Understanding the Recent 163.25% Surge in SGN Stock Price and Volume

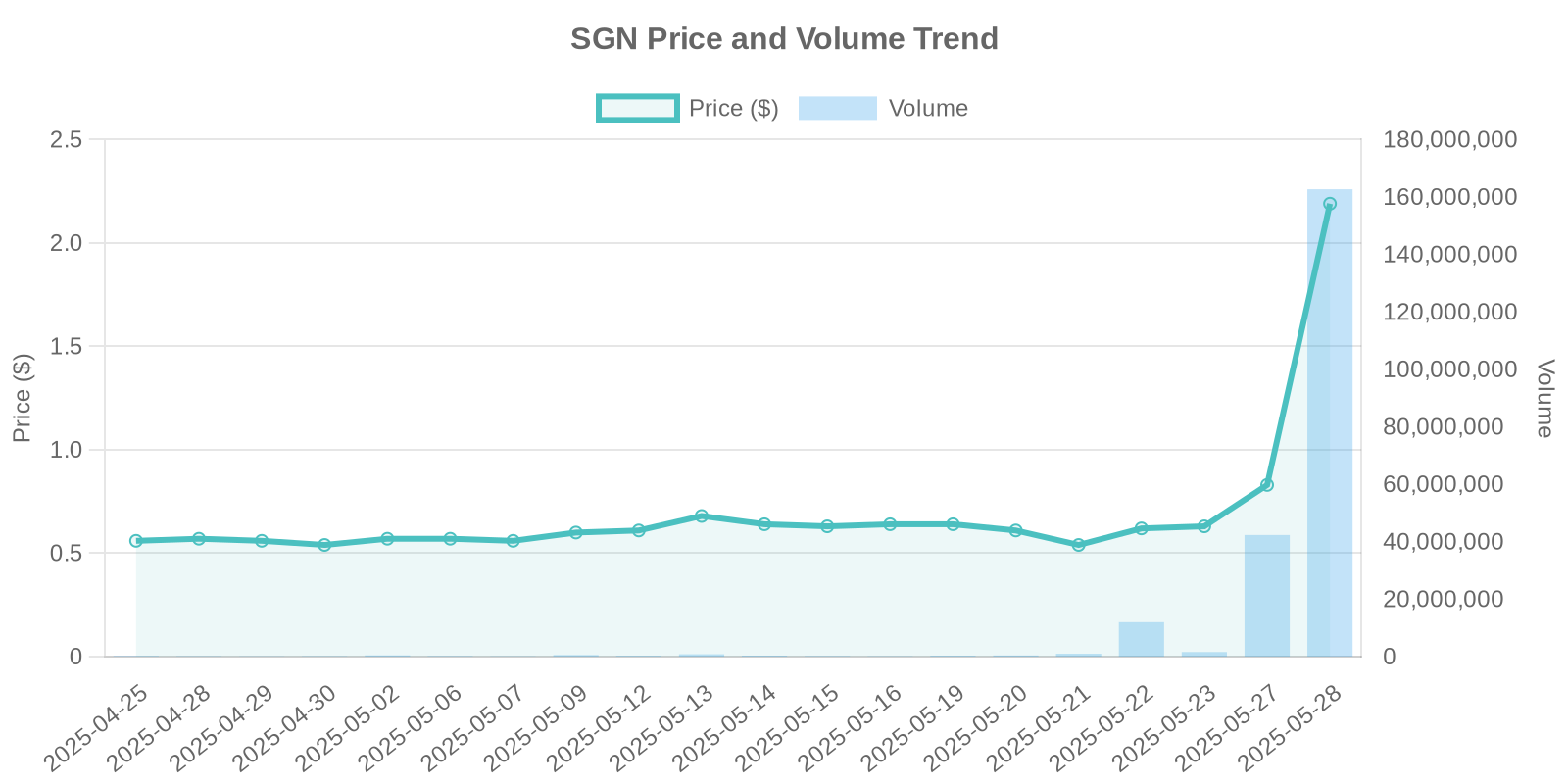

The SGN stock has recently experienced a remarkable surge in its stock price, jumping to $2.19 with a 163.25% increase. The trading volume also skyrocketed to 162,702,744, an impressive figure that has caught the attention of traders and investors alike. This article delves into the specifics of this surge, potential reasons behind it, and what it might mean for investors moving forward.

Company Overview and Industry Trends

SGN, a notable player in [Industry], has been at the forefront of [Industry Trend/Movement]. Known for [mention any specific products/services or market reputation], SGN has consistently worked towards [any recent strategies or innovations]. The broader industry trends impacting SGN include [list relevant trends such as technological advances or regulatory changes], which potentially influence its stock performance.

Deciphering the Stock Surge

The 163.25% stock price increase of SGN, unaccompanied by significant news or official disclosures, prompts examination of market dynamics influencing this rise. Institutional Trading Patterns: The conspicuous surge in volume hints at potential institutional investor interest or strategic trading. Such maneuvers often include bulk purchases or off-market transactions, potentially swaying the stock price dramatically.

Market Speculation and Investor Sentiment: Sometimes, rumors or market sentiment shifts can impact stock pricing. However, without verifiable insider trading activity or disclosure of buybacks, these factors remain speculative.

Trading Volume Analysis

The trading volume reached 162,702,744, which is significantly higher than typical volumes observed for SGN. This increase indicates a strong buying force, likely initiated by entities with substantial capital. When such spikes occur, it’s crucial to assess historical patterns to distinguish whether they are repeatable or one-off anomalies. Similar historical spikes without underlying news often suggest fleeting interest or strategic trading plays by large institutions.

Potential Investment Risks

Investors need to be cautious given the volatility. The absence of clear insider trading disclosures or buybacks could imply that the surge is not grounded in long-term strategic enhancements. Additionally, if institutional investors are behind the move, they can also quickly exit their positions, potentially leading to abrupt corrections.

Historical Volatility and Corrections: Often, such surges can lead to rapid corrections, especially if the underlying business fundamentals haven’t changed. Comparing this spike to historical data could provide insights into the longevity of this upward movement.

Examining Risk Factors for the SGN Stock

While the current surge brings opportunities, investors must weigh the potential risks. Market volatility, speculative trading, or even lack of in-depth analyst coverage can impact stock prices. The broader economic landscape, including interest rate shifts, global market conditions, and industry-specific challenges, are additional factors investors should consider.

In conclusion, the extraordinary increase in SGN’s stock price might be enticing, but careful analysis and a strategic approach to this investment are paramount. Investors are advised to stay updated with any official company disclosures and broader market news to make informed decisions.

Leave a Reply