KDLY Stock Sees Unprecedented Surge

n

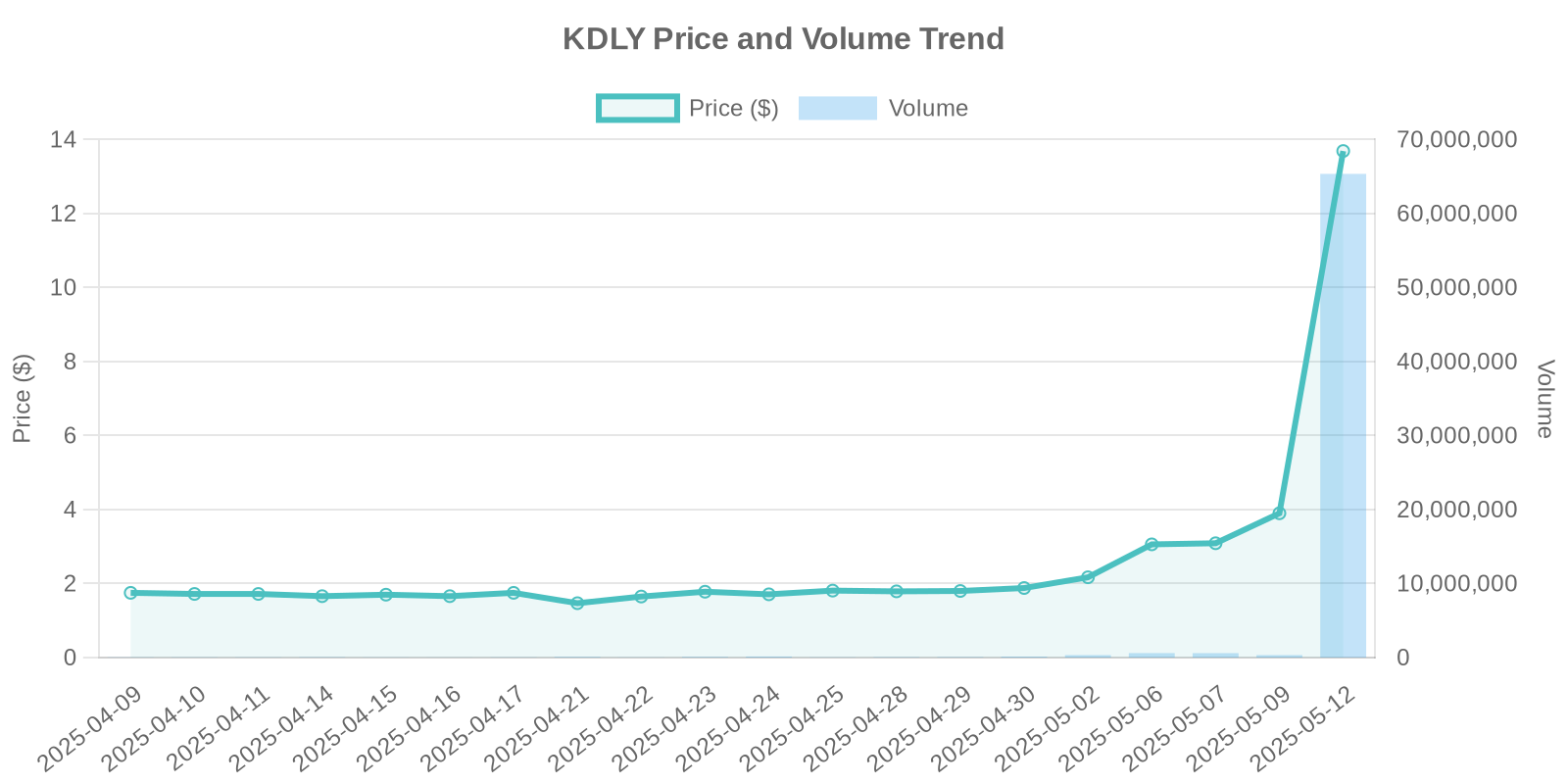

The stock market was abuzz when KDLY experienced a dramatic surge, with its stock price climbing to $13.69, marking a remarkable increase of 251.03%. Such a substantial rise calls for an in-depth analysis to comprehend the underlying forces at play and assess the investment implications for stakeholders.

nn

Understanding KDLY’s Stock Surge

n

The current volume of KDLY stock trading stands at a colossal 65,317,391, indicating a significant increase in market interest. While a leap of over 250% in stock value could be attributed to various factors, the absence of clear news or disclosures makes this surge particularly intriguing for investors and analysts alike.

nn

Potential Causes: Institutional Trading Patterns

n

In scenarios where a stock experiences a sharp surge without any accompanying public announcements, one might speculate about institutional trading activities. These large-scale trades, often executed by hedge funds or investment institutions, can significantly influence stock prices. In KDLY’s case, the volume suggests that substantial buying pressure, possibly from institutional investors, might have propelled the stock price.

nn

Industry Trends and Company Overview

n

KDLY operates in a sector that has witnessed robust investor interest in recent times. The company’s strategic initiatives and sector-specific trends might have contributed to increased speculative trading, further amplifying the stock price. Understanding such dynamics is crucial for estimating future growth potential.

nn

Insider Trades and Stock Buyback

n

Currently, there are no disclosed insider trades or stock buyback announcements for KDLY, removing these as potential factors contributing to the stock surge. However, the lack of insider selling might reflect confidence in the company’s prospects.

nn

Investment Risks and Considerations

n

Investors should proceed with caution, as sharp stock price surges can be followed by equally rapid declines. The speculative nature of the recent surge, combined with potential volatility, suggests that KDLY’s stock may pose higher risk levels, especially for risk-averse investors.

nn

Historical Patterns and Comparisons

n

A review of historical trading patterns reveals that similar surges have often corrected over time, once initial excitement wanes. KDLY’s future performance will heavily depend on its ability to convert the current market interest into sustainable growth and responses to forthcoming market developments.

nn

Conclusion: Balancing Opportunity and Risk

n

While KDLY’s current stock surge presents a lucrative opportunity, investors must carefully evaluate the possible risks. Considering potential institutional trading impacts and market-speculative behavior is vital for making informed investment decisions.

Leave a Reply