Introduction

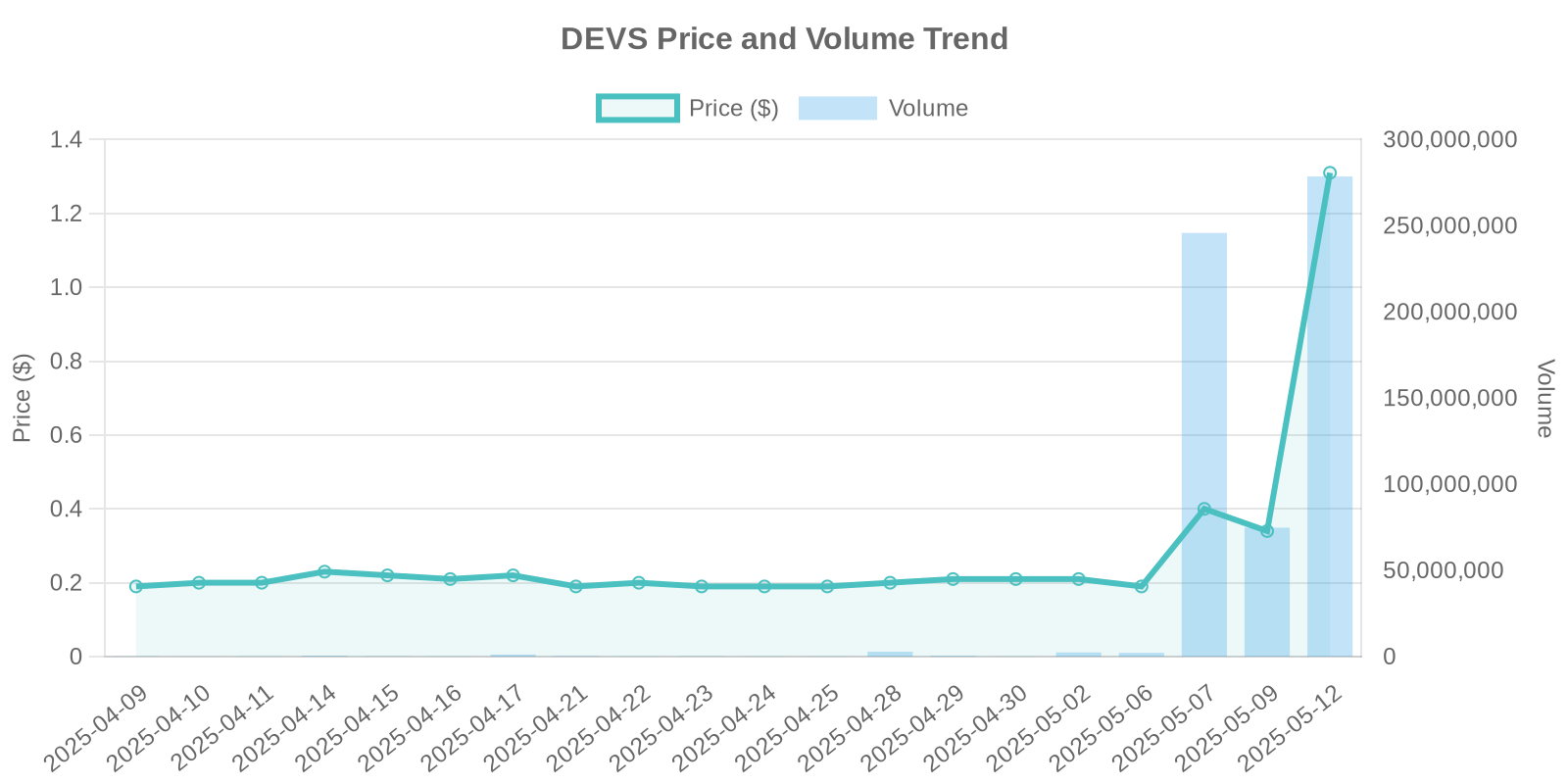

DevvStream Corp. (NASDAQ: DEVS), a notable player in the carbon management industry, has seen a significant stock surge of 290.93%, closing at $1.31 with a trading volume of 272,494,817. This unexpected leap has sparked interest among investors and analysts, given the absence of insider trading disclosures and stock buyback announcements.

Company Overview

DevvStream Corp. focuses on the development, investment, and marketing of environmental assets. Their business model capitalizes on the rising demand for carbon management solutions in an evolving regulatory landscape globally.

Industry Context

The global carbon capture and storage market is witnessing robust growth. Recent agreements and collaborations, such as the one between DevvStream’s affiliate, Monroe Sequestration Partners, and Southern Energy, highlight the strategic importance of carbon capture projects. These initiatives align with the increasing regulatory requirements for decarbonization across aviation and maritime sectors.

Analysis of Recent News

Recent news featuring DevvStream includes an announced partnership with Southern Energy, designed to enhance carbon capture strategy in Louisiana. Southern Energy’s development plans for a $1 billion biomass-to-fuel facility further demonstrate significant investment in low-carbon solutions. These ventures promise extensive carbon credit generation and play into the regulatory framework supporting 45Q tax credits.

