NuCana’s NCNA Stock Sees Unprecedented Surge: Analyzing the 130% Price Increase

Introduction to NuCana and Its Recent Stock Performance

NuCana plc (NASDAQ: NCNA), a clinical-stage biopharmaceutical company based in Edinburgh, has recently captured the market’s attention. Known for its innovative cancer treatment advancements, NuCana is now in the spotlight as its stock price has soared by an impressive 130.66%, reaching $1.10. With a traded volume hitting 137,373,243 shares, this major increase has both investors and analysts seeking a deeper understanding of the driving forces behind this surge.

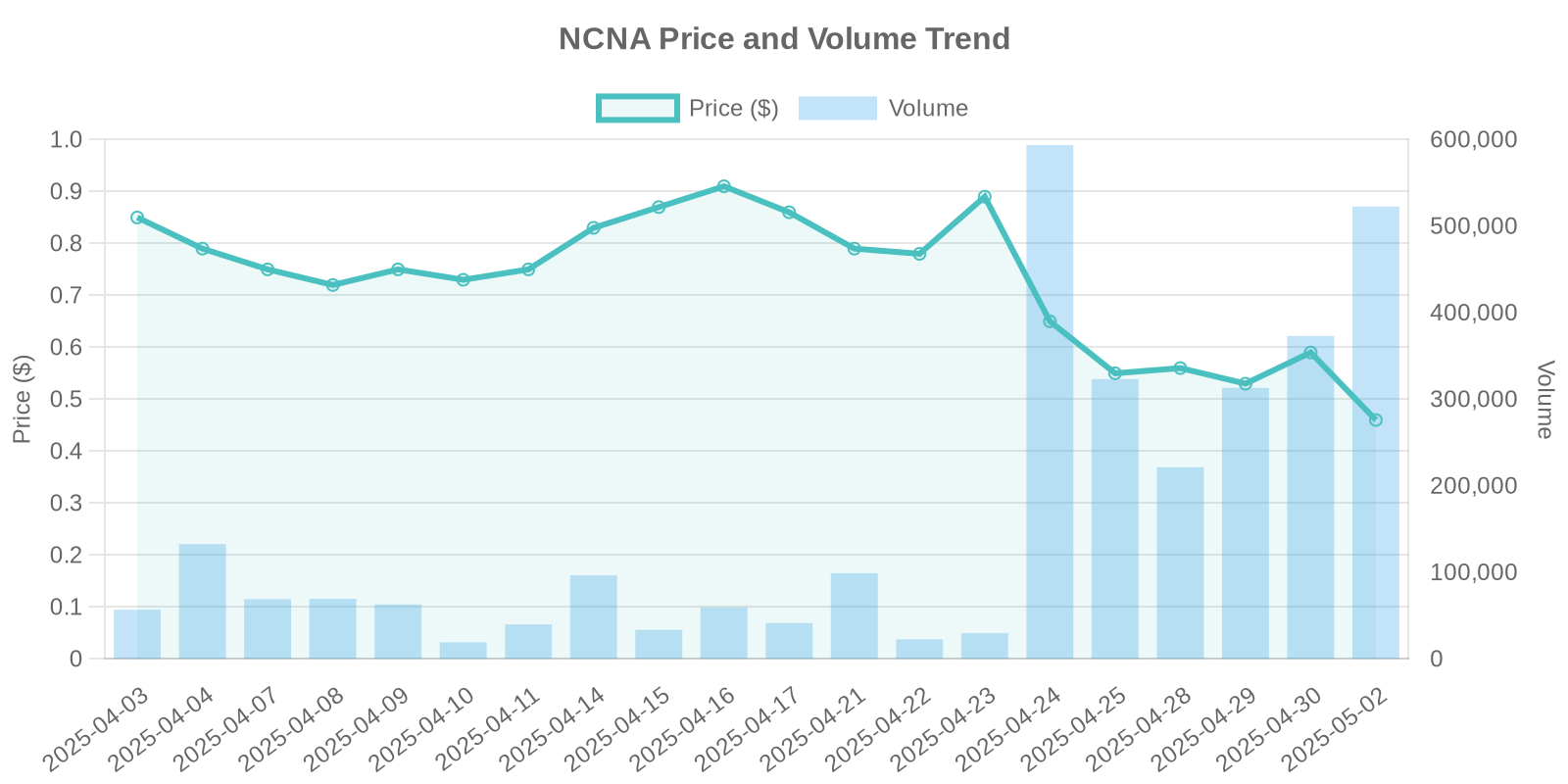

Details of the Stock Surge and Volume Analysis

The surge in NCNA stock is accompanied by a massive trading volume, which suggests a significant market movement. Surges of this nature are usually attributed to positive company developments, but absent explicit news on ongoing clinical trials, the company’s financial maneuvers provide some insights.

Implications of the $7 Million Registered Direct Offering

On May 6, 2025, NuCana announced its $7 million registered direct offering. Priced at $0.6454 per ADS, inclusive of Series A and B warrants, the offering is strategic for funding its ongoing and future drug development efforts. The strategic financial move aims to bolster corporate expenses and potential expansions through investments and collaborations. According to a recent Globe Newswire publication, these efforts were formalized under the SEC’s regulated framework, ensuring investor protection and transparency.

Analyzing Institutional Trading Patterns

The lack of direct announcements or positive trial results might suggest that this recent surge is influenced heavily by institutional trading. Such actors often react swiftly to financial events like the registered offering, potentially indicating perceived undervaluation at pre-offering prices. This significant increase in volume suggests institutional investors may see this as a lucrative long-term play, potentially supportive of NuCana’s future outlook.

Comparisons with Historical Trends

Historically, similar spikes in stock price have been observed within the pharma and biotech sectors, often tied to product development milestones or partnership announcements. However, the current situation reflects strong investor interest based on perceived future value and strategic corporate actions rather than any immediate clinical breakthroughs.

Potential Risks for Investors

Despite this positive momentum, retail investors should approach with caution. Biotech investments, particularly in a clinical-stage company like NuCana, come with inherent high risks. The volatility observed in the stock could mean equally significant downturns in the absence of material advancements or delays in product development timelines. Furthermore, if subsequent findings from clinical trials do not meet the market’s expectations, the stock could see a reversal in its current gains.

Future Outlook and Investment Considerations

NuCana remains a promising prospect within the biopharmaceutical landscape due to its focus on innovative cancer treatments. However, this surge emphasizes the importance of comprehensive due diligence. Investors should closely monitor insider trading activities, which, although currently undisclosed, could provide cues regarding the management’s confidence in its strategic trajectory. Likewise, further developments regarding insider trades and potential buybacks could affirm or dispel current investor sentiments.

Conclusion

While NuCana’s impressive stock surge underscores a strong market interest, the specifics call for a careful evaluation of development updates and financial maneuvers. With the current stock price hovering at $1.10, reflective of a 130% increase, watching upcoming company disclosures and broader market reactions will be essential for gauging future performance. Prospective investors must weigh potential rewards against inherent risk factors typical of the biotech sector.

Leave a Reply