Understanding the Surge in RGLS Stock Price

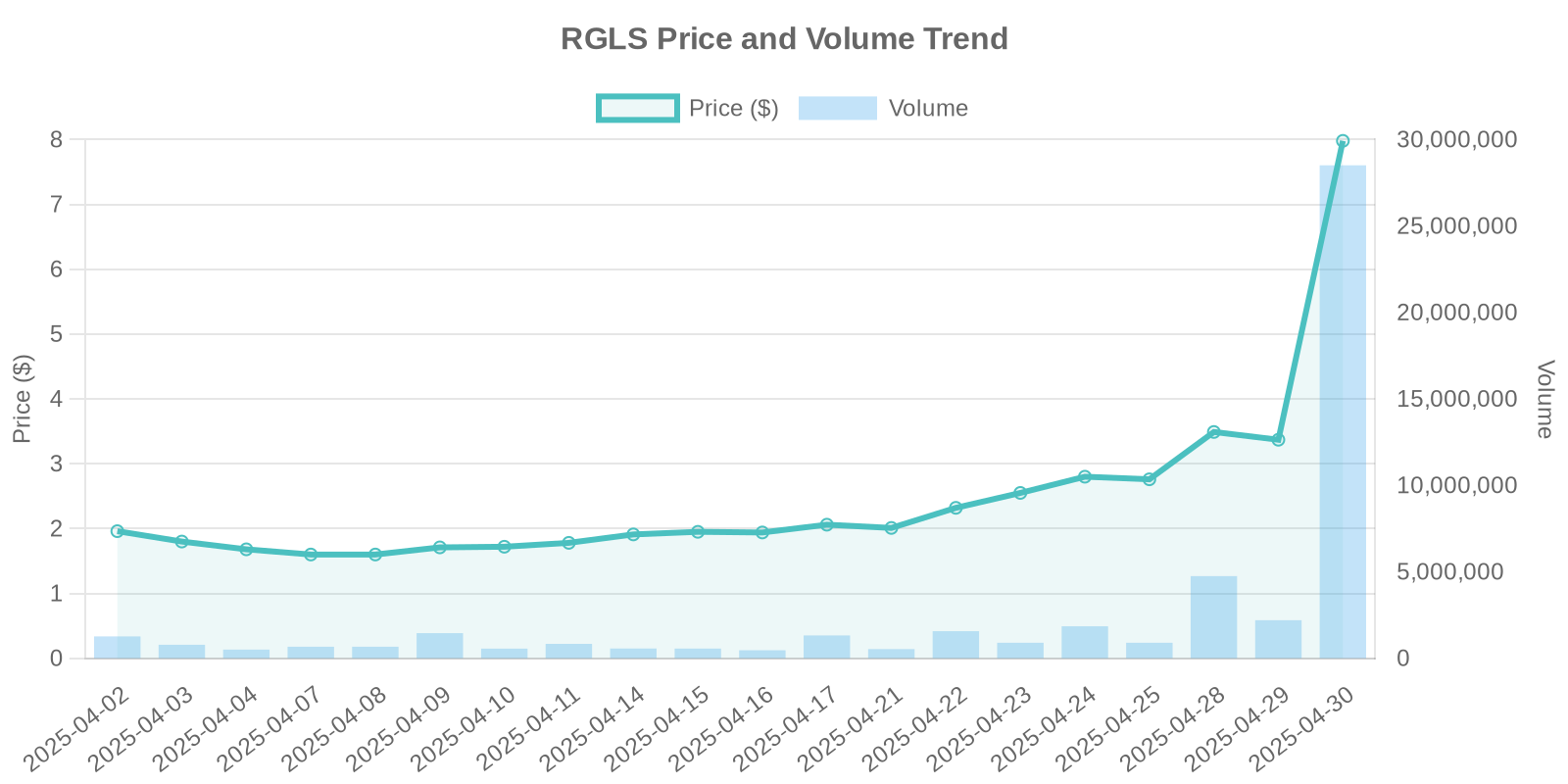

The stock of Regulus Therapeutics Inc. (Nasdaq: RGLS) has experienced a remarkable surge, climbing by 136.8% to a current price of $7.98. This dramatic increase coincides with the announcement that the company has entered into a definitive agreement with Novartis AG to be acquired for $7.00 per share in cash, with an additional contingent value right (CVR) offering a potential $7.00 per share upon achieving specific regulatory milestones. This analysis will delve into the factors driving this surge, potential institutional trading patterns, and associated investment risks.

