NITO Stock Surges 140.28%: An In-Depth Analysis of the Recent Stock Price Increase

The stock market is buzzing with the latest developments in NITO stock, which recently soared by an impressive 140.28%, bringing its current price to $0.68. This surge has caught the attention of many investors as they try to understand the dynamics behind this dramatic increase.

Understanding NITO: A Brief Company Overview

NITO is a company that has been quietly operating within its sector, making significant strides in innovation and market presence. While not a headline-grabbing giant, its recent stock performance suggests increased interest from investors and institutions alike.

Industry Trends and Market Conditions

The industry in which NITO operates has seen various emerging trends, including technological advancements and shifting consumer demands, which might have contributed to the recent stock price increase. Market conditions have been generally favorable, promoting growth in niche sectors.

Analysis of the Stock Surge

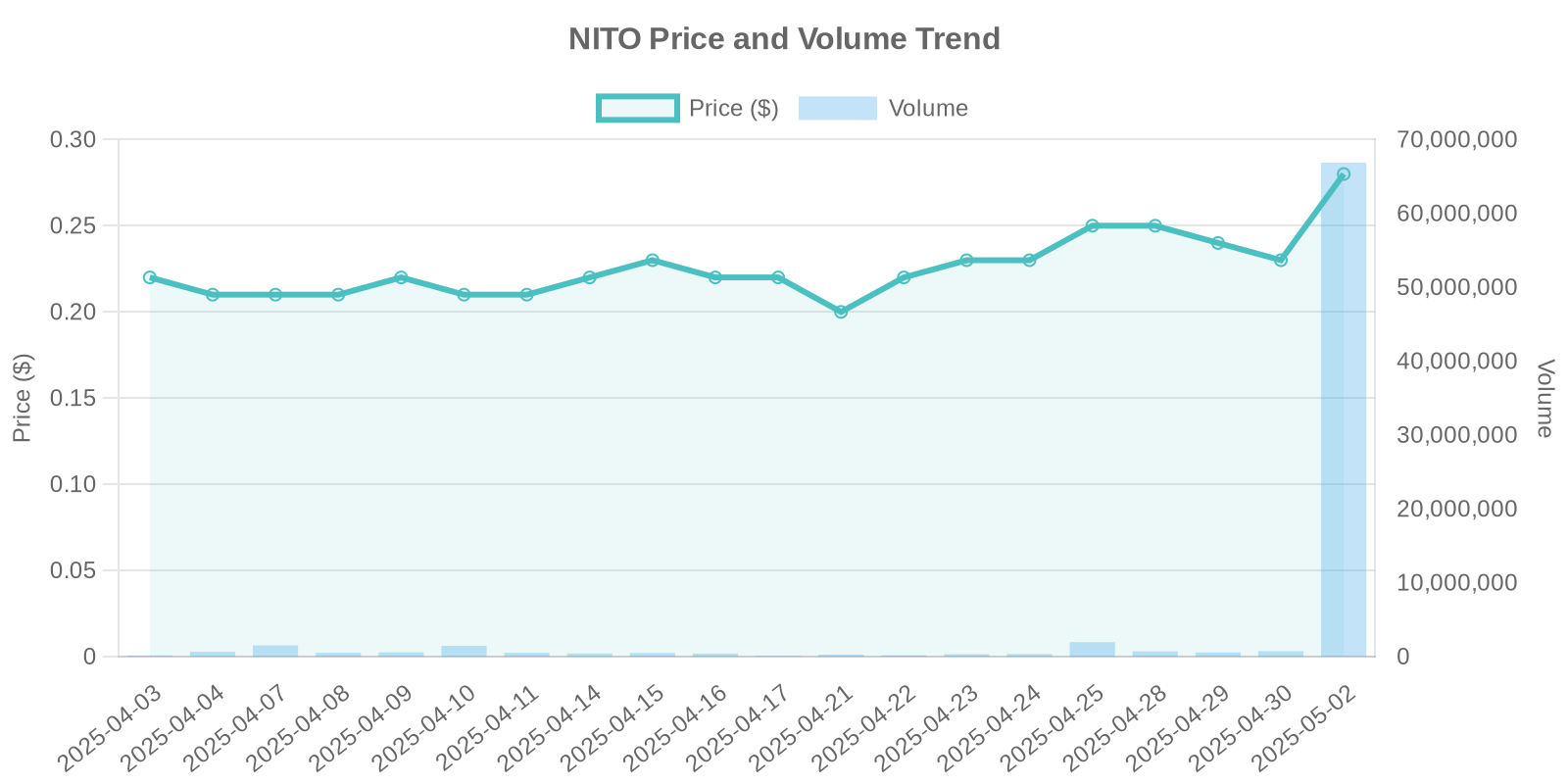

The impressive 140.28% surge in NITO stock is notable, especially considering the high trading volume of 593,482,508. This kind of volume suggests a significant interest from institutional investors, perhaps indicating strategic buy-ins or larger portfolio shifts.

Absence of Insider Trading and Buybacks

As of now, there have been no significant insider trades or stock buybacks announced. This absence indicates that the surge might be driven purely by market factors rather than internal strategic moves.

Potential Institutional Trading Patterns

With no clear news or disclosures triggering this rise, it’s plausible that institutional trading patterns are at play. Large-scale purchasing by institutional investors can lead to such surges, driven by strategic reallocations based on future growth potential.

Investment Risks and Considerations

Investors should remain cautious, as a rapid increase often entails heightened risk. Factors such as market volatility, speculative behaviors, and potential corrections need to be considered. An analysis of historical patterns similar to this surge can provide some insight, but each situation has its distinct nuances.

Conclusion: Investor Alert and Future Projections

While the current surge in NITO offers an exciting opportunity, it is wise for investors to exercise due diligence. Monitoring market updates and seeking comprehensive financial advice is key to navigating potential investment risks effectively.

Leave a Reply