Introduction to Gryphon Digital Mining and Recent Surge

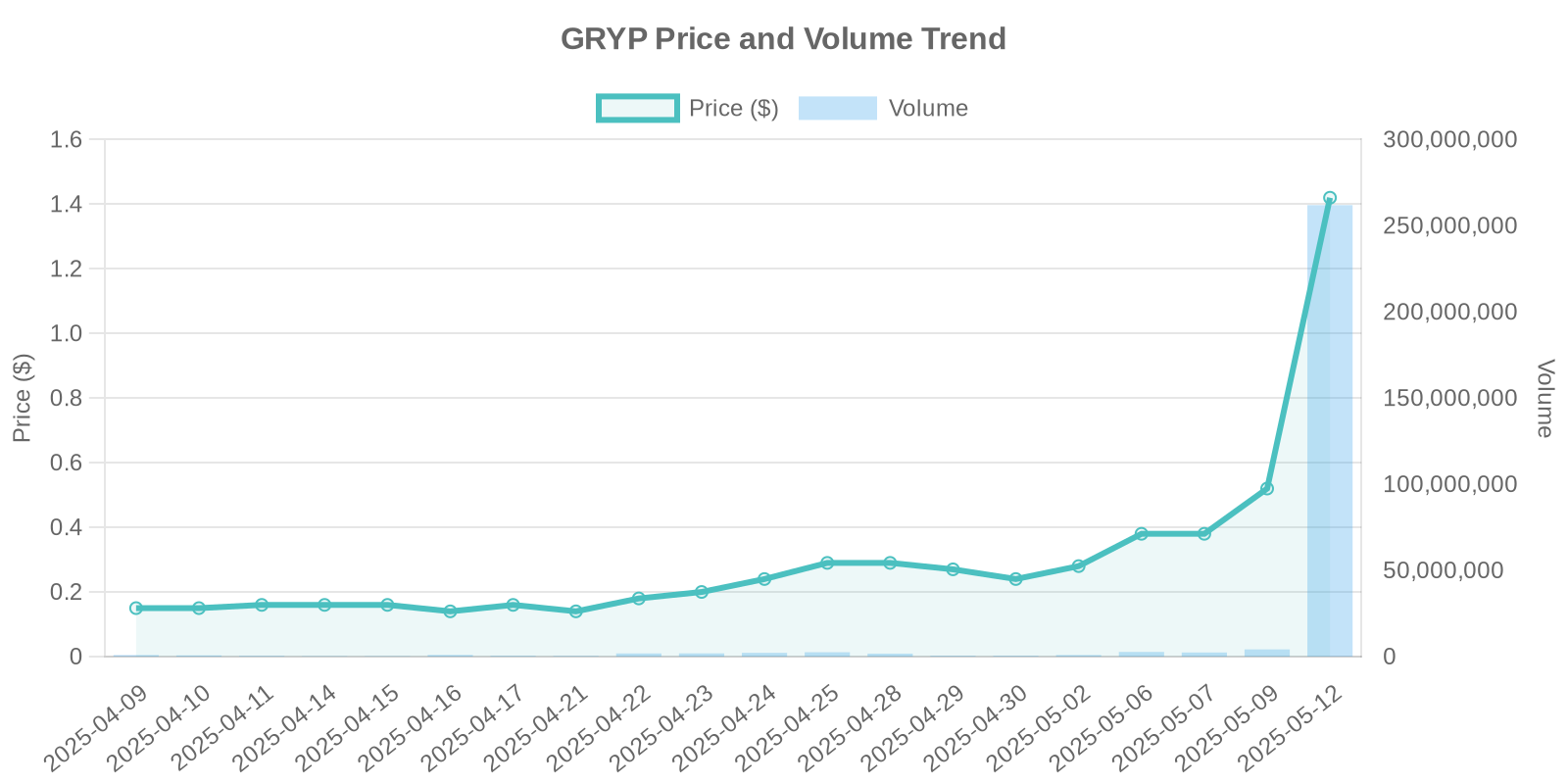

Gryphon Digital Mining, Inc. (NASDAQ: GRYP) recently experienced a remarkable stock surge, with its price rocketing by 173.08% to $1.42. This meteoric rise is largely attributed to Gryphon’s significant merger announcement with American Bitcoin Corp., a strategic move that positions the newly combined entity to become a leader in the Bitcoin mining industry.

Understanding the Merger Announcement

As per the news released on May 12, 2025, Gryphon Digital Mining has entered a definitive merger agreement with American Bitcoin. This stock-for-stock transaction is set to culminate in the formation of one of the world’s most formidable pure-play Bitcoin mining companies. The merger aims to leverage American Bitcoin’s infrastructure strategy to establish a powerful mining and accumulation platform. This is expected to resonate positively with stockholders, as they become part of a market leadership narrative.

Impact of the Merger News on GRYP Stock

The announcement of the merger has had a profound impact on GRYP stock, driving its price up by an impressive 173.08%. The trading volume surged to 261,354,896, indicating heightened investor interest. Such a boost can be attributed to the attractive prospects of the new company’s market positioning and the leadership’s strategic vision.

Company Overview and Industry Context

Gryphon Digital Mining has been making waves in the Bitcoin mining space, focusing on scaling operations efficiently. Concurrently, the broader cryptocurrency market has witnessed fluctuating trends, with Bitcoin as a pivotal player. The mining sector is growing, driven by technological advancements and increasing demand for efficient crypto-mining operations. This merger is set to tap into these trends, potentially setting new benchmarks in the industry.

Analysis of Institutional Trading Patterns

While the merger announcement is significant, a keen examination suggests potential institutional trading behaviors contributing to the surge. Large volumes and the absence of insider trading disclosures or company buyback activities point towards institutional interests, possibly anticipating long-term gains from the merger’s strategic benefits. Investors should consider monitoring disclosures for any new institutional entries or exits.

Exploring Investment Risks

Despite the promising outlook, potential risks must be acknowledged. The transaction completion is contingent on several closing conditions, including stockholder approval, which introduces procedural uncertainties. Additionally, the considerable stock dilution post-merger (with Gryphon stockholders expected to own about 2% of the new entity) might affect stock value perceptions in the interim.

Trading Volume and Historical Comparisons

The surge in GRYP’s trading volume is reminiscent of past patterns observed around significant M&A activities in the sector. A similar upward trajectory was seen during previous significant announcements in the mining industry, suggesting market participants often react strongly to consolidations that introduce new strategic growth avenues.

Long-Term Outlook

In the long term, the success of this merger lies in execution. If American Bitcoin delivers on its promise of creating a cost-efficient Bitcoin mining platform, Gryphon stockholders and prospective investors could see excellent value creation. The company’s strategic realignment positions it well to capitalize on the evolving crypto landscape.

Conclusion and Investor Takeaways

In conclusion, Gryphon Digital Mining’s merger with American Bitcoin represents a notable shift within the Bitcoin mining space, marked by an astounding stock surge. While the immediate market response has been overwhelmingly positive, investors should consider the procedural and strategic risks involved. This move underscores the importance of keeping abreast with industry trends and corporate developments for optimal investment strategies.