TIVC Stock Surge: In-depth Analysis of a 103% Increase

Understanding the Recent Surge in TIVC Stock Price

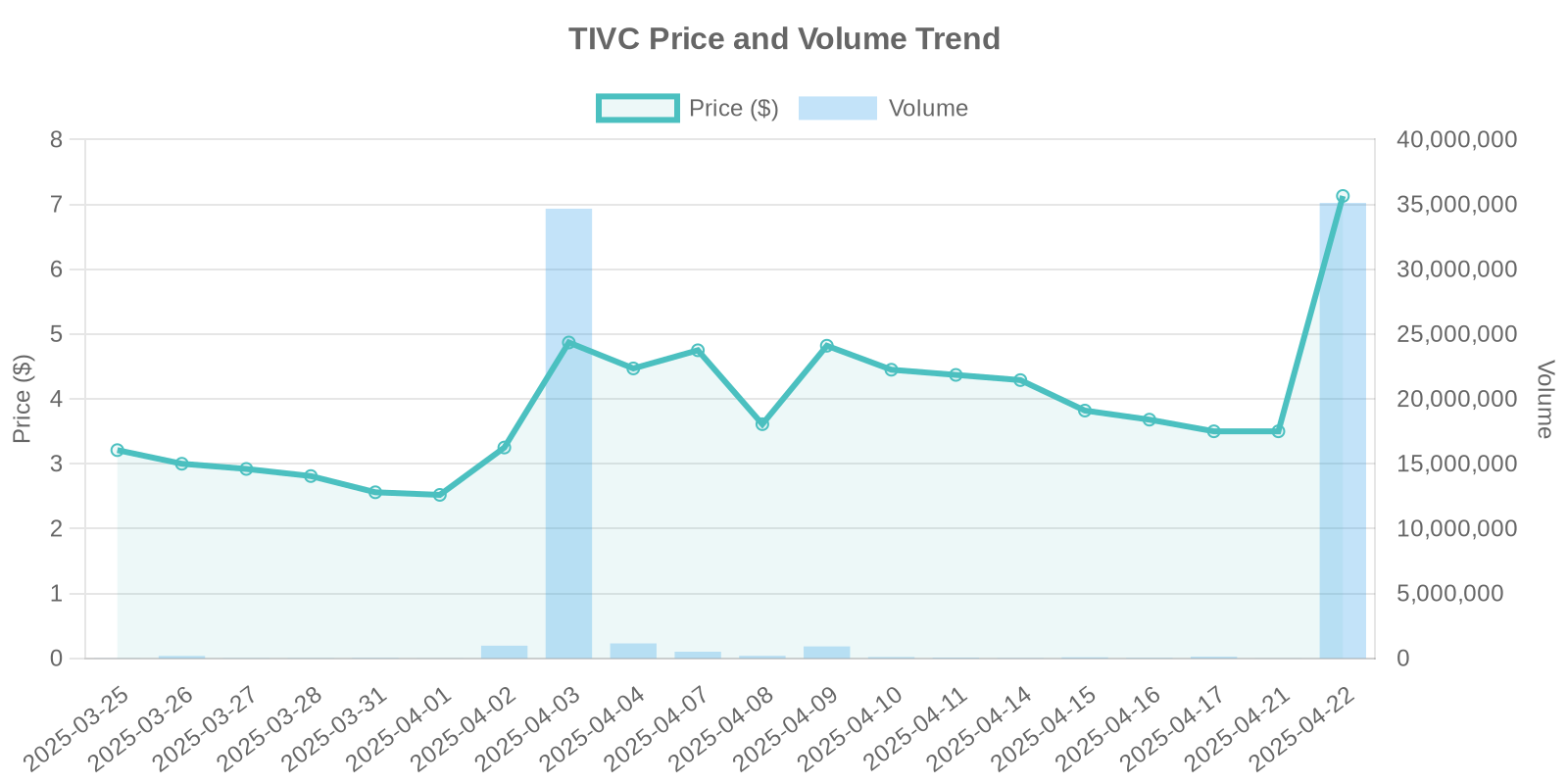

On April 22, 2025, Tivic Health Systems, Inc. (NASDAQ: TIVC) experienced an astounding stock price surge of 103.71%, elevating its current trading value to $7.13. This substantial increase was coupled with a trading volume of 35,066,097 shares, raising questions about potential catalysts behind this movement.

Company Overview: Tivic Health Systems, Inc.

Tivic Health Systems, Inc. is a pioneering therapeutics company known for its innovative biologic and bioelectronic product candidates. The company’s notable focus on the TLR5 and Vagus Nerve Stimulation (VNS) programs aims to address critical health challenges such as acute radiation syndrome and neurological disorders, reflecting its strategic commitment to health innovation.

Analysis of Recent News and Meetings

Significant developments came to light following a BusinessWire release on April 22, 2025, detailing Tivic Health’s meetings with the White House and FDA. These discussions highlighted considerable government interest in Tivic’s product candidates for military and defense applications. The prospect of expedited pathways to approval for products like Entolimod™ could catalyze future growth and market presence.

Stock Buyback Announcement and Its Implications

Tivic’s recent announcement of a $25 million stock buyback plan, anticipated for March 21, 2025, adds another dimension to the surge narrative. While specific details regarding the buyback method and shares remain undisclosed, such actions often signal company confidence and can alter market sentiment positively.

Potential Influence of Insider Trading

No explicit insider trading activities have been reported concurrent with the stock surge. Insider trading can frequently impact stock volatility; however, without concrete disclosure, such assumptions remain speculative.

Institutional Trading Patterns and Volume Analysis

In the absence of explicit news that fully explains the stock price movement, the trading volume records suggest potential institutional trading or algorithmic activity. With over 35 million shares exchanged, this surge in volume far exceeds typical trading patterns, potentially indicating high institutional interest or speculation.

Investment Risks and Considerations

Despite the promising developments driving the recent TIVC stock surge, investors must remain vigilant. Industry-related challenges, regulatory approval uncertainties, and market competition can pose significant risks. Additionally, while idyllic government interest provides a growth opportunity, any shift in political or funding priorities could adversely affect the company’s future.

Comparative Analysis of Historical Patterns

Analyzing similar surge patterns in biotech stocks, it’s evident that sudden interest often revolves around speculative news or scientific breakthroughs. The current scenario with Tivic draws parallels to other firms experiencing temporary surges due to regulatory milestones or speculative endorsements.

Looking Ahead

For retail investors interested in TIVC stocks, understanding the blend of strategic partnerships, technological advancements, and regulatory landscapes becomes pivotal. While the recent developments are promising, thorough due diligence and a balanced risk assessment remain essential for making informed investment decisions.