FOXO Stock Soars: A Comprehensive Analysis of the 151% Increase

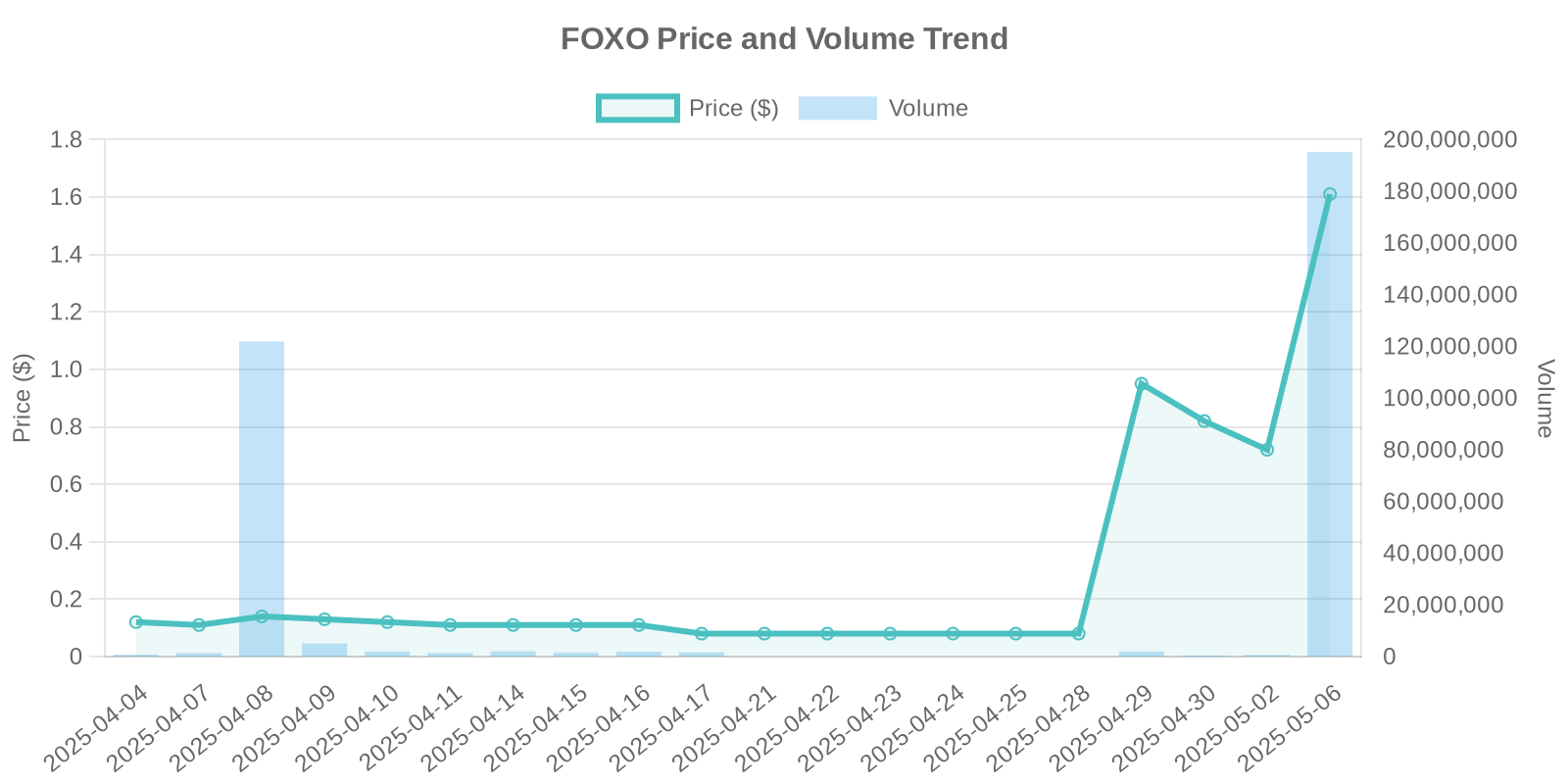

The recent significant surge in FOXO Technologies Inc. (NYSE American: FOXO) stock price has caught the attention of investors. With a current price standing at $1.6 and a remarkable increase of 151.53%, the trading volume has ballooned to an impressive 195,163,456 shares. This article delves into the catalysts behind this rally, offering insights into potential reasons, market reactions, and risks involved for potential investors.

Understanding FOXO Technologies’ Market Dynamics

FOXO Technologies Inc., a diversified company operating under three umbrella sectors, continues to make headlines. Its subsidiaries include Rennova Community Health, Myrtle Recovery Centers, and FOXO Labs, which engage in healthcare and biotechnology, especially with a focus on enhancing human health and lifespan.

Behavioral Health: A Key Driver

The main contributor to the stock’s recent surge appears to be the operational milestones achieved by its behavioral health subsidiary, Myrtle Recovery Centers, Inc. The company proudly announced reaching over 5,000 patient care days and serving 400 patients since August 2023, as reported by a recent press release published on May 6, 2025.

Robert Merritt, CEO of Myrtle, expressed confidence in the facility’s growing reputation, further supported by Seamus Lagan, CEO of FOXO Technologies, who emphasized the significant impact of Myrtle’s services on rural communities in East Tennessee. These developments signal robust growth potential, which could have bolstered investor sentiment.

Industry Trends and Market Response

The healthcare sector, particularly behavioral health services, has experienced heightened demand post-pandemic, driving more investments and interest. The expansion of Myrtle Recovery Centers into additional locations reinforces FOXO’s strategic positioning in a growing market, aligning with investor interest in stable, recession-resilient sectors.

Examining Institutional Trading and Market Volatility

Despite the lack of clear insider trading or stock buyback disclosures, the massive uptick in trading volume on the day of the surge suggests potential institutional interest. Such patterns often indicate a strong buy signal from large investors who foresee significant upside potential.

Institutional trading could be a key factor here, as these entities often have access to more sophisticated market data and trend analysis. Given the substantial volume increase correlating with the stock surge, it’s plausible to infer strategic accumulation by major market players.

Potential Risks for Retail Investors

Despite the positive momentum, several risks linger. The forward-looking statements in the press release highlight various uncertainties, including competitive industry pressures and regulatory challenges. Investors should also be wary of the overall volatility of biotech stocks, which can experience rapid price fluctuations based on news and market sentiment.

Furthermore, the volatility in FOXO’s stock price without corroborating insider activity could also indicate speculative trading rather than fundamental long-term growth, cautioning retail investors against over-exposure.

Conclusion

FOXO Technologies’ stock surge is undoubtedly compelling, driven by the achievements of its Myrtle Recovery Centers and the broader healthcare sector trends. However, potential investors should consider both the optimistic growth prospects and inherent risks, particularly those highlighted in the company’s forward-looking statements.

Understanding market patterns, especially unusual volume spikes, can offer valuable insights. While the recent surge presents an attractive opportunity, a balanced approach considering institutional trading patterns and potential volatility will be crucial for informed investment decisions.

Leave a Reply