SXTC Stock Surge: An In-Depth Analysis of the Recent 103.92% Increase

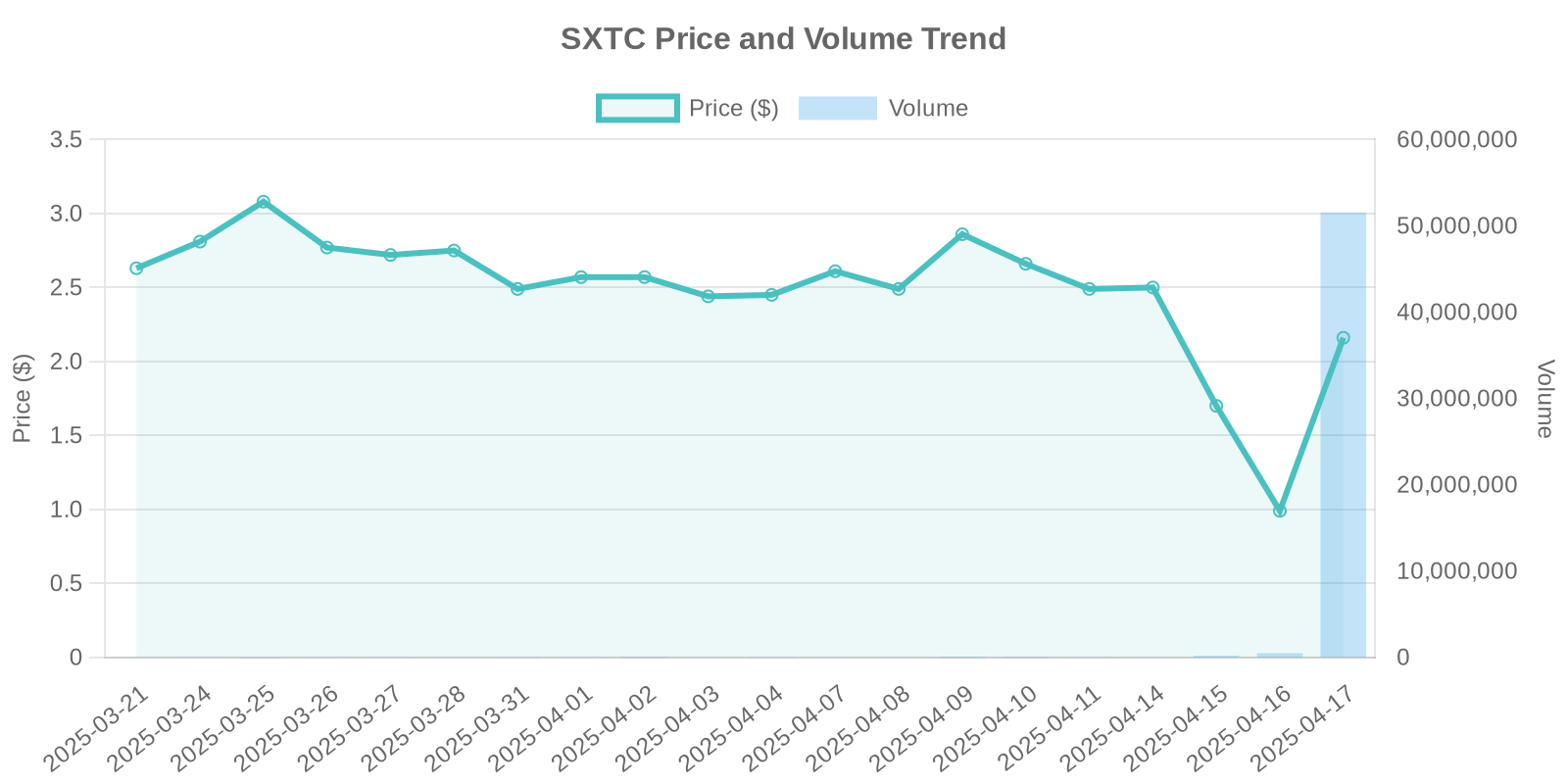

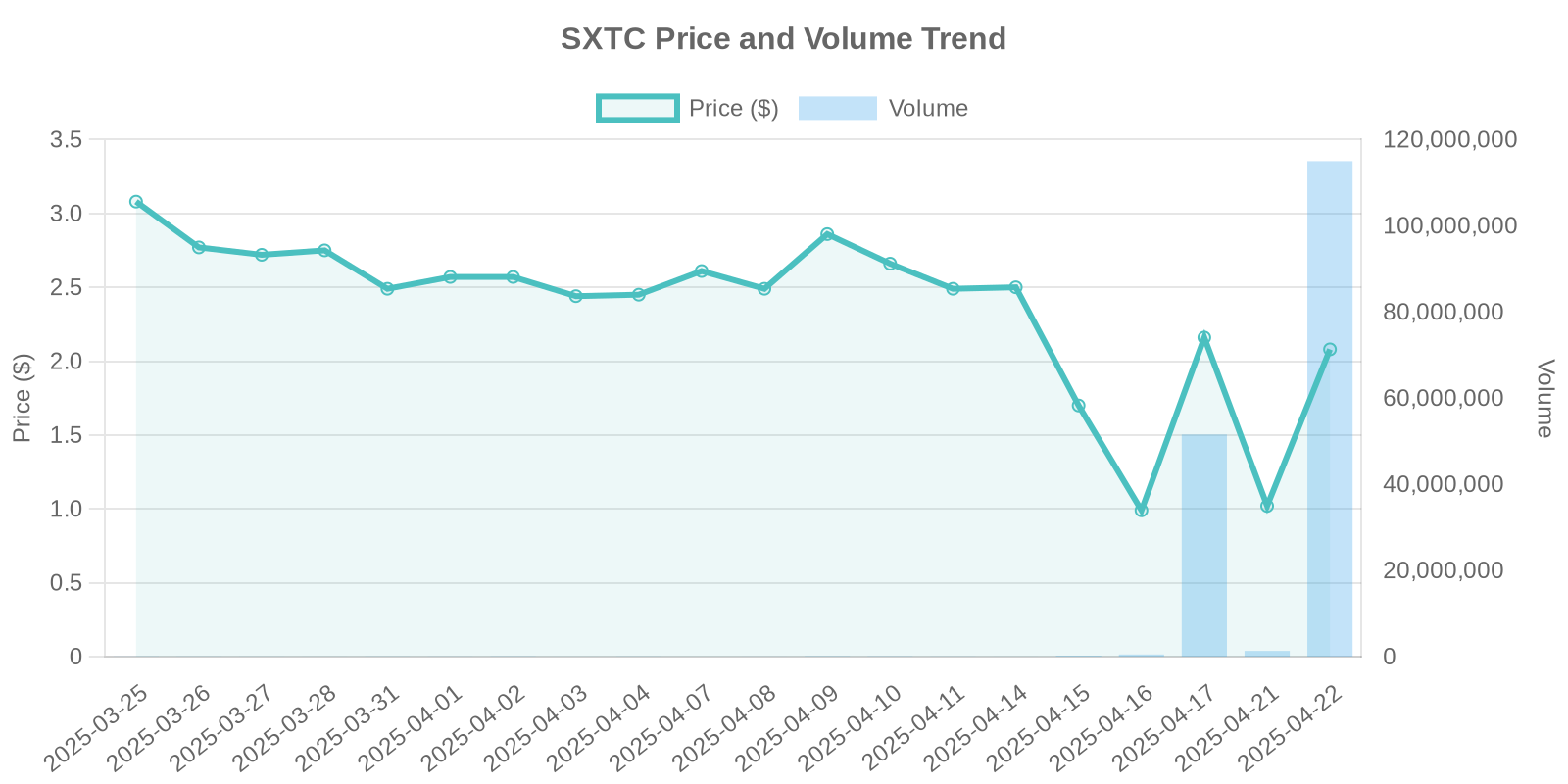

On the cusp of market volatility, SXTC stock has surprised investors with a dramatic surge, climbing 103.92% to reach a current price of $2.08. With trading volume skyrocketing to an impressive 114,882,321 shares, it’s crucial to dissect the factors behind this sudden increase and understand the potential risks involved.

Company Overview of SXTC

SXTC, known formally as China SXT Pharmaceuticals, operates within the pharmaceutical industry, focusing on the research, development, and sale of traditional Chinese medicine. This rapidly growing sector is driven by an increasing global interest in herbal and alternative therapies.

Understanding the Surge in SXTC Stock Price

The 103.92% surge in SXTC’s stock price is noteworthy, especially in the absence of clear news or significant public disclosures. Potentially, this could point to behind-the-scenes financial maneuvers such as institutional trading. Nevertheless, without confirmed insider trading being reported, SXTC presents a curious case for analysis.

The Role of Institutional Trading in the Surge

When a stock surges without any immediate news, it often raises speculation about possible institutional trading activities. Large institutional investors have the power to cause price shifts, either by large-scale buying or selling activities. Given the massive jump in volume to over 114 million shares, it’s plausible that such trading is driving the SXTC increase.

Implications of Buybacks on Stock Prices

Although no formal stock buyback announcements have been made, buybacks can significantly impact stock prices by reducing supply and enhancing shareholder value. Investors should remain on alert should SXTC announce any buyback plans in the future, as this could further influence price movements.

Trading Volume and Buying Patterns

The extraordinary trading volume accompanying SXTC’s price rise is worth examining further. Typically, a surge in volume alongside a price increase suggests robust buying activity, possibly indicating strong market interest or internal reshuffling of portfolio strategies by big players.

Potential Risks for Investors

Despite the attractive surge, potential risks should be factored in. Price volatility could result from market corrections post-surge, particularly in the absence of supportive news or financial disclosures. Retail investors should be cautious, evaluating the company’s fundamentals before making investment decisions.

Conclusion

SXTC’s stock price surge provides both a captivating investment story and a lesson in market dynamics. While the increase presents opportunities, it also requires a balanced approach considering the potential volatility and lack of clear market signals. Investors should remain informed and vigilant to navigate this unpredictable terrain effectively.