Understanding the 100% Surge in MRIN Stock: Key Insights and Analysis

nn

Current Surge Overview

n

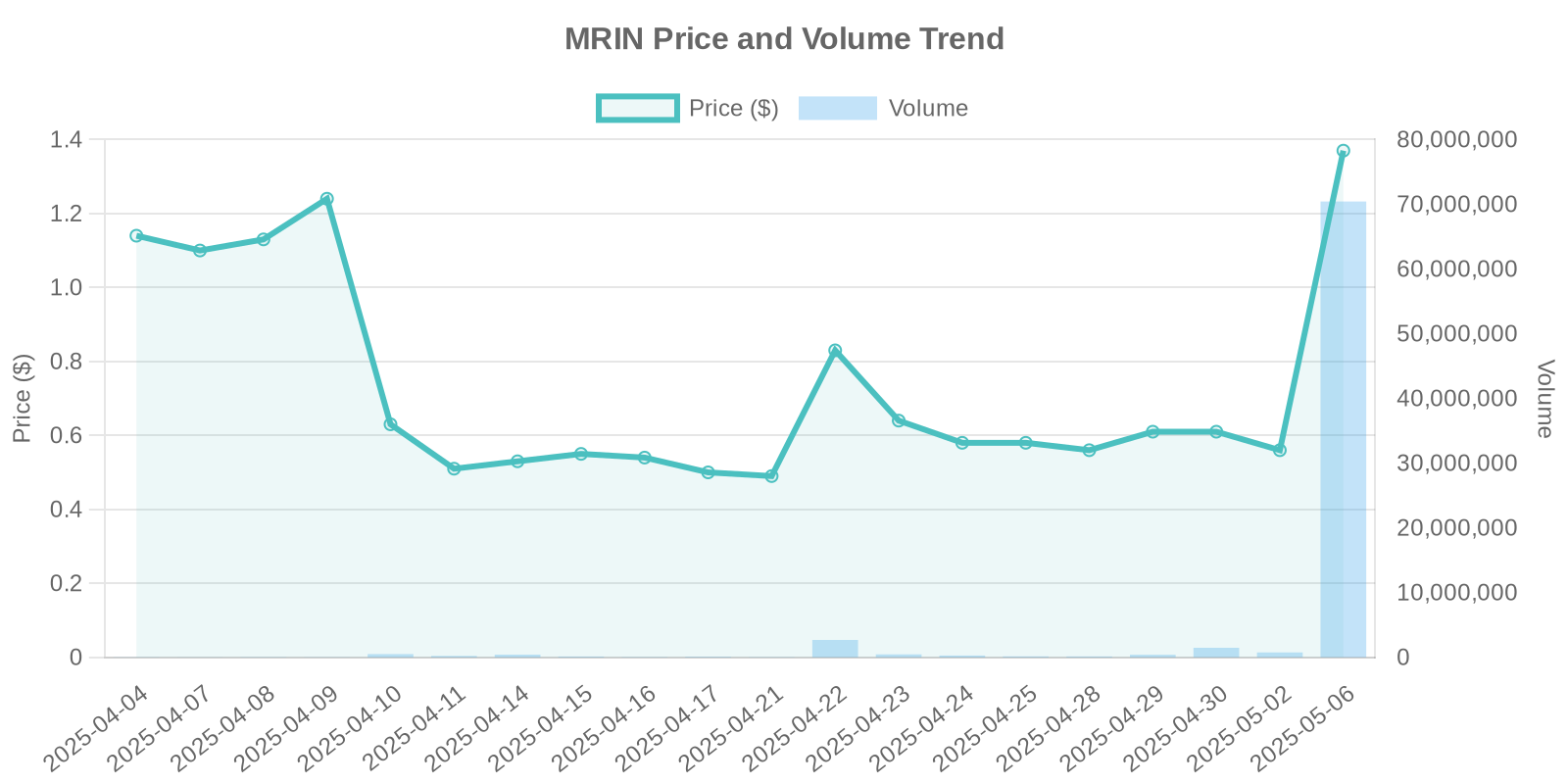

In a surprising turn of events, MRIN stock saw a significant surge of 100%, reaching a current price of $1.7. The trading volume also surged, with 55,946,625 shares changing hands—a clear indicator of heightened investor interest.

nn

Company Overview

n

Marin Software Incorporated (NASDAQ: MRIN) operates in the digital advertising industry, offering cross-channel advertising management solutions. Known for helping advertisers target audiences efficiently, MRIN is part of a rapidly evolving industry where digital transformation is a key driver.

nn

Industry Trends and Context

n

The digital advertising industry is known for its dynamic growth, largely driven by the increasing shift towards digital marketing. Companies like Marin Software are well-positioned to benefit from this trend by providing solutions that enhance advertising efficiency and ROI.

nn

Significance of the Stock Surge

n

The recent 100% surge in MRIN’s stock price suggests significant investor optimism or strategic moves by institutional players. While there is no immediate news release or public disclosures explaining the surge, this dramatic price movement warrants further analysis.

nn

Insider Trading and Buyback Program Insights

n

Currently, there are no significant public disclosures regarding insider trading or stock buyback programs that might justify the price surge. This gap in direct news feeds speculation about institutional buying or speculative trading activities possibly driving up the stock price.

nn

Trading Volume and Patterns Analysis

n

The enormous surge in trading volume is a crucial indicator to consider. When there is an extraordinary spike in volume alongside a price jump, it often points towards possible institutional interest. This could be through strategies such as buying in bulk for strategic positioning or through sentiment-driven trading.

nn

Potential Institutional Trading Patterns

n

In the absence of clear news, the possibility of institutional trading activities is heightened. Large investment funds or institutional traders may be taking positions due to speculative bets or based on undisclosed strategic insights. Investors should monitor ownership filings and institutional holdings closely.

nn

Risk Assessment for Investors

n

Despite the attractive surge, retails investors should tread cautiously. Stocks moving significantly without clear fundamental catalysts can be risky, often leading to volatility and potential pullbacks. Keeping an eye on future news releases, institutional holdings changes, and market sentiment is crucial.

nn

Comparative Analysis with Historical Patterns

n

Assessing MRIN’s past performance during similar surges can provide insights. Historically, we’ve seen that without concrete news, such rapid rises are followed by market corrections. Thus, understanding past patterns can help in making informed decisions.

nn

Conclusion

n

The surge in MRIN stock price is undoubtedly intriguing, offering potential opportunities but also significant risks. As we await more information, careful evaluation and strategic thinking are essential for investors.