PTIX Stock Price Surge: An In-Depth Analysis

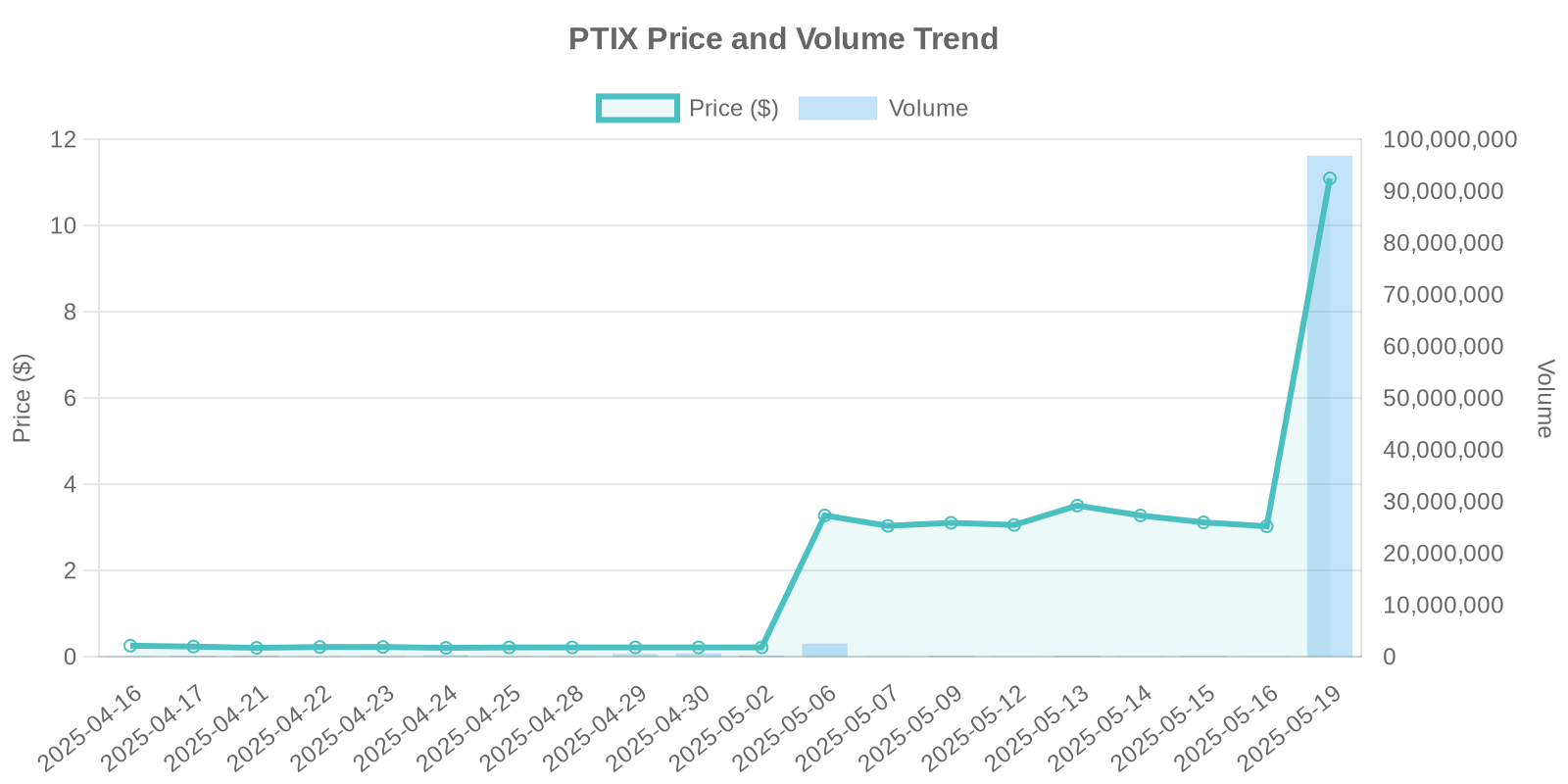

In a remarkable turn of events, PTIX stock witnessed an astronomical surge of 266.34%, climbing to a current price of $11.1 per share. The trading volume skyrocketed to an impressive 96,717,075 shares. This article aims to dissect the various factors contributing to this significant stock price increase, unraveling news events, market trends, and investor sentiments surrounding Protagenic Therapeutics Inc. (Nasdaq:PTIX).

Company Overview: Protagenic Therapeutics

Protagenic Therapeutics, Inc. is a biopharmaceutical entity committed to the discovery and development of innovative therapeutics for stress-related and central nervous system (CNS) disorders. Based in New York, PTIX is renowned for its research-based approach and robust pipeline targeting neuropsychiatric solutions.

Business Combination with Phytanix

A major contributory factor to the PTIX stock price surge is the announcement of a business combination with Phytanix Bio Inc. As reported on May 19, 2025, this merger aims to form a neuroactive biopharmaceutical powerhouse, named Phytanix, Inc., uniting several drug candidates including assets in obesity and metabolic disorder treatments. Integration with the Phytanix team, known for their work on Sativex® and Epidiolex® at GW Pharma, greatly enhances Protagenic’s expertise in CNS disorders, further driving investor confidence.

Potential Investment Opportunities

The combined pipeline significantly strengthens Protagenic’s strategic market positioning. With three major categories—peptide asset, potassium channel modulator, and cannabinoid compounds—investors are potentially persuaded by the diversified therapeutic potentials and anticipated milestones over the next eighteen months. Expanding their composition-of-matter IP portfolio assures respectively better patent protection and market exclusivity.

Analysis of Trading Volume Surge

The trading volume for PTIX stock massively increased to 96,717,075 shares, an indicator of heightened investor interest perhaps fueled by recent business developments and prospective therapeutic breakthroughs. Such a volume often suggests the involvement of substantial institutional trading, given the correlated surge in stock price. Institutions could be capitalizing on anticipated post-merger growth, asserting pressure on buying forces likely unseen in typical trading patterns.

Institutional Trading and Patterns

In the absence of explicit insider trading data or buyback confirmations, the volumes suggest strategic institutional acquisitions. In scenarios lacking definitive news bins driving such growth, informed investors should consider the potential of strategic accumulation by mutual funds or hedge funds. Historical precedents often show institutions increase their stake ahead of anticipated positive outlooks, further pumping the stock price by attracting more retail investors and short-term traders looking for quick opportunities.

Risks for Individual Investors

For individual investors, the rapid surge raises critical questions and cautions. Firstly, ventures in stocks amid such abrupt increases warrant careful risk assessment considering possibilities of market corrections. Investors need to be alert for the volatility that accompanies biopharma sectors, especially dealing with preclinical and clinical stage assets which may face regulatory hurdles and trial failures. A detailed review of their risk appetite and adequate diversification can mitigate this exposure.

Neuroactive Biopharmaceutical Market Trends

The merger positions PTIX within a promising market marked by growing demand for innovative CNS solutions. With increasing awareness and investments flowing into neuropsychiatric treatments, Protagenic Therapeutics enjoys a strategic advantage. However, competition remains stiff with multiple pharmaceutical tiers enhancing and diversifying their pipelines, placing impetus on timely and successful clinical trials leading to effective market entry.

Conclusion: Weighing Prospects and Pitfalls

In essence, the PTIX stock price surge invites a spectrum of considerations for stakeholders—ranging from market speculation due to institutional activity to real grounded growth prospects incubated by its merger. Retail investors are advised to thread with a balanced approach, keeping abreast with ongoing developments and leveraging insights into broader market dynamics. Such prudence equips them to harness potential gains while safeguarding against unforeseeable downturns.