recoveries, or partnerships—none of which are currently attributed to OMEX in recent weeks.

Conclusion: Navigating an Uncertain Yet Exciting Terrain

The absence of immediate news accompanying OMEX’s stock surge necessitates a cautious approach. While the allure of marine asset recovery holds substantial revenue potential, the road to profits can be fraught with logistical, regulatory, and environmental challenges. Investors are encouraged to continually monitor official filings, sector-related news, and broader market trends to make informed decisions.

OMEX’s recent momentum is a reminder that stock market dynamics can often defy conventional logic, warranting a balanced perspective that weighs potential rewards against achievable risks.

Leave a Reply