n

nFoot Locker (FL) Stock Price Surges Amid Acquisition by Dick’s Sporting Goods

n

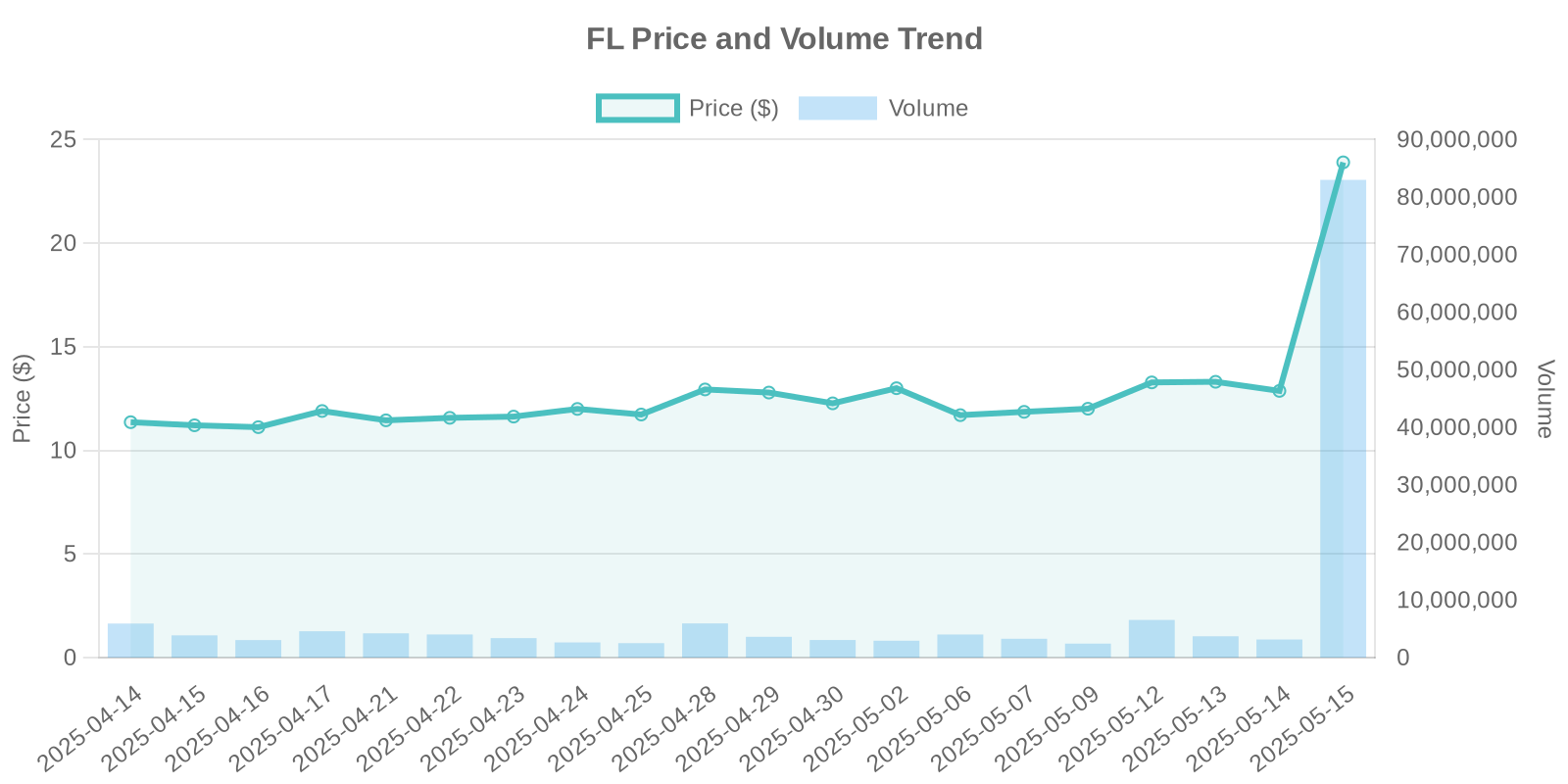

The stock market witnessed a significant turn with Foot Locker, Inc. (NYSE: FL) experiencing a massive surge in its stock price by 85.86%, reaching $23.92. This surge comes in light of a major announcement that Dick’s Sporting Goods (NYSE: DKS) is set to acquire Foot Locker for approximately $2.4 billion. This transaction has captivated investors, impacting trading patterns and raising questions about future market dynamics.

n

Market Reaction and Stock Price Increase

n

Foot Locker’s stock price increase is underpinned by the market’s enthusiastic reaction to the news of the acquisition by Dick’s Sporting Goods. The announcement preceding the opening bell catalyzed a substantial buying force, pushing the trading volume to 82,996,216 shares. Historically, acquisition announcements often lead to stock price surges due to perceived increases in company value and potential growth synergies. This pattern aligns with the notable pre-market activity where Foot Locker shares skyrocketed, echoing the merger buzz.

n

Insight into Company Overview and Industry Trends

n

Foot Locker, Inc., a prominent footwear and apparel retailer, has been an influential entity with approximately 2,400 stores globally. Despite its vast presence, recent financial reports indicate a downturn, with a notable net loss in the preliminary first quarter of 2025, amounting to $363 million. This financial backdrop, coupled with acquisition news, positions the company within a transformative phase. Meanwhile, the retail and sports industry continues to evolve, embracing digital innovations and omnichannel capabilities as core growth drivers.

n

Interpreting Financial Results and Insider Trading

n

According to recent preliminary results, Foot Locker faced a challenging quarter, highlighted by a 2.6% decrease in comparable sales. Despite these metrics, market optimism surrounding the acquisition suggests confidence in Dick’s ability to revitalize Foot Locker’s financial trajectory. Regarding insider trading, no anomalous trading behavior prior to the announcement suggests the surge is primarily externally driven by the market’s response to the acquisition news rather than insiders capitalizing on undisclosed information.

n

Stock Buyback and Institutional Trade Patterns

n

As the headlines focused on the forthcoming acquisition, no substantial stock buyback programs were reported, suggesting the surge is less corporate action-driven and more aligned with external buyer interest. The high trading volume and price spike could indicate institutional trading patterns, where large funds and entities may have adjusted their portfolios in anticipation or reaction to the merger strategy, seeking to leverage the expected synergies from integrating Foot Locker within Dick’s operational framework.

n

Potential Risks and Investor Considerations

n

While the merger presents a promising avenue for growth and structural realignment, it is important to approach with caution. The integration process entails strategic overlap management, culture alignment, and ensuring market competitiveness amidst evolving consumer demands. Additionally, the uncertainty in Foot Locker’s current financial health calls for cautious optimism, stressing the importance of market due diligence and strategic diversification for investors.

n

Long-Term Implications for the Sports Retail Industry

n

The combination of Foot Locker’s branded presence with Dick’s operational expertise marks a significant consolidation within the sports retail sector. This entity is poised to reshape consumer engagement through enhanced digital footprints and innovative store conceptualizations. With Dick’s maintaining Foot Locker as a standalone brand, there’s potential for scaling through cross-brand leverage while retaining distinct market identities.

n

Conclusion: Monitoring the Post-Acquisition Market

n

As the market adjusts to this major retail industry development, ongoing observation of stock performance post-acquisition will offer insights into the strategic effectiveness and market reception of the combined entity. Investors ought to remain informed on transitional phases, potential further announcements, and market conditions impacting the broader retail landscape.

nn