Understanding the SXTC Stock Price Surge

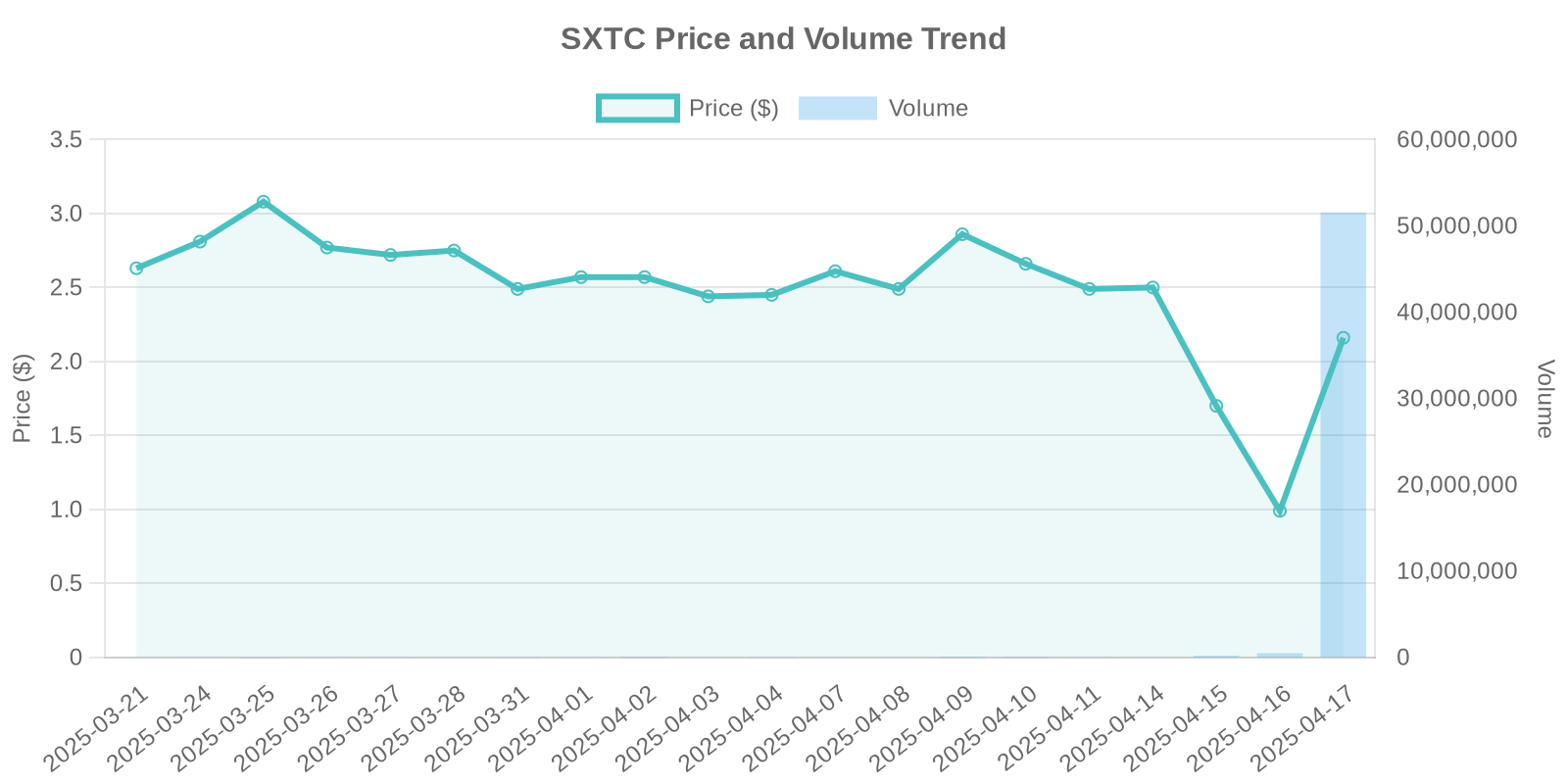

The recent surge in SXTC stock has caught the attention of many investors. On October 2023, SXTC saw its stock price rocket by 116%, reaching a new height of $2.16. The trading volume spiked to 51,451,474, indicating significant market activity.

Company Overview: SXTC

SXTC, a prominent health technology company, focuses on innovative solutions in the pharmaceutical sector. Despite its niche presence, SXTC’s strategic initiatives have positioned it for growth within its industry.

Analyzing the Surge: Potential Factors

Without any detailed news releases or disclosures, the factors driving SXTC’s stock surge remain speculative. Typically, such significant fluctuations might indicate institutional trading patterns or market sentiment shifts. Investors should consider both possibilities as they assess investment risks.

Institutional Trading Patterns

The absence of insider trading or stock buybacks during this surge suggests that institutional trading might be at play. Large-volume trades often involve institutional investors leveraging significant capital to move the market in a favorable direction. This pattern, lacking insider buy/sell activities or company buyback initiatives, raises questions about the source and sustainability of this surge.

Comparing Historical Trading Patterns

Historically, SXTC has experienced little volatility, making this sudden increase noteworthy. Comparing the current situation with similar past patterns can reveal that this may be attributable to temporary speculative interest rather than a long-term value shift.

Examining Market Dynamics and Volume

The spike in SXTC’s trading volume, reaching 51,451,474, far exceeds its average, highlighting intensified market interest. Such trends are often driven by speculative trading or potentially algorithmic trading strategies implemented by large financial institutions. Understanding these dynamics can provide insights into short-term volatility risks.

Risks for Retail Investors

While the SXTC stock surge can present opportunities for investors, it also introduces significant risks. Retail investors should remain cautious, as surges without clear fundamental support might lead to increased volatility and potential downturns.

Industry Context and Trends

In the broader health technology sector, innovation drives significant interest, often causing rapid stock movements. However, it’s crucial for investors to align stock investment decisions with fundamental financial analyses and long-term strategic planning rather than reactionary trading.

Conclusion and Investor Recommendations

In light of the recent SXTC stock price surge, investors should carefully monitor the company’s announcements, industry trends, and potential patterns of institutional trading. While opportunities exist, the associated risks cannot be overlooked. Delving into industry reports, shareholder communications, and financial statements will equip investors with a better understanding of potential value drivers or risk factors.

Leave a Reply