NVNI Stock Price Surge: Understanding the 111.22% Increase

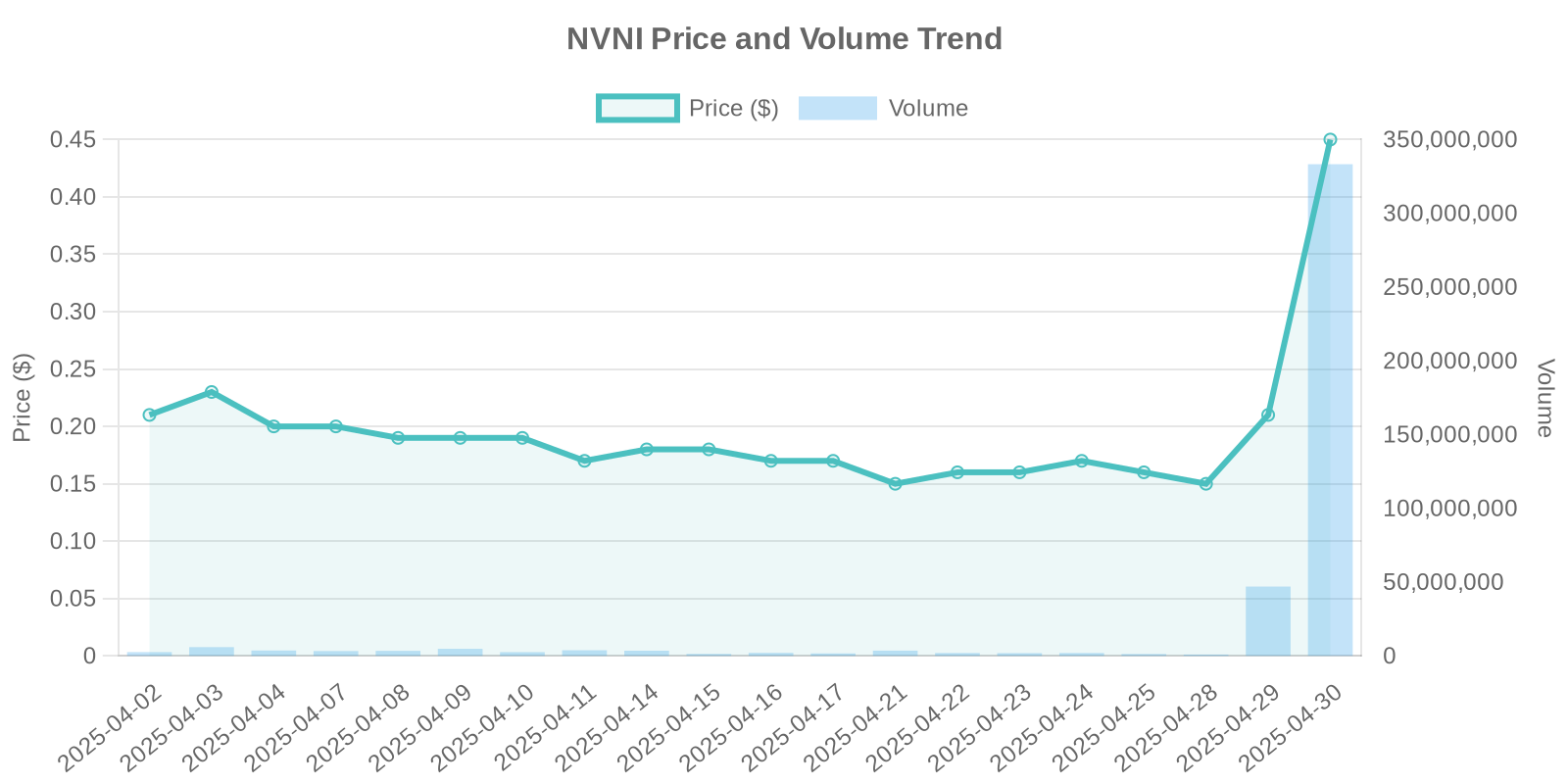

The recent surge in NVNI stock has captured the attention of both institutional and retail investors. As of the latest data, NVNI’s stock price leapt by an astonishing 111.22%, bringing its current price to $0.45. This surge occurred with a significant jump in trading volume, totaling 326,682,227 shares. But what’s driving this dramatic increase, and what should investors be mindful of?

Financial Performance and Market Reaction

Nvni Group Limited recently disclosed its 2024 financial results, which highlighted record revenue figures. The company reported net operating revenue of R$193.3 million, reflecting a 14.4% increase compared to the previous year. This financial strength may be influencing investor confidence and contributing to the stock price surge.

Furthermore, Nvni achieved its first operating profit of R$16.5 million, a substantial improvement from a 2023 loss of R$(189.2) million. This transition to profitability is often a significant catalyst for stock price increases, as it demonstrates the company’s operational success and potential for sustainable growth.

Improved Key Performance Indicators (KPIs)

The company saw improvements across several KPIs, including gross profit, EBITDA, and adjusted free cash flow. Gross profit and margin grew to R$122.5 million and 63.4%, respectively. Meanwhile, adjusted EBITDA increased by 30% to R$57.4 million. These metrics suggest Nvni is enhancing its financial health and operational efficiency, likely generating positive sentiment amongst investors.

Industry Trends and Market Dynamics

As a leading acquirer of private SaaS B2B companies in Latin America, Nvni operates in a region with a burgeoning tech sector. The SaaS B2B industry in Latin America is poised for growth, driven by increasing digital transformation and cloud adoption. Nvni’s strategic focus on this market positions it advantageously to capitalize on these trends, which may be reflected in its stock performance.

M&A Strategy and Future Growth Prospects

Nvni’s announcement of a term sheet for acquiring Munddi Soluções em Tecnologia Ltda. aligns with its ambitious M&A strategy. If successful, this deal would be the first of four planned acquisitions in 2025, potentially amplifying the company’s growth trajectory and investor appeal. Such strategic expansions are often viewed favorably, as they increase a firm’s market share and service offerings.

Potential Risks and Institutional Trading Patterns

Despite the positive outlook, there are no clear disclosures or direct news to account for the 111.22% surge in this timeframe. This raises the possibility of institutional trading patterns influencing the stock’s volatile movement. Given the substantial trading volume, it is plausible that large institutions or funds have entered or exited positions, influencing the stock’s performance.

Investors should be cautious of the volatility associated with such unexplained surges. Historical patterns suggest that stocks experiencing significant increases without clear news might undergo corrections once speculative trading subsides.

Comparative Analysis of Trading Volume Patterns

The surge in NVNI’s trading volume is noteworthy, as a 111.22% price increase alongside such volume indicates strong buying pressure. However, comparing this to similar past events where stocks surged rapidly, it’s vital to monitor subsequent trading sessions for stability. Excessive volume coupled with rising stock prices often precedes potential reversals, especially in the absence of sustaining news.

Conclusion

The NVNI stock price surge is underpinned by robust financial results and strategic growth initiatives. However, investors should remain vigilant of inherent risks, particularly in the face of unexplained price movements. Understanding the industry context, examining financial improvements, and recognizing potential institutional influences are crucial for making informed investment decisions.