Introduction

The stock market, known for its inherent volatility, occasionally surprises investors with dramatic surges that capture the headlines. Such is the case with ZCAR stock, which recently experienced a meteoric rise of 153.07%, pushing its stock price to a remarkable $10.3. This surge, occurring with a trading volume of 47,189,195, has left both investors and financial analysts eager to understand the underlying factors.

Understanding the ZCAR Stock Surge

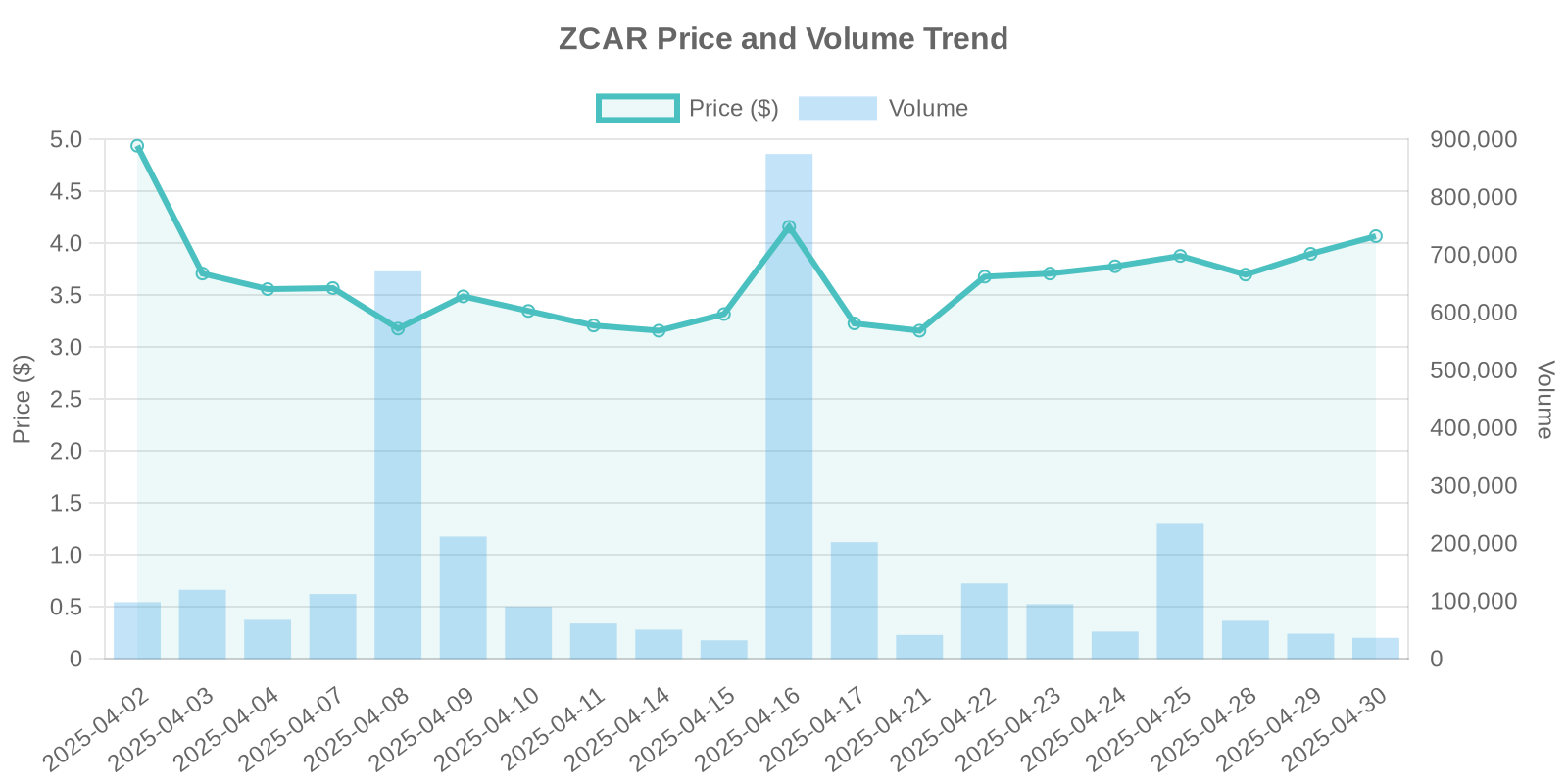

As of the latest trading data, ZCAR has exhibited an extraordinary increase in its stock price, skyrocketing by 153.07%. Typically, such a surge would be accompanied by significant news or disclosure, yet our findings indicate an absence of either. This magnifies the mystery and propels speculation around different potential drivers such as institutional trading patterns.

Trading Volume and Institutional Influence

An essential aspect of analyzing this surge is the trading volume, which has seen a tremendous increase, rising to 47,189,195. This spike in volume often hints at significant institutional engagement. Large buyers, such as hedge funds or mutual funds, may have initiated sizeable purchases, thus driving up the stock price. Such movements can sometimes be traced back to speculative trading or repositioning ahead of anticipated developments.

Spotlight on ZCAR: Company Overview

ZCAR is an innovative player within its industry, focusing on a range of products that have previously seen stable growth. Historically, ZCAR has not been a frequent flyer on the volatility scale, maintaining a relatively stable position within the market. Its recent surge, however, suggests a potential shift in market perception or strategy.

Market Trends and Industry Context

Given its industry backdrop, ZCAR operates in a sector currently witnessing transformative trends, including digital transformation and sustainable development. A closer look at rival company movements may reveal competitive shifts driving investor sentiment toward ZCAR.

Analysis of Insider Trading and Buybacks

While insider trading and stock buybacks can significantly influence stock prices, no revealing information or data on these activities has surfaced concerning ZCAR during this period. The lack of insider trades or buyback announcements suggests the current surge is not driven by these typical catalysts.

Potential Institutional Trading Patterns

The absence of clear news or disclosures about ZCAR’s operations points towards possible institutional trading patterns. Large funds, through algorithmic trading, can create short-term volatility, causing sharp price movements as seen. Retail investors often face increased risks during such periods due to potential unpredictability.

Historical Comparisons and Risk Assessment

Historically, similar stock surges have generally been accompanied by significant corporate developments or macroeconomic factors. In the case of ZCAR, the substantial increase without clear disclosures raises questions. The unusual price behavior patterns should alert investors to a potentially unstable post-surge adjustment phase.

Investment Risks and Considerations

While the opportunity for short-term profit is appealing, such market patterns also present elevated risks. The absence of concrete catalysts might suggest a speculative bubble, with the risk of correcting once speculative buying slows down. Investors are advised to closely monitor trading volumes and emerging news to make informed decisions.

Conclusion

The 153% surge in ZCAR stock price has undeniably piqued the interest of the investor community. Yet, without concrete news or disclosures, understanding the exact cause remains speculative. While potential institutional trading is one avenue for explanation, investing during such volatile times necessitates a well-informed approach, weighing both potential benefits and associated risks.

As always, thorough due diligence and maintaining a diversified portfolio remain critical strategies for navigating the unpredictable currents of the stock market.

Leave a Reply