SYTA Stock Surge: In-Depth Analysis of the 101% Increase Amid Core Gaming Merger

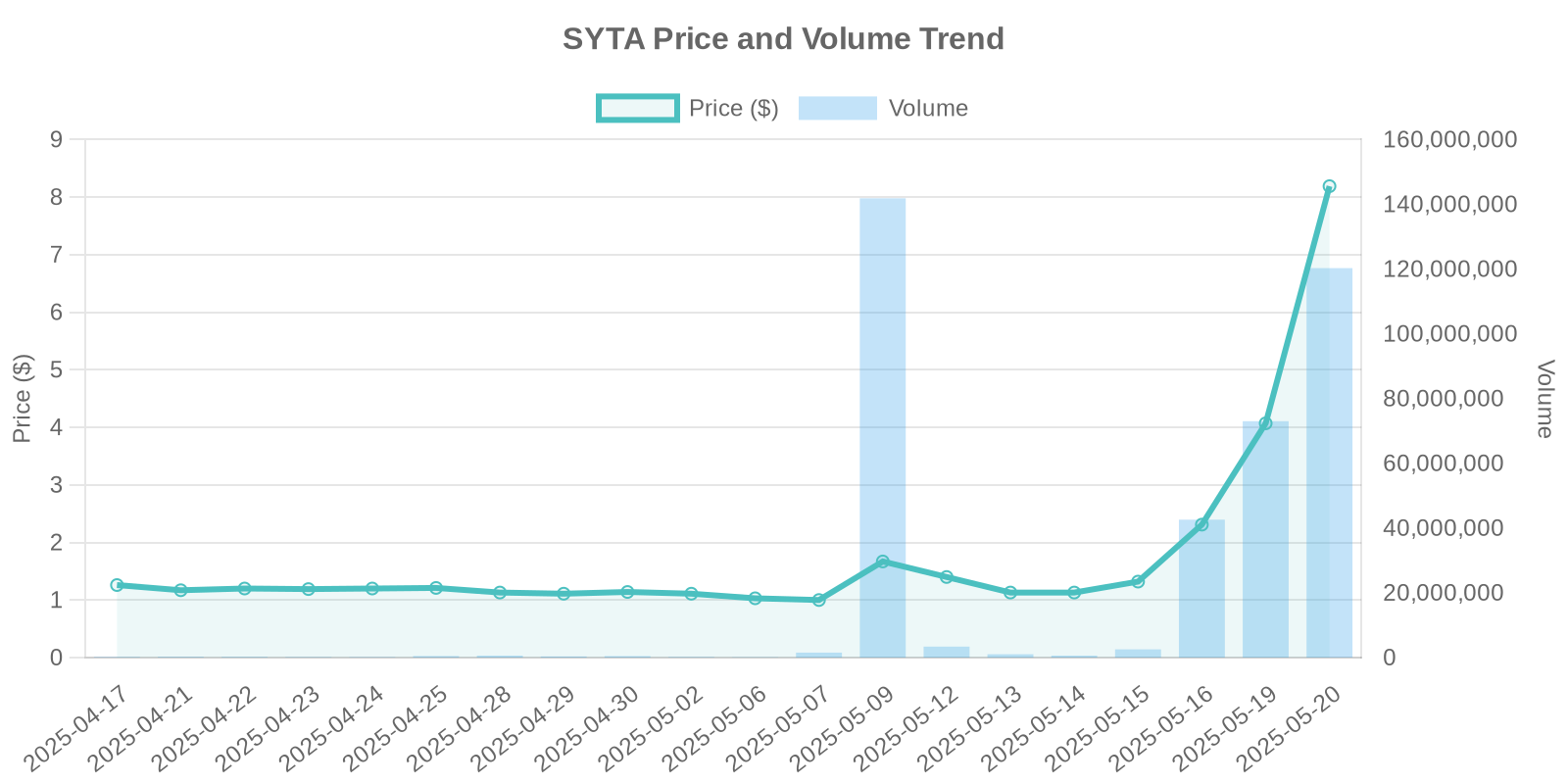

The remarkable surge in Siyata Mobile Inc.’s (NASDAQ: SYTA) stock price by 101.23% to an unprecedented $8.19 has caught the attention of investors and market analysts alike. This surge accompanies a dramatic rise in trading volume to 118,168,715 shares, suggesting a buoyant yet speculative market sentiment. While Siyata Mobile has not disclosed insider trading activity or stock buyback statuses, the surge is intriguing enough to demand a closer inspection, especially in light of its recent definitive merger agreement with Core Gaming.

Company Overview: Siyata Mobile and Core Gaming

Siyata Mobile is a vanguard player in the development of mission-critical Push-to-Talk over Cellular (PoC) handsets and accessories. Recently, the anticipation around its merger with Core Gaming—an AI-driven mobile gaming firm—has contributed to its stock’s volatile trajectory. Core Gaming, renowned for its AI prowess and substantial portfolio, has redefined revenue models through ad-supported, in-app purchase-driven monetization.

The Significance of the Core Gaming Merger

The merger with Core Gaming, expected to transform Siyata Mobile’s landscape, offers significant insights into the recent stock surge. Core Gaming’s avant-garde approach, as highlighted in news sources like 24/7 Market News, emphasizes the introduction of Nowifi, an offline gaming hub designed for seamless user experiences regardless of connectivity challenges. This product reflects Core Gaming’s innovative edge and potential to capture a unique market segment, consequently driving investor confidence in Siyata Mobile.

Trading Volume and Institutional Patterns

A whopping surge in trading volume to 118,168,715 shares suggests a pronounced interest in SYTA stock. Such volume discrepancies often indicate possible institutional purchases, speculative trading, or algorithmic trading interventions. Similar historical patterns usually precede or accompany major corporate news or mergers, as evidenced in this scenario.

Correlation with Market Trends

In the absence of clear disclosure on insider trades or buyback activities, the trading volume surge may correlate with institutional acquisition strategies anticipating growth potential post-merger. Historical analysis indicates that stocks often experience such volume spikes due to institutional investors positioning themselves ahead of anticipated corporate developments.

Potential Risks for Investors

While the merger and subsequent stock surge present robust growth opportunities, investors must heed potential risks. The absence of insider trading disclosures and stock buyback programs suggests caution. Furthermore, the market’s often speculative nature, driven by merger anticipation, could realign rapidly should institutional interests wane or external market factors disrupt forecasted trajectories.

Conclusion: Balanced Outlook

The SYTA stock surge linked to its merger with Core Gaming represents a tantalizing opportunity driven by groundbreaking technological mergers. However, potential investors should weigh these prospects against inherent market risks and the lack of tangible insider actions. Staying informed on new disclosures and market behavior adjustments will be pivotal for leveraging this stock investment effectively.