Today, we would like to introduce our newly released Passive Fund or ETF (Exchange-Traded Fund) holdings data and discuss how to use this data effectively.

What is Passive Investing?

First, passive investing is an investment strategy that seeks to track the performance of a specific index or benchmark. Unlike actively managed funds, passive funds don’t involve portfolio managers actively selecting stocks or timing the market. Instead, they simply reflect the market index.

Commonly known ETF products fall under passive investing and are typically associated with lower management fees and the potential for stable, long-term returns.

1. Cost Efficiency: Passive funds generally have lower management fees compared to active funds, positively impacting investors’ long-term returns.

2. Transparency: Since these funds track the the entire market or a specific index, the composition of the investment portfolio is clear and transparent.

3. Diversification: Investing in a wide range of assets allows effective risk diversification across different stocks or industries.

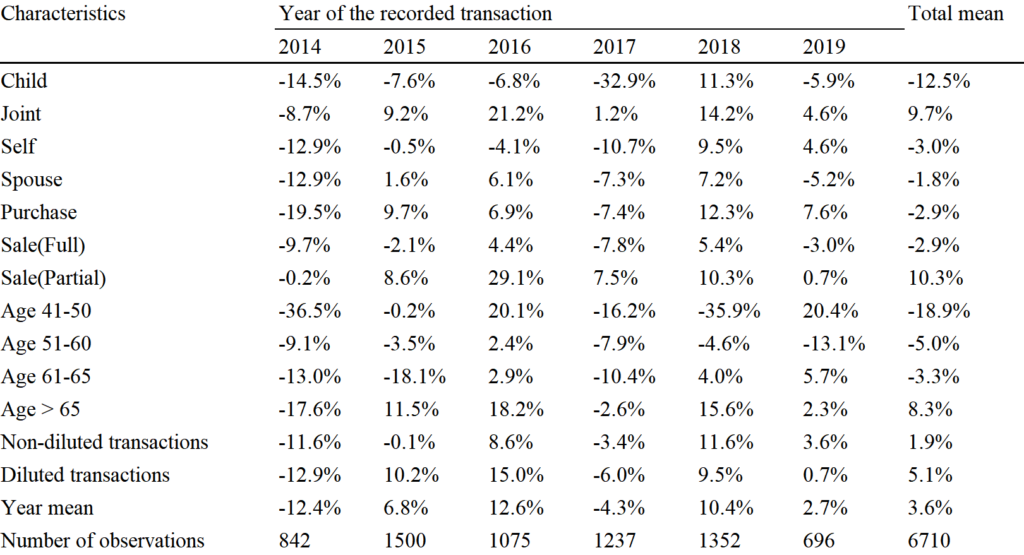

Market Shift: From Active Funds to Passive Funds

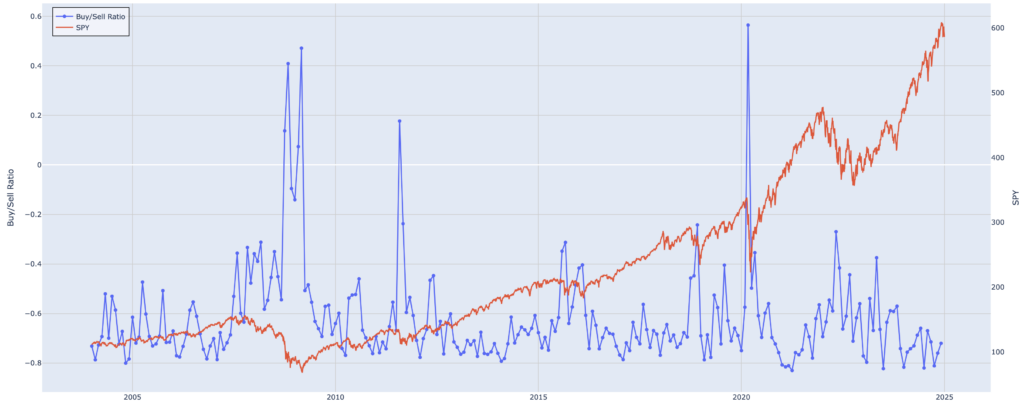

Traditionally, fund managers have preferred active investment strategies. However, as the graph above shows, passive fund growth has surged in recent years.

