Understanding the Unprecedented Surge of ABVE Stock Price

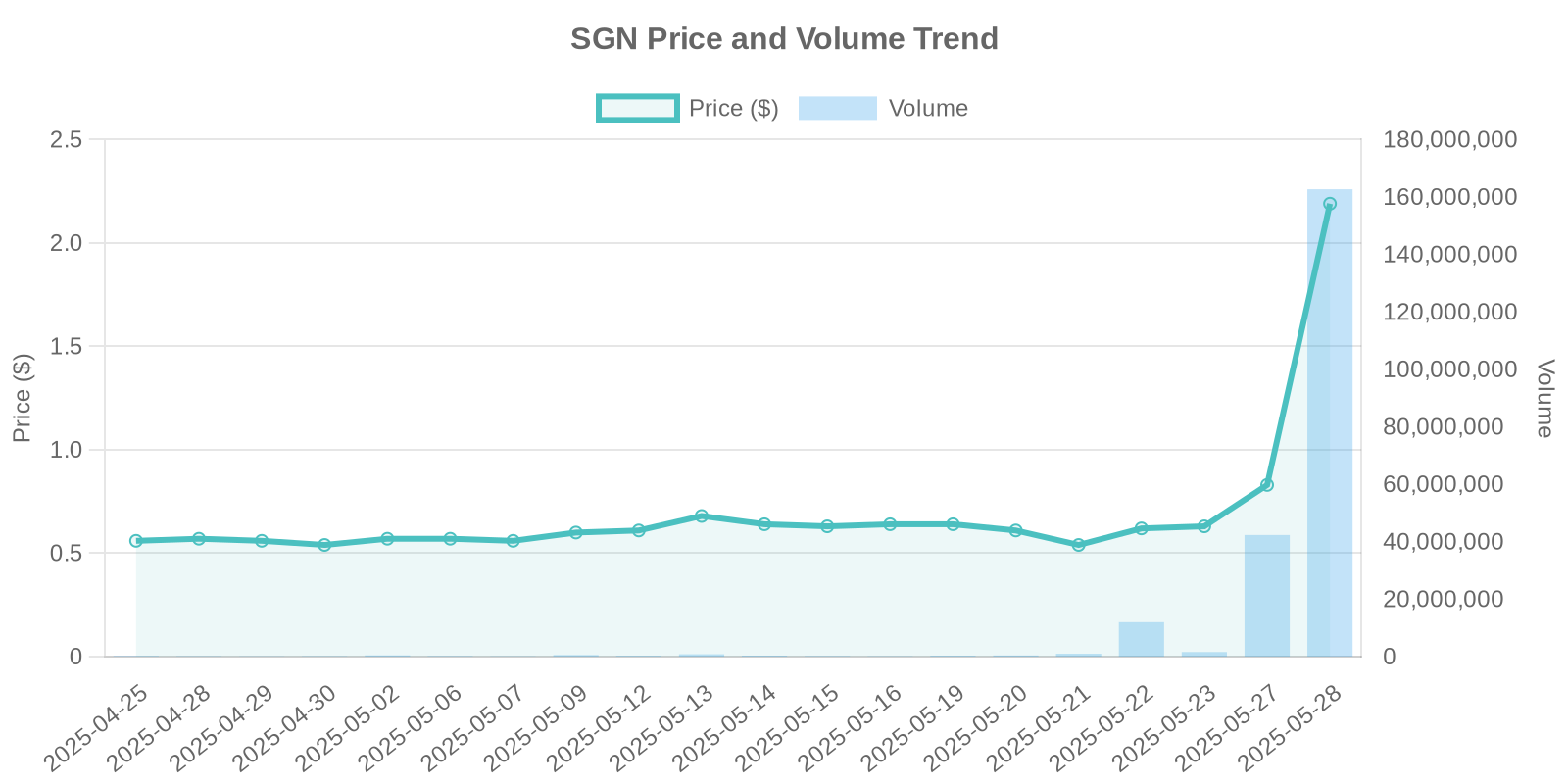

The stock market witnessed a remarkable event this week as ABVE stock price surged by an astonishing 102.38%, bringing the current trading price to $3.4. This significant increase marks an intriguing point of discussion for retail investors and market analysts alike, especially given the staggering volume of 180,765,704 shares traded. We will dive deep into the potential causes of this surge, from market trends to possible institutional trading patterns, to provide a comprehensive insight into ABVE’s recent stock performance.

Company Overview: Who is ABVE?

ABVE, a company committed to [describe industry, e.g., renewable energy solutions], has remained relatively under the radar until this recent price movement. Known for [describe key services or products], the company operates in an industry that has shown consistent growth and innovation over the past few years. The renewable energy sector, for instance, is poised to be a major contributor to global energy solutions as governments worldwide push for sustainable energy alternatives.

Industry Trends: An Expanding Horizon

The broader industry in which ABVE operates is experiencing a significant transformation, driven by green technology demands and favorable governmental policies. The push towards [mention specific trends, like carbon neutrality or electric vehicle adoption] is one factor fueling optimism in stocks within similar segments. This context is essential when considering the reasons behind ABVE’s stock price surge, as industry wounds often reflect directly in the market behavior of individual companies.

Analyzing the Stock Surge: Institutional Trading Patterns?

The lack of direct news or disclosures coinciding with ABVE’s stock price surge suggests other factors might be at play. Institutional trading patterns are often culprits behind such unexplained price movements. The substantial trading volume exceeding 180 million shares indicates a possible influx of institutional interest, potentially through large block trades unseen to the average retail investor. Such trades can dramatically affect stock prices, sparking volatility as seen here.

Insider Trading and Stock Buybacks

Currently, there are no publicly available insider trades or ongoing stock buyback programs for ABVE. These factors can be pivotal in price movements, as insider buying or selling signals confidence levels in company prospects. Lack of such activities, combined with the surge, points towards external factors or market speculation rather than internal corporate strategies.

Examining Potential Investment Risks

Investing in ABVE following such a dramatic increase warrants caution. Volatility raises the risk profile, as steep gains can quickly reverse. Investors should consider potential drawbacks: speculative bubbles, liquidity challenges, and the absence of confirmed news corroborating the price change. The hyped nature of such a surge can sometimes lead to an overvaluation mirage without substantial news or data backing it.

Historical Patterns and Volume Analysis

Analyzing historical data is crucial in understanding current trends. Comparable patterns in other stocks often reveal that unnatural surges can stabilize over weeks. The exceptional volume in ABVE shares hints at powerful buying forces, possibly stemming from algorithmic trading or institutional accumulations – phenomena not uncommon in today’s digital trading environments.

Investors are urged to closely monitor further developments and announcements from ABVE, potentially offering more clarity on this surge. Keeping an eye on broader market cues and sectorial changes can also provide foresight into ABVE’s future trajectory, shielding investors from abrupt market corrections.

Conclusion: Vigilance in Volatility

While ABVE’s stock surge is an investment beacon for some, it should be approached with considered scrutiny and robust risk assessment. Without clear news, the possibility of transient institutional maneuvers could underlie the gains. Investors must weigh potential rewards against risks, considering both the promising industry setting and the inherent volatility accompanying such surges.