Introduction

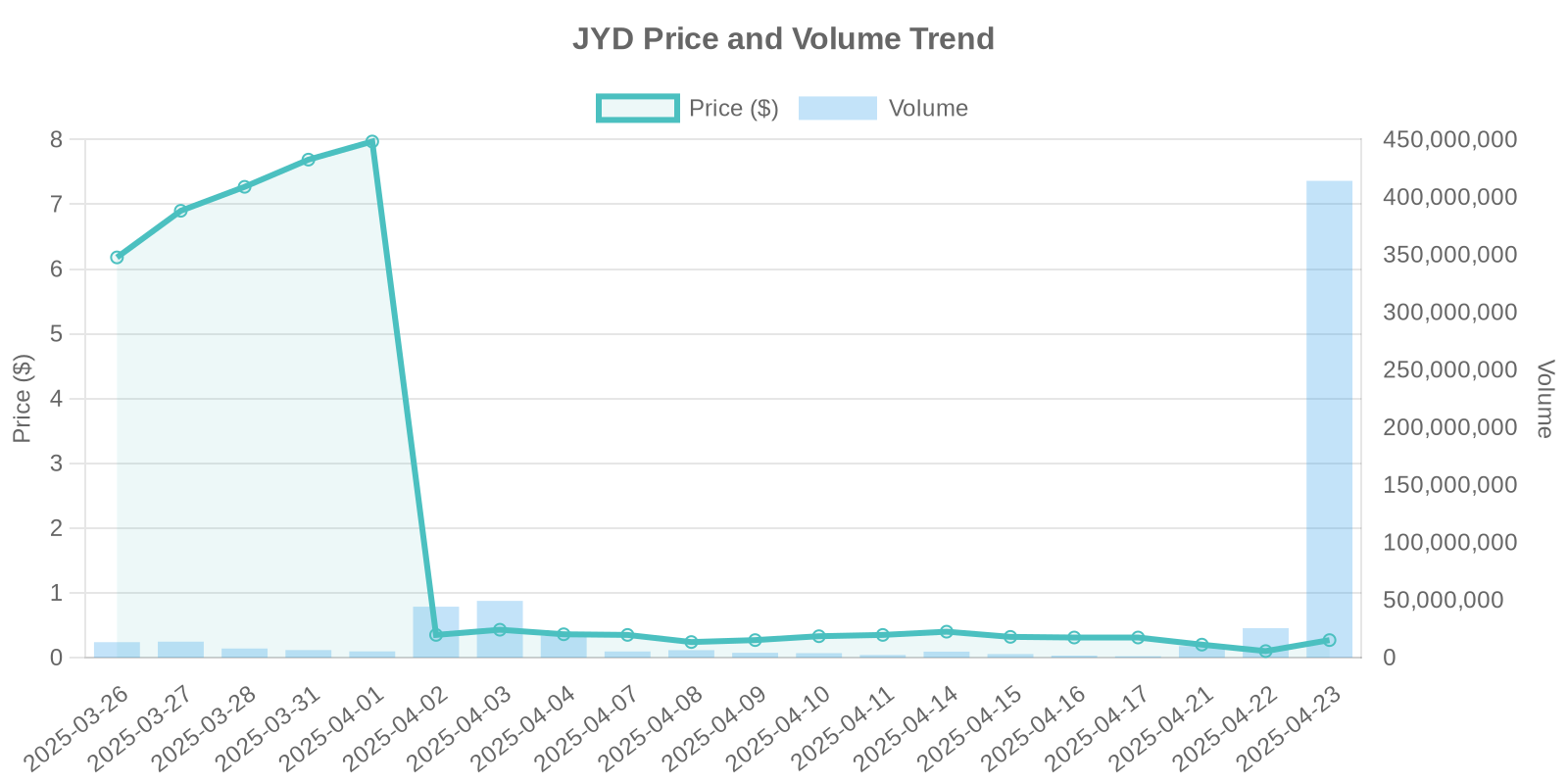

The recent surge in Jayud Global Logistics Limited’s (NASDAQ: JYD) stock price has caught the attention of investors and market analysts. With a remarkable 160.2% increase, the stock price has jumped to $0.27, accompanied by a trading volume of 413,289,667 shares. This analysis delves into the complexities behind this significant stock movement, exploring potential causes, institutional trading patterns, and investment implications.

Company Overview

Jayud Global Logistics Limited, headquartered in Shenzhen, China, is a prominent provider of end-to-end supply chain solutions, specializing in cross-border logistics. With operations in 12 provinces across China and over 16 countries worldwide, Jayud leverages its strategic location to enhance logistics efficiency. The company’s services include freight forwarding, supply chain management, and tailored logistics solutions, underpinned by robust IT systems. For more information, visit their official website.

Recent Developments and Potential Impact on Stock Price

On April 23, 2025, Jayud Global Logistics announced the filing of its 2024 Annual Report on Form 20-F with the SEC. This filing provides comprehensive audited financial data, potentially reassuring investors regarding the company’s financial health. However, the filing itself typically doesn’t stimulate such a drastic stock surge, prompting further investigation into market dynamics.

To learn more, refer to Yahoo Finance.

Analysis of Trading Volume and Price Surge

The massive trading volume during the price surge suggests heightened interest from market participants. While no specific insider trading or stock buybacks have been disclosed, the volume could indicate institutional trading participation. Historically, significant inflows from institutional investors can drive stock prices up due to large purchase orders.

Institutional Trading Patterns

In the absence of clear news, institutional trading often acts as a catalyst for abrupt stock price movements. These entities might have acted based on proprietary analyses or market sentiment, betting on Jayud’s long-term strategic prospects and recent financial disclosures.

Potential Risks for Retail Investors

Retail investors should approach the current high of JYD stock with caution. The absence of clear insider or management actions supporting the price increase signals potential volatility. Investors must consider the company’s broader financial health and market trends before making decisions, as significant upward movements can sometimes correct just as rapidly.

Conclusion

While the surge in Jayud’s stock price is notable, retail investors are advised to conduct thorough due diligence, factoring in potential market fluctuations and institutional behaviors. As always, balance potential gains with associated risks, staying informed through reliable sources and official company disclosures.