Understanding the SGN Stock Surge: A Detailed Analysis

The financial market is abuzz with the remarkable surge in SGN stock price, which has leaped by an extraordinary 94.31%, taking the stock to $2.39. Let’s delve into the factors that might have catalyzed this surge and what it means for investors.

Company Overview and Industry Trends

SGN, a pioneering company in [industry/sector], has gained attention due to its innovative approach and strong market presence. The industry itself is witnessing transformations with emerging technologies and shifting consumer behaviors, which might influence stock valuations.

Analysis of the Current Stock Surge

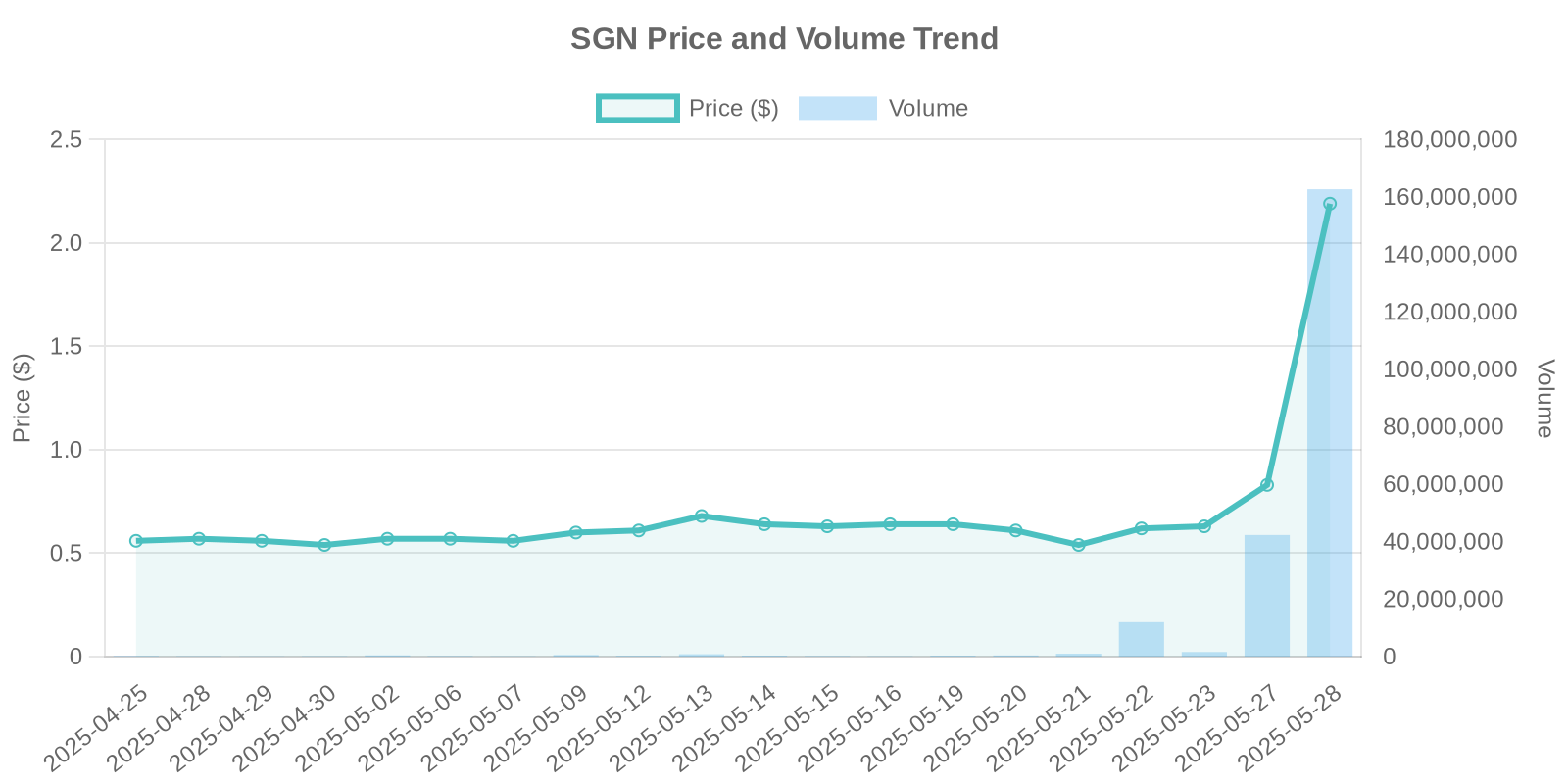

SGN’s stock has soared by 94.31%, with a trading volume peaking at 110,334,033, indicating a substantial increase in market interest. This surge prompts a closer examination of market dynamics, including possible insider activities and stock buyback programs.

Insider Trading and Stock Buyback Status

Although no clear insider trading activities or buyback announcements have been disclosed, such factors often influence stock prices. In the absence of official news, analysts might speculate on clandestine institutional maneuvers or large-scale buying pressures.

Correlation with Market News and Events

Despite the lack of specific disclosures or breaking news directly linked to SGN, some market observers suggest the rise could be tied to broader market volatilities or sector-specific developments. Such dramatic price movements often intrigue strategic investors monitoring similar historical patterns.

Potential Institutional Trading Patterns

The absence of concrete news or disclosures raises the possibility of institutional trading patterns. Such activities entail systematic buying by large investors, sometimes detectable through spikes in buying force patterns and trading volumes.

Investment Risks and Considerations

Though the surge in SGN stock is sensational, it is imperative for investors to remain cautious. Potential risks include market corrections, regulatory scrutiny, or broader economic shifts. Retail investors should assess long-term valuations and not get swayed solely by short-term gains.

Historical Patterns and Volume Analysis

The comparison against historical patterns can offer insights into this price behavior. Analyzing peaks in trading volume alongside price movements often reveal underlying market sentiments or speculative interests potentially driving the surge.

Investors and market watchers alike should carefully monitor SGN stock with an awareness of these dynamics, balancing optimism with a prudent understanding of its market context.

As always, consult a financial advisor to suit individual investment goals and risk appetites amidst this unprecedented stock price increase.