HBIO Stock Price Soars 135.74%: Analyzing the Unexpected Surge

In recent trading sessions, HBIO stock saw an extraordinary surge, with its price catapulting to $0.67, marking a 135.74% increase. This unexpected rise has turned many heads in the stock market community, prompting a thorough analysis of the factors that could have influenced this movement.

Company Overview: Understanding HBIO

Harvard Bioscience Inc. (NASDAQ: HBIO) is a global developer of innovative scientific instruments used to advance life science and clinical research. With a focus on providing high-quality solutions to scientific problems, HBIO is a key player in the bioscience industry. The company has consistently worked towards solidifying its position amidst rapidly evolving industry trends.

Industry Trends Influencing HBIO

The bioscience industry is characterized by rapid technological advancements and a growing emphasis on health research. Companies like HBIO are continuously innovating to meet the needs of modern laboratories and research institutions. The rising demand for more sophisticated scientific tools could be a catalyst for the recent stock price surge.

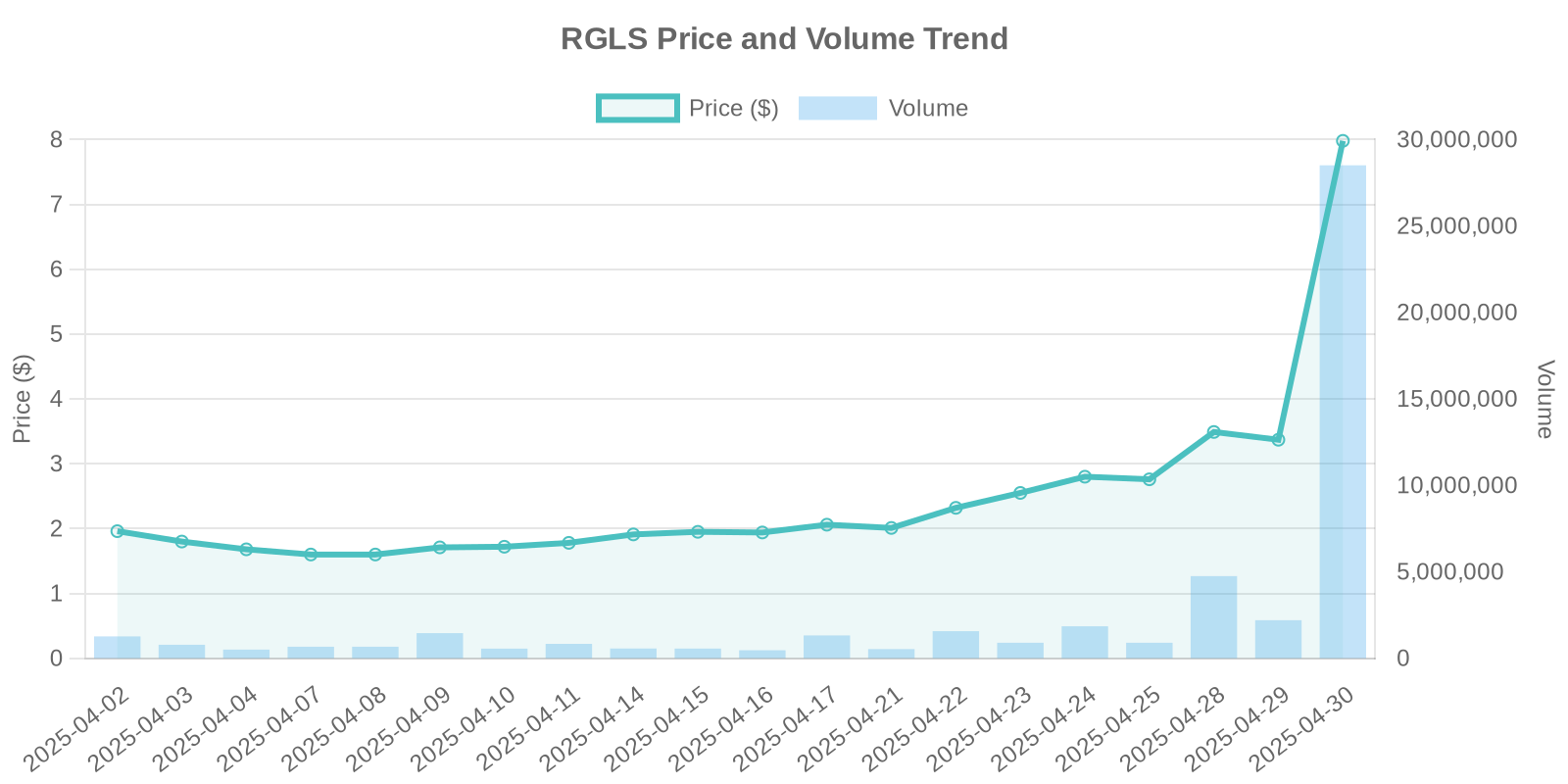

Examining the Recent Surge: Price and Volume Analysis

The dramatic 135.74% surge in HBIO’s stock price was accompanied by an unusually high trading volume of 627,492,974 shares. This surge could potentially indicate a large-scale institutional trading pattern. When a stock experiences such high volume, it often signals heightened interest from institutional investors or a major shift in market sentiment.

Insider Trading and Buyback Analysis

As of the data provided, there is no clear indication of insider trading or stock buybacks influencing HBIO’s recent performance. While insider activity and buybacks often precede significant stock movements, their absence suggests that the surge may be more tied to broader market dynamics or external factors.

Absence of Direct News: Speculating Institutional Activity

Without specific news disclosures to attribute to the price increase, we turn our attention to institutional trading activity. Large stocks surges without specific catalyst news can sometimes be driven by institutional investors rebalancing portfolios or taking strategic positions. Retail investors should consider this possibility in their analyses.

Potential Investment Risks

While the surge in HBIO stock is indeed attention-grabbing, potential investors should be mindful of associated risks. Rapid stock increases can sometimes lead to equally rapid downturns, especially if the rise is speculative rather than news-driven. It’s essential to remain cautious and analyze both technical indicators and fundamental factors before making investment decisions.

Historical Comparisons and Future Outlook

Historical analysis of HBIO’s stock performance reveals periods of volatility, a common characteristic in the biotech sector. By comparing this recent surge to past patterns, investors might gauge future movements. While past performance doesn’t guarantee future results, it can offer insights into market behavior.

As HBIO continues to innovate within the bioscience industry, market participants will be watching closely to see if the current price surge translates into sustained growth. Investors should stay updated on news releases and financial disclosures that could impact future stock valuations.