Understanding the 164% Surge in NVTS Stock Price: Key Drivers and Risks

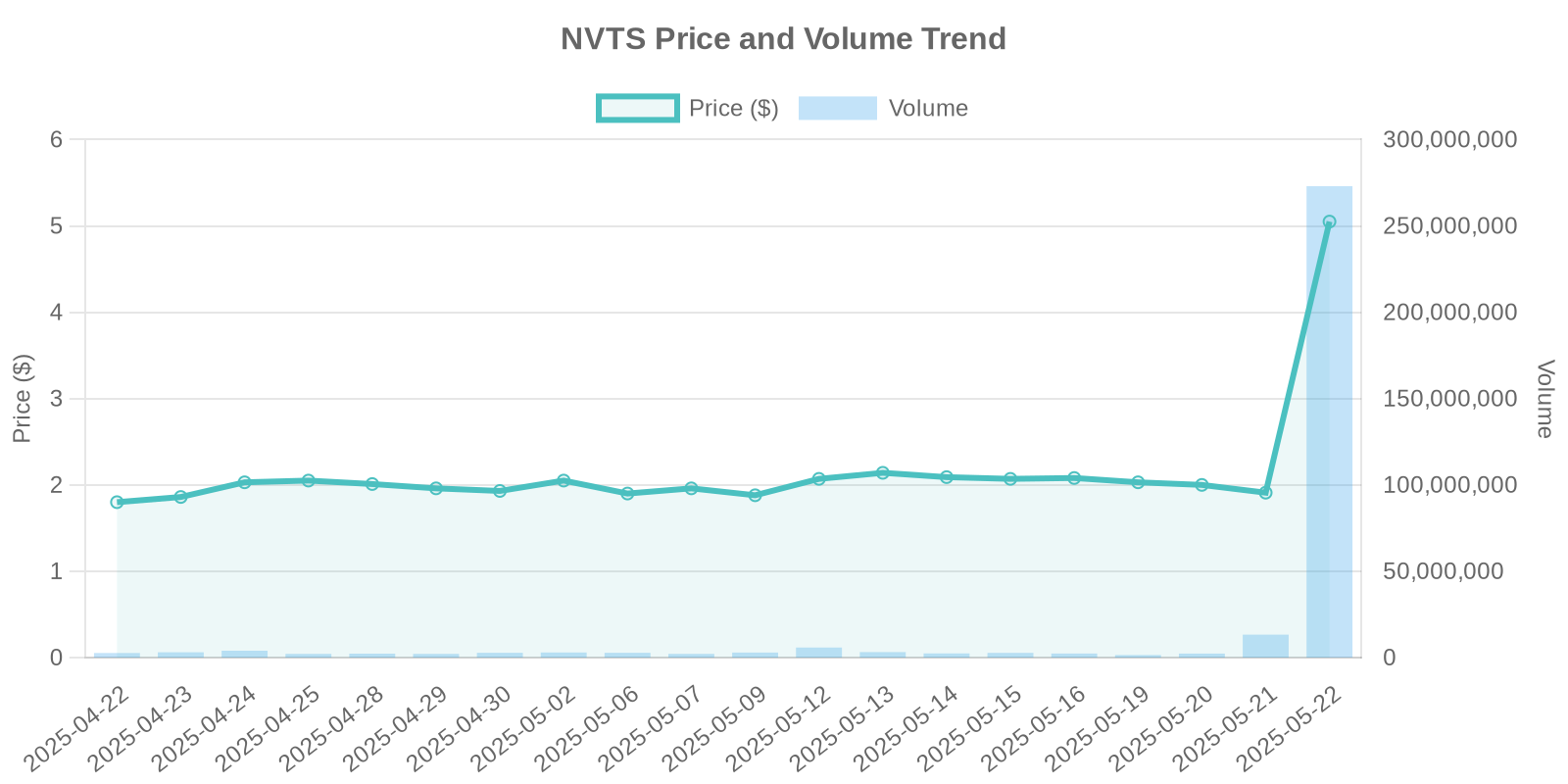

Navitas Semiconductor (NASDAQ: NVTS) has experienced an extraordinary surge in its stock price, rising by 164.4% to a current price of $5.05. This remarkable increase has captured the attention of investors and analysts alike. In this article, we delve into the potential factors behind this surge and the associated investment risks.

Key Factors Driving NVTS Stock Surge

Collaboration with NVIDIA

A significant catalyst for the surge in NVTS stock is the newly announced collaboration with NVIDIA. On May 21, 2025, Navitas announced that its GaN and SiC technologies were selected by NVIDIA to support the high-voltage, high-efficiency power architecture for Nvidia’s next-generation 800 V HVDC data center systems. This collaboration positions Navitas as a critical player in the burgeoning AI data center infrastructure market, a sector demanding higher power levels with greater efficiency. This announcement provides Navitas exposure to broader markets and aligns with the increasing demands for AI computation power, where NVIDIA holds a leading position.

Industry-Leading Technology Developments

Navitas Semiconductor is at the forefront of power semiconductor innovations, recently launching a new 12kW GaN & SiC platform. According to the announcement also dated May 21, 2025, this platform sets new efficiency standards by achieving 97.8% efficiency, which is paramount for hyperscale AI data centers. Such technological advancements further enhance Navitas’s competitive edge in supporting energy-efficient infrastructure for data-intensive applications, thus possibly attracting increased institutional interest.

Trading Volume Analysis

The unprecedented surge was accompanied by a significant spike in trading volume, with 272,303,360 shares traded. The elevated volume suggests intense buying pressure potentially fueled by institutional investors and algorithmic trading. The absence of recent news or disclosures beyond the collaboration may imply concerted institutional positioning, possibly aligned with anticipation of future growth driven by strong partnerships and technological superiority.

Potential Investment Risks

Sensitivity to Industry Trends

Despite these promising developments, NVTS stock remains sensitive to industry trends in power delivery systems and broader technological shifts. Fluctuations in semiconductor demand, shifts towards alternative technologies, and competitive pressures from other semiconductor manufacturers pose significant risks to sustaining price momentum.

Market Volatility and Speculative Trading

The rapid increase in stock price also heightens market volatility, posing challenges for retail investors. The current trading patterns suggest speculative activity, making NVTS potentially susceptible to rapid price corrections if market sentiment shifts or if anticipated growth does not materialize as swiftly as expected.

Financial Performance and Valuation Concerns

Investors should scrutinize Navitas’s financial health and market valuation, especially given the stock’s rapid appreciation. Evaluating revenue streams, profitability, and expansion strategies will be vital in ensuring that the stock price reflects fundamental value rather than speculative exuberance.

Conclusion: Weighing Opportunities and Caution

The surge in Navitas Semiconductor stock price signifies robust growth potential attributed to strategic collaborations and cutting-edge technology products. However, investors must cautiously approach this volatility, balancing enthusiasm about Navitas’s potential against market and industry risks. Continued monitoring of insider trading patterns and future developments with NVIDIA and other industry stakeholders essential for informed investment decisions.

Leave a Reply