Company Overview: Regulus Therapeutics

Regulus Therapeutics is a biopharmaceutical firm that focuses on microRNA-targeted therapies. Its flagship product candidate, farabursen, is aimed at treating Autosomal Dominant Polycystic Kidney Disease (ADPKD), potentially becoming the first-in-class therapeutic in this domain. Given its innovative approach and the pressing need for effective ADPKD treatments, Regulus has been at the forefront of attracting industry attention.

Impact of the Novartis Acquisition Announcement

The acquisition agreement details an upfront payment of $7.00 per share, translating to a significant 274% premium over Regulus’ 60-day volume-weighted average price. This premium reflects the high value Novartis sees in Regulus’ pipeline and its potential impact on ADPKD treatment. Additionally, a CVR worth $7.00 per share further incentivizes investors, contingent on the approval of farabursen. With the deal approved by both companies’ boards, the acquisition is anticipated to close in the second half of 2025, subject to regulatory conditions.

Trading Volume Analysis

The trading volume for RGLS has surged to an impressive 28,493,132 shares, a clear indication of significant market interest and activity following the merger announcement. Such a high volume suggests strong institutional trading involvement, likely driven by the perceived value of the pending acquisition and the potential returns from the CVR mechanism. Historical data often shows similar surges in trading volumes when biotech companies announce strategic buyouts or partnerships, illustrating the substantial market interest and speculative investment in innovative healthcare solutions.

Insider Trading and Stock Buybacks

As of now, there are no explicit disclosures regarding insider trading or stock buyback activities that might have influenced Regulus’ stock price surge. Absence of such disclosures often shifts investor focus to market sentiment and external drivers, such as mergers and acquisitions (M&A), which in this case is the Novartis acquisition announcement.

Potential Institutional Trading Patterns

Given the lack of recent insider trading or buyback announcements, the pronounced surge in RGLS stock could be attributed to institutional investors recalibrating their positions in response to the acquisition news. Institutional investors often maneuver large volumes of stocks, which could account for the volume spike observed. Moreover, investment funds with mandates focused on life sciences and biotechnology may find the Regulus-Novartis merger particularly appealing due to its long-term growth potential and strategic alignment within the sector.

Industry Trends and Competitive Landscape

The acquisition highlights a broader trend in the pharmaceutical industry towards strategic consolidations, aimed at bolstering pipelines and addressing unmet medical needs. With big pharmaceutical companies like Novartis investing heavily in innovative biotechnological advancements, companies developing advanced therapeutic modalities are in high demand. This competitive landscape is expected to drive further M&A activity, enhancing shareholder value and accelerating the development of cutting-edge treatments.

Potential Investment Risks

While the surge in RGLS stock presents attractive short-term gains, potential investors should weigh the inherent risks. These include the dependency of the additional $7.00 CVR on regulatory approval milestones for farabursen, the uncertainty surrounding ADPKD market adoption, and standard M&A completion risks that could affect deal closure timelines or outcomes. Furthermore, the biotech sector inherently carries high research and development costs, potentially impacting profitability if product approval takes longer than anticipated.

Conclusion: Navigating Investment Opportunities and Risks

The surge in RGLS stock provides a significant opportunity for investors driven by the acquisition dynamics and Novartis’ proven track record in successfully integrating biotechnological acquisitions. While optimistic about RGLS prospects, investors should remain cognizant of volatile market conditions, potential regulatory hurdles, and sector-specific risks. The market’s reaction highlights the potential value within Regulus’ innovation pipeline, making it a noteworthy consideration for stakeholders aligned with long-term growth in the biopharmaceutical sector.