MULN Stock Price Surge: Analyzing the 198.7% Spike Amid Strategic Moves by Mullen Automotive

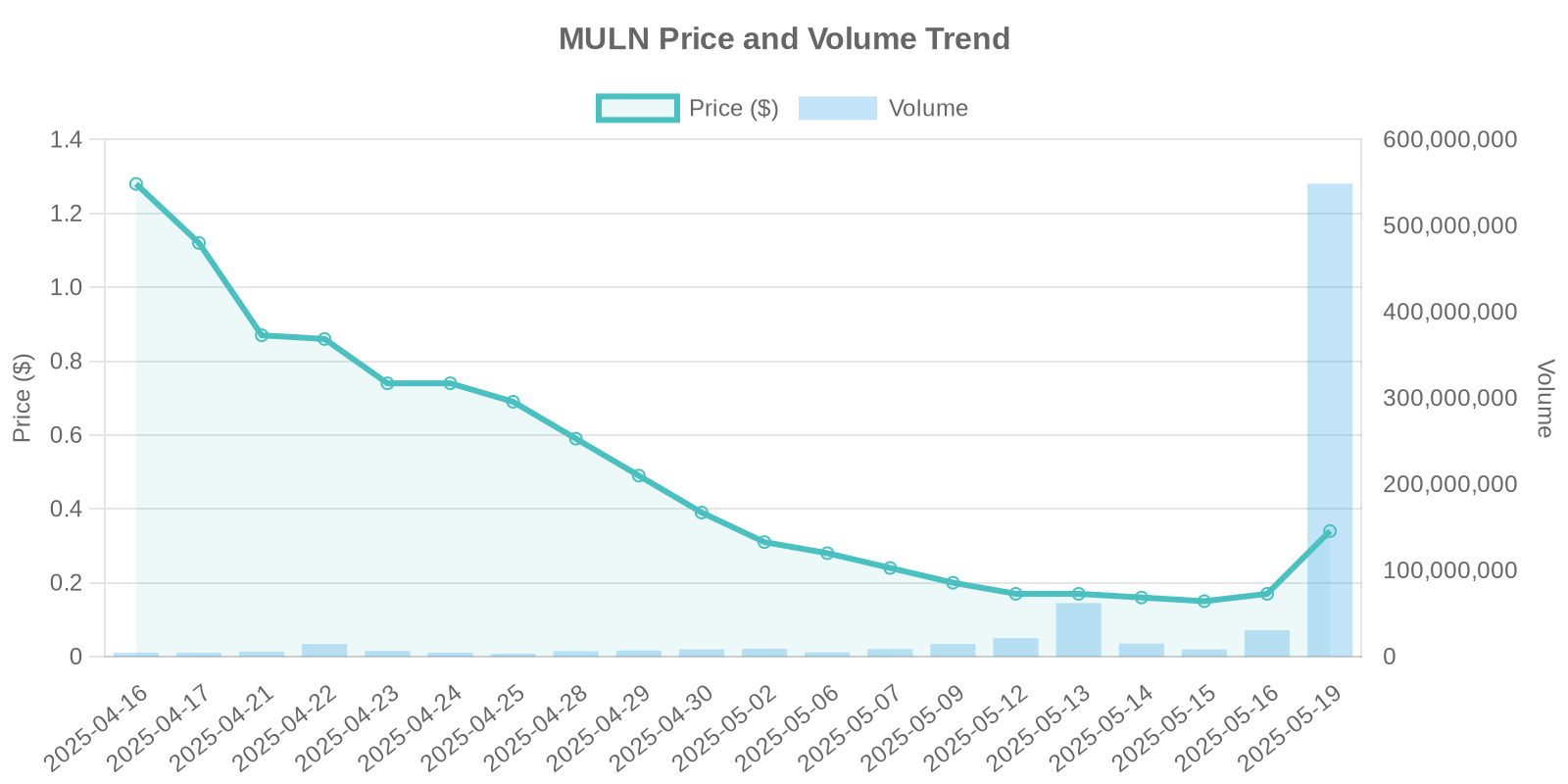

Mullen Automotive Inc. (NASDAQ: MULN) has recently caught the spotlight in the stock market with its share price surging by an extraordinary 198.7%, closing at $16.1. With a trading volume reaching an impressive 32,223,538, the surge in MULN stock price has raised eyebrows among investors and analysts alike.

Company Overview and Recent Developments

Mullen Automotive, known for its innovative electric vehicles (EVs), has been making waves with significant strategic developments. The company’s recent move to increase its share in Bollinger Motors to 95% following a settlement with founder Robert Bollinger signifies a robust commitment to expanding its EV market presence. This acquisition could be one of the pivotal factors driving investor interest and subsequently the MULN stock price.

Analysis of Stock Surge Amid Strategic Developments

In the context of the recent stock price increase, it is crucial to highlight key strategic moves by Mullen Automotive. Emerging from receivership, Bollinger Motors continues to focus on its all-electric commercial vehicles. The Bollinger B4 and the upcoming B5 models underscore the company’s commitment to electrifying commercial fleets, which could be enhancing investor confidence.

Incentive Programs: Driving Force Behind Stock Momentum

Another critical driver behind the MULN stock surge is the opportunity provided by incentive programs. Mullen has recently been included in the ComEd Business & Public Sector EV Rebate Program in Illinois, offering businesses incentives of up to $15,000 on the Mullen ONE Class 1 EV cargo van. These incentives significantly minimize upfront costs, encouraging more fleet electrification, which potentially boosts Mullen’s market share and attracts investor attention.

Market Expansion and Strategic Partnerships

Strategically, Mullen is also poised to expand internationally with plans to launch its high-performance FIVE RS EV Crossover in Germany by the end of 2025. Collaborations with reputable engineering partners such as Faissner Petermeier Fahrzeugtechnik AG demonstrate Mullen’s commitment to quality and innovation, bolsters its global presence, and likely contributes to the current stock surge.

Potential Institutional Trading Influences

While the recent surge in MULN’s stock price does not directly correlate with specific insider trading or buyback activities, the possibility of institutional trading patterns influencing the share price cannot be overlooked. Institutional investors could perceive Mullen’s strategic moves and financial maneuvers as indicative of strong future growth, leading to increased buying activity.

Risks and Considerations for Investors

Despite the positive outlook, potential risks must be considered. Mullen is operating in a highly competitive market with significant capital requirements. Market fluctuations, regulatory changes, and execution risks, particularly in international expansions, remain potential challenges that could impact future stock performance.

Conclusion: Optimism with Caution

The remarkable surge in Mullen Automotive’s stock price reflects a convergence of strategic expansions, incentive-driven market opportunities, and strengthening investor sentiment. However, potential investors should balance this optimism with due diligence, acknowledging the inherent risks involved in high growth potential stocks within the volatile EV sector.

In conclusion, while Mullen Automotive’s forward momentum presents compelling investment opportunities, understanding the broader industry dynamics and company-specific challenges will be key to making informed investment decisions in this rapidly evolving market.