Introduction

As Twin Vee PowerCats Co. (NASDAQ: VEEE) witnessed a dramatic stock surge, climbing to a price of $7.45—a staggering 192.16% increase—on a volume of 82,280,396 shares, market analysts and investors are keenly analyzing this rare phenomenon. In this article, we delve into the factors propelling this surge and examine potential implications for both current and future investors.

About Twin Vee PowerCats Co.

Twin Vee PowerCats is a prominent manufacturer and distributor of power sport boats renowned for their catamaran hull designs. As a leader in the catamaran sport boat sector, the company, based in Fort Pierce, Florida, has established a strong reputation for stability, efficiency, and a smooth ride over its 30 years of operation.

Key Drivers of VEEE Stock Surge

1. Public Offering Announcement

One significant catalyst for the surge is Twin Vee’s recent announcement regarding its public offering of 750,000 shares at $4.00 each, intending to raise $3,000,000. ThinkEquity is managing this underwritten offering, detailed in the news content filed with the U.S. Securities and Exchange Commission. The offering’s scheduled closing on May 12, 2025, and anticipated use of proceeds for working capital, generally bodes well for investor confidence and operational expansion.

2. Impressive Q1 2025 Earnings

Twin Vee PowerCats’ Q1 2025 financial results also bolstered investor sentiment, showing a phenomenal 91.7% revenue increase compared to the previous quarter, achieving $3.6 million. The enhanced gross margin of 14.9% and improved net loss reinforce the company’s strong performance trajectory.

“Our team executed well across the board, growing revenues by more than 90% over the previous quarter,” stated Joseph Visconti, CEO and President, signaling robust market confidence in Twin Vee’s expanding dealer network.

Potential Institutional Trading Patterns

The lack of clear insider trading or company buyback initiatives suggests the surge may be influenced by heightened institutional trading interest. Such patterns often precede or follow significant corporate developments like a public offering, where institutional investors play a crucial role, seizing opportunities from favorable financial disclosures.

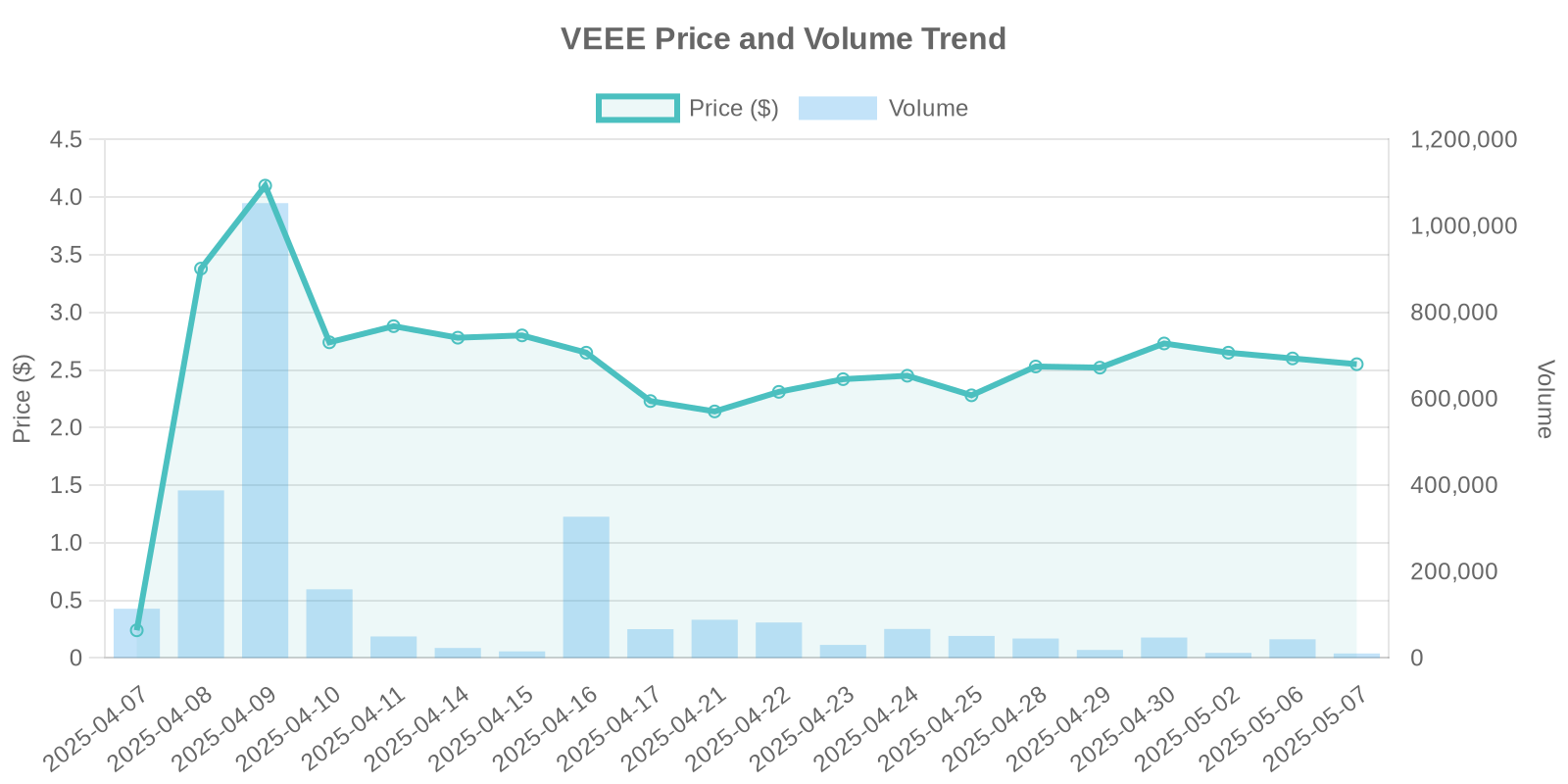

Trading Volume Analysis

The surge in trading volume, reaching 82,280,396, is remarkably higher than typical volumes, pointing to a possible influx of institutional investors or high-frequency trading systems reacting to favorable news and market conditions.

Investment Risks

While recent developments are promising, there remain investment risks associated with Twin Vee PowerCats. These include potential market volatility post-public offering and execution risk related to the strategic deployment of new capital. Investors should remain cautious of market fluctuations and the company’s capability to meet growth projections.

Industry Trends

The broader power sport boat industry is experiencing growth due to increased leisure spending and a rising interest in recreational boating. Twin Vee PowerCats capitalizes on these trends by expanding its dealer network and market presence, poised to benefit from reviving consumer demand.

Conclusion

While Twin Vee PowerCats Co. showcases solid fundamental performance and catalyzed a substantial stock surge, investors must weigh industry prospects against potential volatility risks. Regulatory filings, earnings outcomes, and market conditions should be thoroughly vetted by potential investors to make informed decisions.

Leave a Reply