FRGT Stock Surge: An In-Depth Analysis of Its 111.21% Price Increase

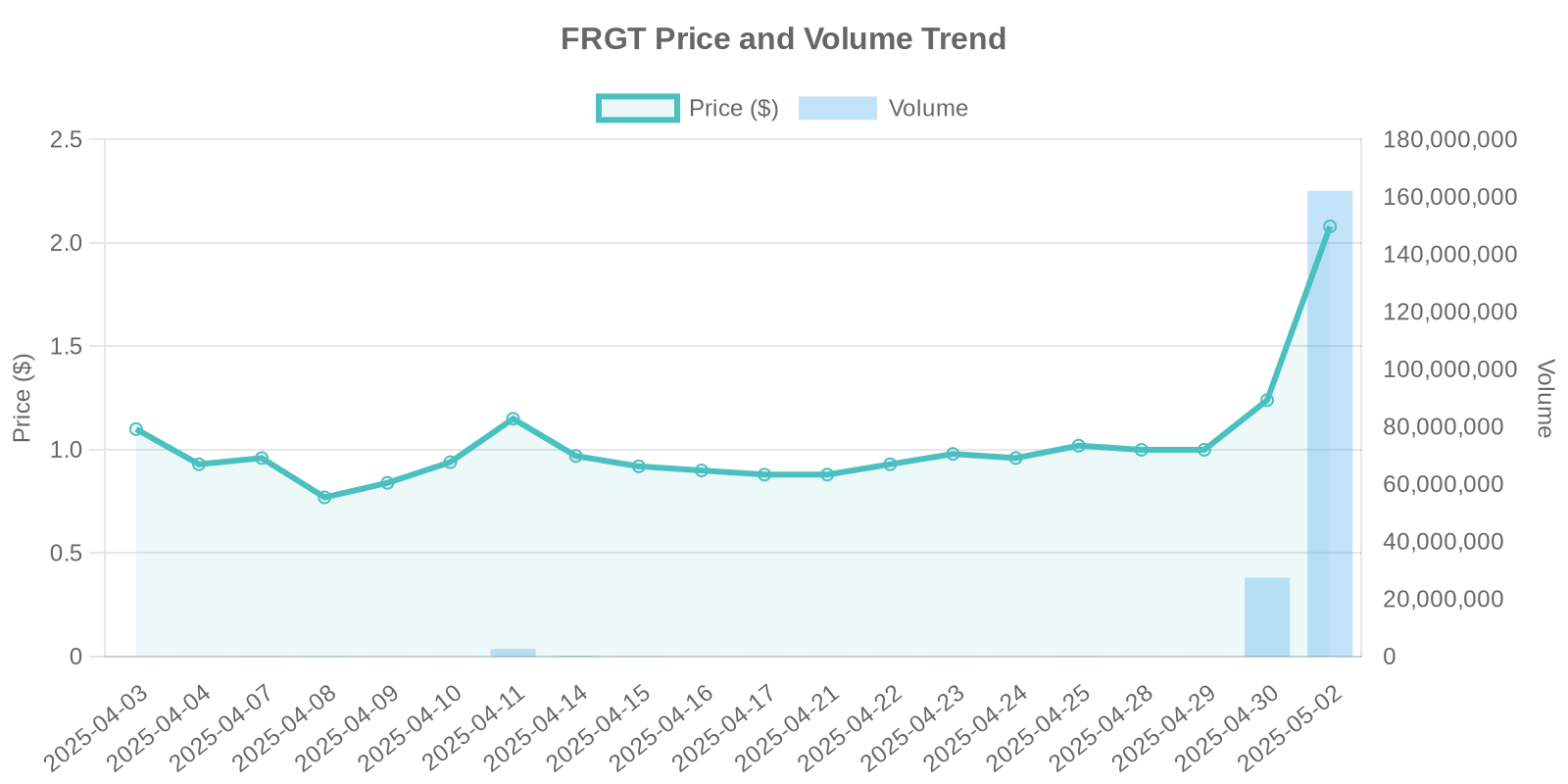

The stock market is full of surprises, and the recent surge in FRGT stock price is one that has caught the attention of many investors. With a current price standing at $2.08 and an impressive surge rate of 111.21%, the stock’s trading volume has soared to an extraordinary 161,527,339. This article will deliver a comprehensive analysis of the factors influencing this rise, potential institutional trading patterns, and the risks that investors should consider.

Company Overview and Industry Context

FRGT, operating in the logistics and freight transportation industry, has strategically positioned itself in a market defined by increasing globalization and e-commerce growth. The company offers innovative solutions in freight services, which have been critical in today’s fast-paced global supply chain environment. As logistics demand rises, the industry’s overall growth positively influences companies like FRGT.

Market Surge: Analyzing the 111.21% Increase in Stock Price

The significant 111.21% rise in FRGT’s stock price has sparked conversations among investors and analysts alike. This surge is particularly notable given the lack of apparent news or official disclosures directly linked to the company’s current valuation rise. With an impressive trading volume of 161,527,339 shares, understanding the underlying factors is essential.

Trading Volume and Institutional Influence

The substantial increase in trading volume may suggest the involvement of institutional investors who typically make large block trades. Such trading activities can considerably influence stock prices due to substantial capital movement. Institutions may see potential in FRGT’s strategic position within its industry or anticipate forthcoming positive developments from the company.

Insider Trading and Stock Buybacks

At this moment, there is no clear evidence of insider trading or official announcements regarding stock buybacks for FRGT. Absence of insider trading and stock buybacks does not necessarily indicate negative connotations but rather highlights the scarcity of public information to validate the stock’s recent performance.

Related News and Investor Sentiment

Currently, no direct news articles or press releases provide clarity on the surge. In such situations, market sentiment, driven by investor speculation and future performance prognosis, might play a significant role. Understanding market psychology can provide insights but also necessitates caution.

Potential Institutional Trading Patterns

With no clear disclosures, the dramatic increase might signal possible hedge fund movements or algorithmic trading. Institutional strategies sometimes involve assessing broader market trends and potential catalysts not visible to the general public. Retail investors should be wary of such moves, as these can rapidly reverse with changing institutional strategies.

Investment Risks and Considerations

Investors should be prudent and consider the risks associated with the FRGT stock’s volatility. High short-term gains could be accompanied by equivalent quick downturns, especially in a less stable informational situation. Diversification, due diligence, and a solid understanding of an investor’s risk tolerance are crucial.

Conclusion: Balancing the Surge with Caution

While FRGT’s stock surge paints a hopeful picture for potential gains, the lack of comprehensive disclosures requires investors to tread carefully. Acknowledging institutional activities and trading volume trends, alongside consistent monitoring of related market news, can equip investors to make informed decisions.

Leave a Reply