Introduction

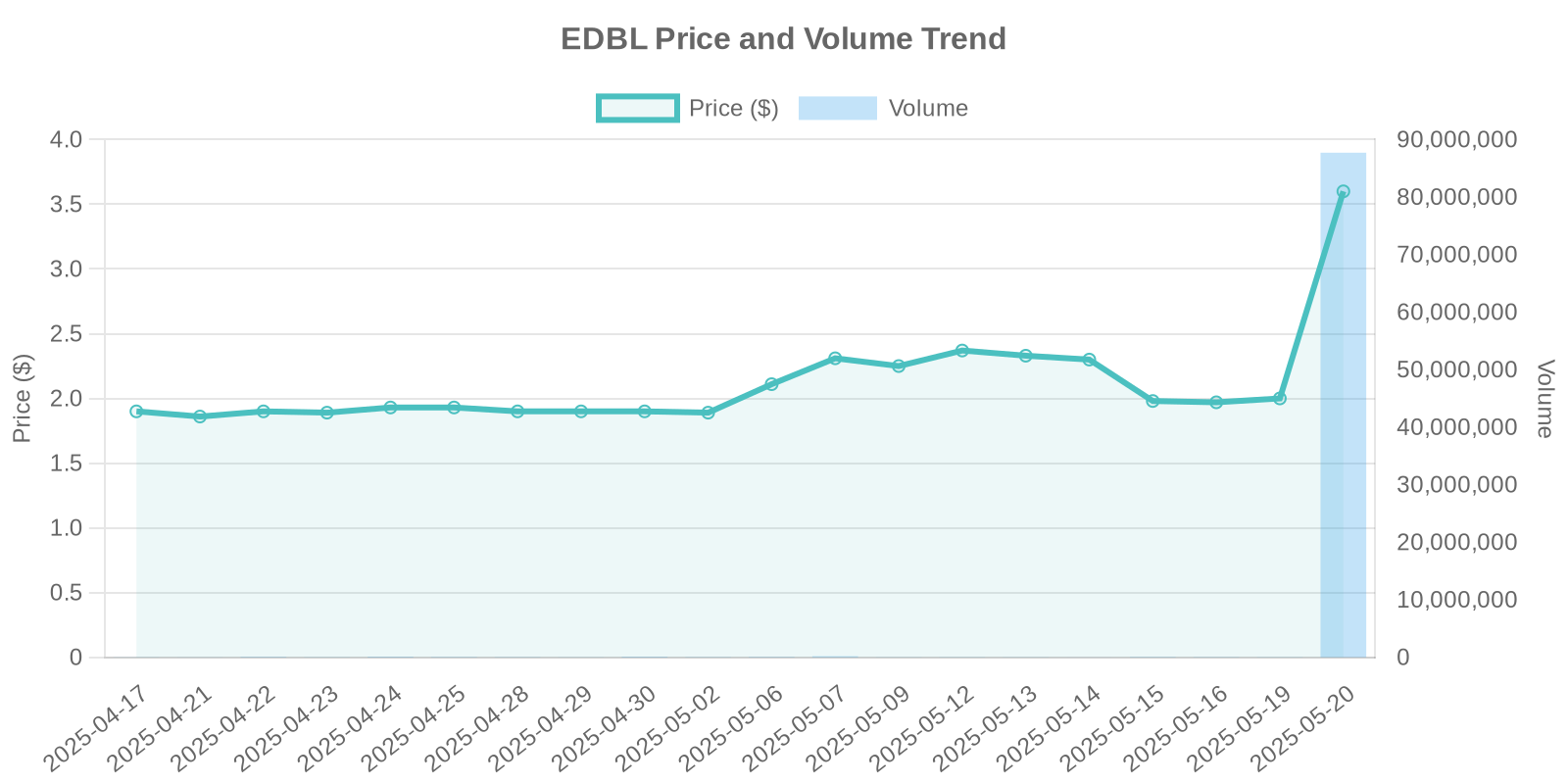

The market has been abuzz with Edible Garden AG Incorporated’s (NASDAQ: EDBL) extraordinary stock price surge of 80.9% as of this week, bringing the current price to $3.6. With a trading volume of 86,014,514 shares, this dramatic increase in EDBL stock demands a deep dive into the underlying factors shaping this boom.

Understanding Edible Garden AG

Edible Garden, a pioneer in controlled environment agriculture (CEA), specializes in locally grown, organic, and sustainable produce and products. Their recent ventures into the sports nutrition market and sustainable farming further define their evolving business strategy.

Key Drivers of EDBL Stock Surge

1. Product Launches

The introduction of the Kick. Sports Nutrition product line on Amazon, in collaboration with Pirawna, is a significant contributor to this surge. The entry aligns with Edible Garden’s expansion into the ‘Better for You’ space. According to CEO Jim Kras, the product meets consumer demands for cleaner, natural formulas devoid of artificial additives, meeting a growing market need.

2. Financial Performance

In the Q1 2025 financial results, Edible Garden reported a 15% increase in non-perishable revenue, showcasing a strategic shift towards higher-margin, shelf-stable offerings. Gross profit saw a near quadruple increase, signaling improved cost management and strategic alignment with consumer preferences.

3. Strategic Acquisitions

Edible Garden’s acquisition of sustainable farming assets from NaturalShrimp Farms Inc. is poised to enhance their R&D capabilities significantly. This move is in line with their Zero-Waste Inspired® mission and could potentially optimize their operational efficiencies.

Institutional Trading Patterns and Risks

Despite no official insider trading or stock buyback activities reported, the surge might indicate substantial institutional interest. High-volume trades could suggest strategic positioning by major investors anticipating future growth.

However, potential risks involve the stock price’s volatility in the absence of concrete insider or buyback engagements. Retail investors should be cautious, as such surges might not reflect long-term value.

Analyzing Trading Volumes

The surge in trading volume, at 86,014,514, outweighs historical averages, indicating a significant increase in market interest. This could be attributed to the anticipatory nature of Edible Garden’s recent product and strategic announcements, aligning with broader market trends in sustainability and health-conscious consumer products.

Conclusion: Balancing Opportunities and Risks

While Edible Garden’s strategic moves and market expansions are promising for the company’s future, retail investors should weigh these against the potential of market volatility and lack of insider activity. In a rapidly changing market, discerning the true value behind EDBL’s stock surge is crucial for making informed investment decisions.

Leave a Reply