Moreover, DevvStream has signed an MoU with Fayafi Investment Holding. This joint venture aims to expedite investment in decarbonization projects, combining operational expertise with large-scale capital resources. The venture is a proactive response to meet climate finance demands with an initial funding target of $100 million.

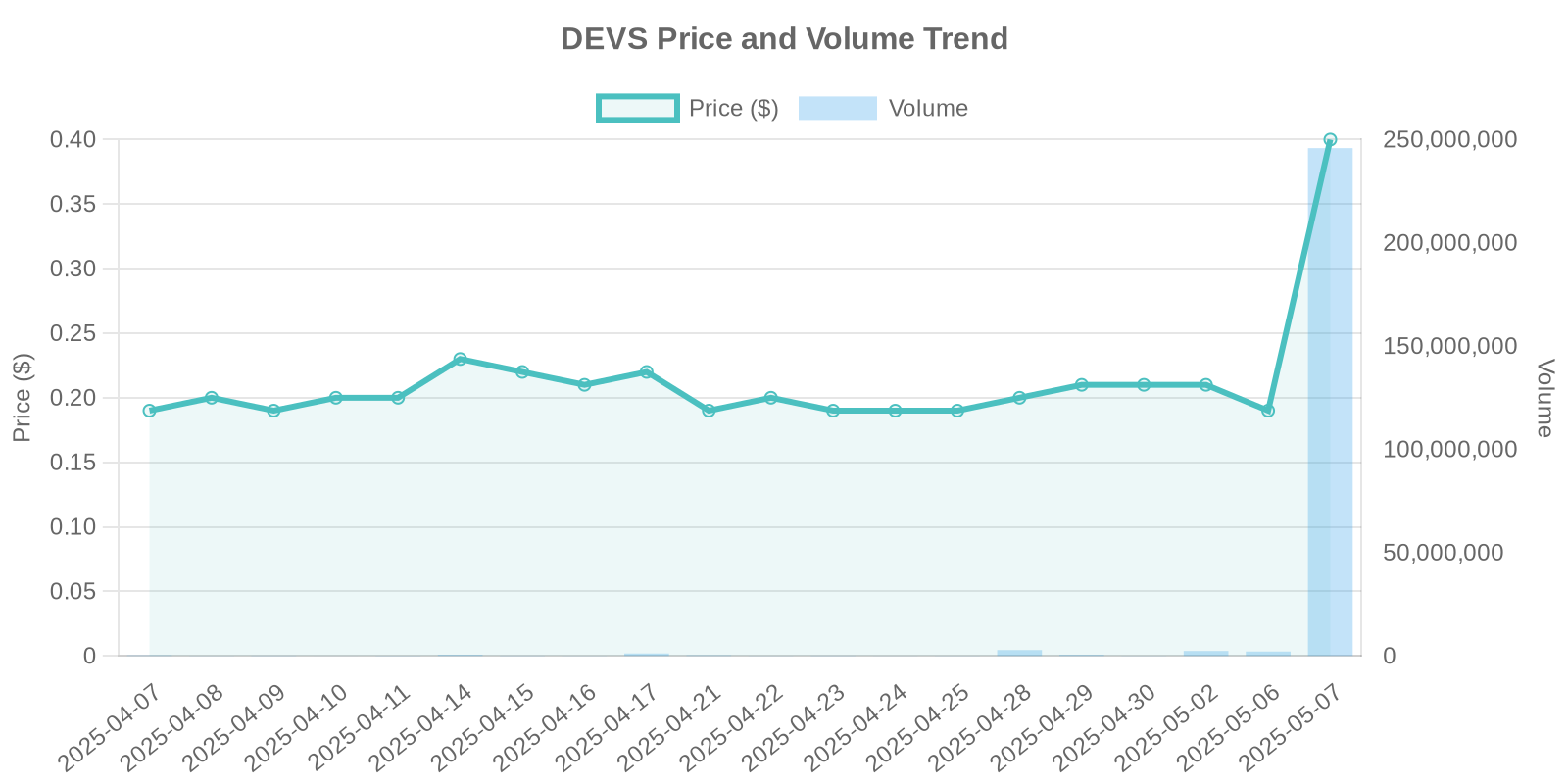

Detailed Analysis of Stock Movement

Despite the absence of direct news linking to immediate insider trading or stock buyback, the remarkable surge in DEVS stock suggests potential large-scale investor interest, possibly institutional. The trading volume of 272,494,817 is notably high, hinting at significant buying force from major stakeholders. Such institutional trading patterns often precede strategic announcements or favorable market rumors.

Historically, such surges occur when a company is poised on the brink of transformative projects or milestones, particularly evident in sectors experiencing regulatory tailwinds like carbon management.

Investment Risks and Considerations

While the surge presents a lucrative opportunity, potential investors must tread cautiously. The lack of concrete insider data or buyback strategies may signal volatility post-surge. Stakeholders should evaluate the risks of rapid valuation changes, especially in an unpredictable global market. Additionally, while the carbon capture industry is burgeoning, project timelines extending into 2027 and beyond suggest a long-term risk profile.

Conclusion

DevvStream’s stock surge underscores the company’s strategic positioning in a high-growth market. The partnerships with Monroe and Fayafi reflect substantial future potential. However, prudent investors should balance optimism with caution, considering possible market corrections.