RGC Stock Price Surges by 283%: Analysis and Implications for Investors

Understanding the RGC Stock Surge

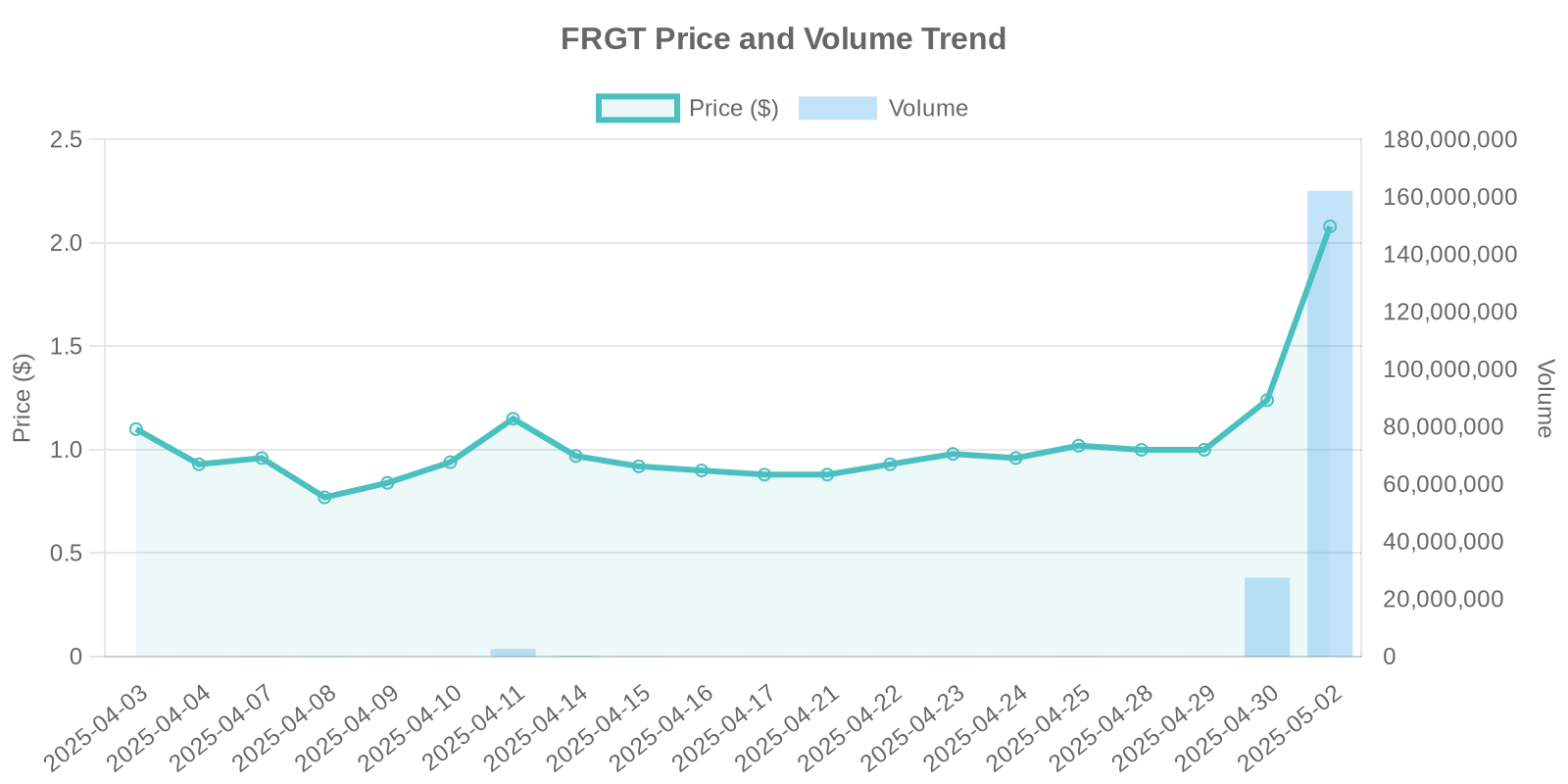

The market has witnessed a remarkable surge in RGC stock price, with a significant increase of 283.13%, bringing the current price to $60. This has sparked interest across investment communities, with a trading volume reaching an impressive 4,920,931 shares.

Company Overview: What You Need to Know About RGC

RGC Holdings is a company that primarily operates in the technology sector, focusing on innovative solutions. Their latest product line has positioned them under the radar of both retail and institutional investors looking for growth opportunities in a vibrant sector.

Industry Trends and Their Influence on RGC

The technology industry is currently experiencing major shifts with the advent of AI technologies and green tech initiatives, potentially benefiting companies like RGC that are quick to adapt and innovate. This broader industry trend may influence investor sentiment positively towards RGC stock.

News and Market Reactions

The RGC stock surge appears to lack an immediate news catalyst. There have been no prominent announcements regarding new partnerships, products, or substantial company milestones that typically drive such large increases. However, this absence of clear news opens the floor to speculation and deeper analysis of underlying trading patterns.

Analyzing Institutional Trading Patterns

Given the lack of clear disclosures, one explanation for the dramatic surge in RGC stock could be significant institutional trading. Large investment firms may be shifting allocations, betting on RGC’s long-term potential based on proprietary insights or favorable analyst forecasts, often unpublished. Such movements can significantly impact the stock price given the volume and capital involved.

Insider Trading and Stock Buybacks: The Unknowns

As of now, there are no disclosed instances of insider trading or stock buybacks that could correlate with the surge in RGC stock prices. The absence of insider selling during the surge might suggest confidence from company insiders in the company’s future prospects, which can be reassuring to some investors.

Risks and Considerations for Investors

While the significant increase in RGC stock price is appealing, investors should consider the associated risks. High volatility, namely without strong news catalysts, can suggest speculative trading that might lead to price corrections. Additionally, if institutional movements are behind the surge, any reversal in their strategies might result in a quick downturn.

Historical Patterns and Comparisons

By comparing past instances where stocks surged similarly without clear catalysts, investors can identify common outcomes, such as subsequent volatility or market corrections. Observing the trading volume patterns reveals the presence of strong buying pressures, likely indicative of speculative trading or strategic accumulation by knowledgeable investors.

Conclusion

The RGC stock surge, despite lacking obvious news drivers, presents both opportunities and risks. Institutional investments could be a promising sign, yet investors should remain cautious, ensuring that investment decisions are based on thorough market analysis and individual risk tolerance levels.