ETFs, in particular, offer investors convenient access to various asset classes, attracting both individual and institutional investors.

Even in Korea, retail investors investing in U.S. markets have become familiar with tickers like SPY and QQQ, reflecting the growing popularity of passive investing.

How to Use ‘Passive Fund Holdings’ Data?

The first way to utilize Waiker’s Passive Fund Holdings Data is by easily identifying ETFs and index funds that track a specific index.

The image above shows search results for passive funds that track the S&P 500 or its derivatives. With Waiker’s data, you can easily view a list of passive funds following the index and gain quick insights into their size (assets, liabilities, etc.).

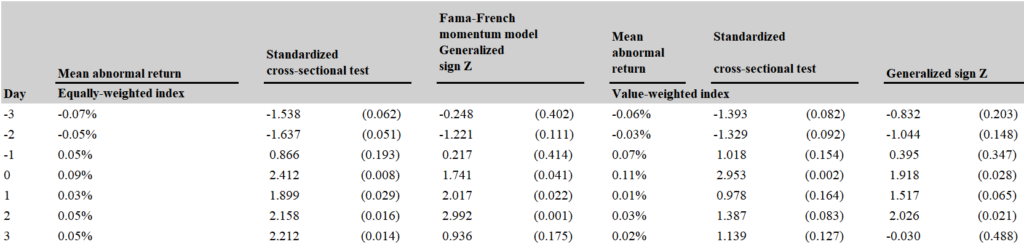

Second Use Case: Identifying Tracking Errors

Waiker’s data also provides the fund’s Net Asset Value (NAV), making it easier to calculate tracking errors. This allows you to conveniently apply trading strategies based on the difference between market prices and NAV.

Tracking error is a crucial metric that shows how faithfully a fund replicates its target index. A lower tracking error means the fund reflects the index more accurately, which enhances investor confidence.

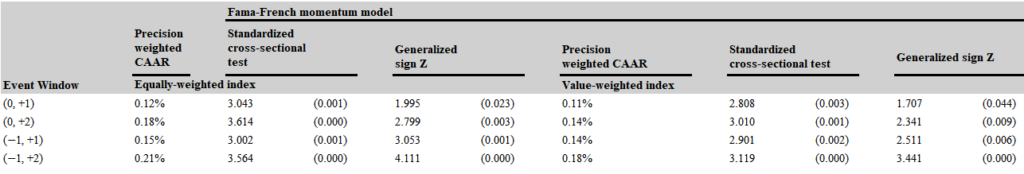

Third Use Case: Utilizing Rebalancing Dates

Index providers recalculate and manage the composition of the index on predetermined dates, such as quarterly or semi-annually.

Inclusions and exclusions of specific stocks in an index can be interpreted as major positive or negative signals, making it important for investors to monitor these changes and dates carefully.

The following example shows the holdings of a specific ETF. As of May 31, 2023, ProShares UltraPro QQQ held 1,249,343 shares of Tesla.

While passive funds primarily track specific indices, the composition and weighting of holdings can vary by fund.

For instance, while the S&P 500 consists of 503 stocks, an actual fund might only hold 501 stocks. Therefore, understanding how many funds hold specific stocks, and to what extent, can help estimate potential buying or selling volumes on rebalancing dates.

Passive Investing: Beyond Market Average Returns

While passive investing is generally a strategy aimed at achieving market-average returns, passive fund data has evolved beyond that purpose.

By applying precise data analysis, investors can optimize quantitative investment strategies using ETFs.

In this article, we briefly introduced several strategies:

1. Listing passive funds that track specific indices

2. Optimizing ETF selection using tracking error analysis

3. Developing precise investment strategies based on rebalancing timing

How are you using ETF data? If you have your own passive investment strategies, feel free to share them!

John C. Bogle:

“Don’t look for the needle in the haystack. Just buy the haystack!”