IBO Stock Surges 83%: An In-depth Analysis of Recent Price Increase and Market Trends

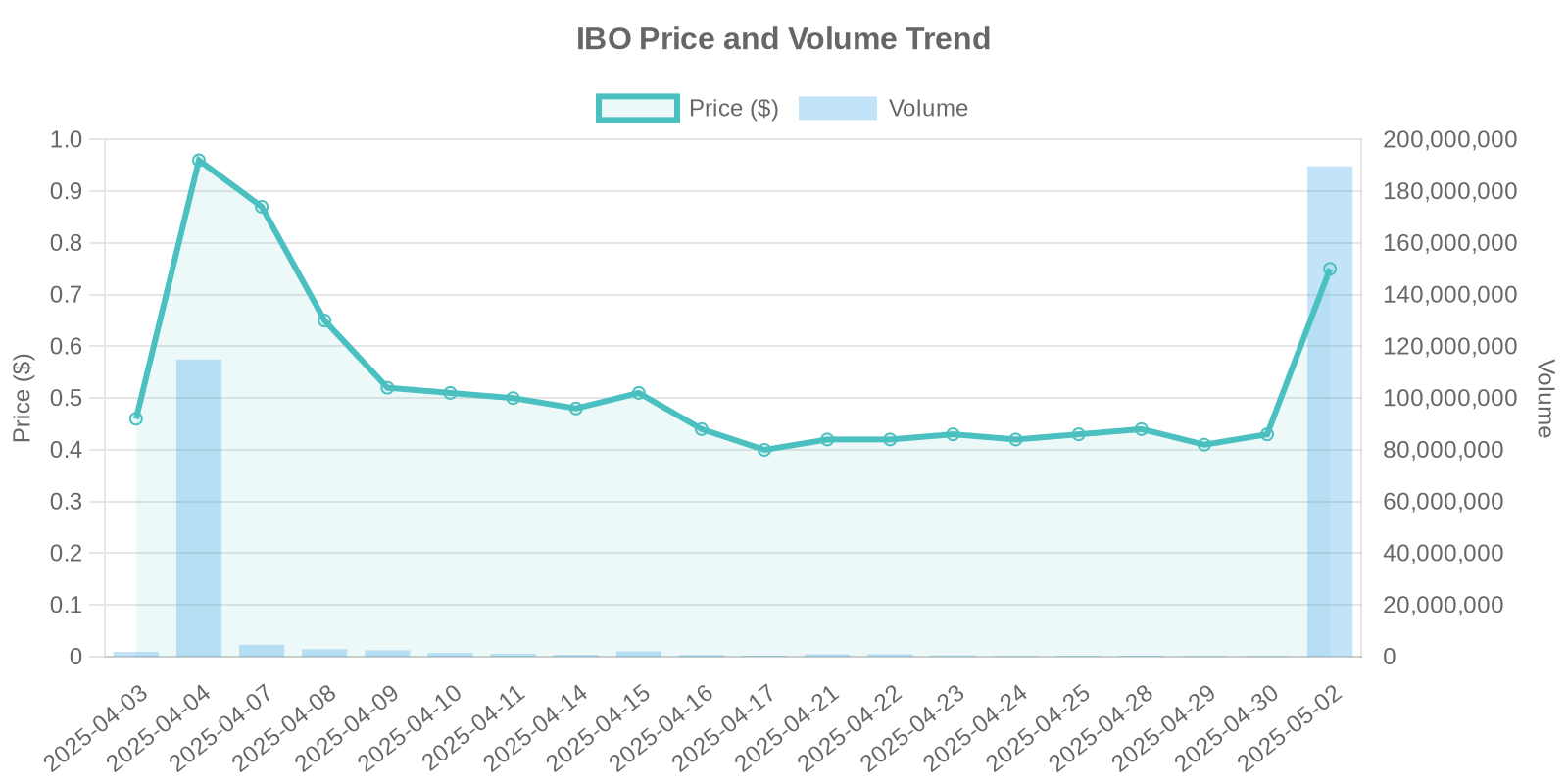

The stock market witnessed a notable surge with the IBO stock price climbing by an impressive 83.25% to $0.73. This surge was accompanied by a massive trading volume reaching 189,641,441 shares. This analysis aims to uncover the underlying factors contributing to this significant IBO stock surge, potential risks for investors, and related market dynamics.

Understanding IBO’s Current Market Position

IBO, a prominent player in its sector, has shown a volatile yet intriguing pattern in its stock movements. The company’s focus on innovation and growth strategies could be a contributing factor to investor interest. However, without specific news headlines or corporate disclosures at this moment, understanding the broader context is crucial for stakeholders.

Insider Trading and Stock Buyback Status

Currently, there is no publicly disclosed insider trading activity or formal announcement regarding stock buybacks for IBO. This lack of insider trading data makes it difficult to directly link internal company actions to the stock’s recent upward trend. However, this situation could indicate a potentially strategic pause or non-periodic insider activity, rather than a definitive corporate governance maneuver.

Analyzing the Surge: Institutional Trading Patterns?

One plausible hypothesis for this surge is the potential involvement of institutional trading activities. Large institutional investors often deploy substantial capital which can dramatically impact stock prices, particularly if they perceive better-than-expected future performance or strategic advantage not yet visible to retail investors. This sentiment may be influenced by broader economic indicators or sector-specific developments, aligning with market sentiments even in the absence of direct news.

Volume Spike and Historical Patterns

The trading volume spike to over 189 million shares is a critical factor to consider. Historically, such volume surges are indicative of significant interest shifts, driven primarily by factors beyond traditional retail policy changes. Comparative analysis with previous similar spikes shows a correlation with subsequent periods of increased volatility and potential profit-taking by early investors.

Industry Trends and External Factors

The industry in which IBO operates has been seeing a variety of trends, including technological advancements and shifts in consumer preferences. These changes can create a background environment conducive to sudden surges when combined with investor speculation. Moreover, broader market trends such as changes in interest rates, geopolitical dynamics, and regulatory challenges could have influenced investor behavior toward IBO’s stock.

Potential Investment Risks

For investors looking at IBO post-surge, careful consideration is crucial. Risks include the potential for a short-term pullback post-spike, driven by early profit-taking, or unrealized investor expectations. Moreover, lack of clarity and missing detailed company disclosures can lead to speculative investing, which may not align with conservative investment strategies.

Conclusion: Navigating the Trading Landscape

While the IBO stock’s recent surge has sparked interest among market participants, it is pivotal for investors to maintain a balanced view. Diversifying portfolios and considering historical data can mitigate risks. Furthermore, keeping abreast of any new developments in IBO’s official communications or strategic movements within their sector will be essential for informed decision-making.

Leave a Reply