Analyzing the 129% Surge in ZKIN Stock Price: What Investors Need to Know

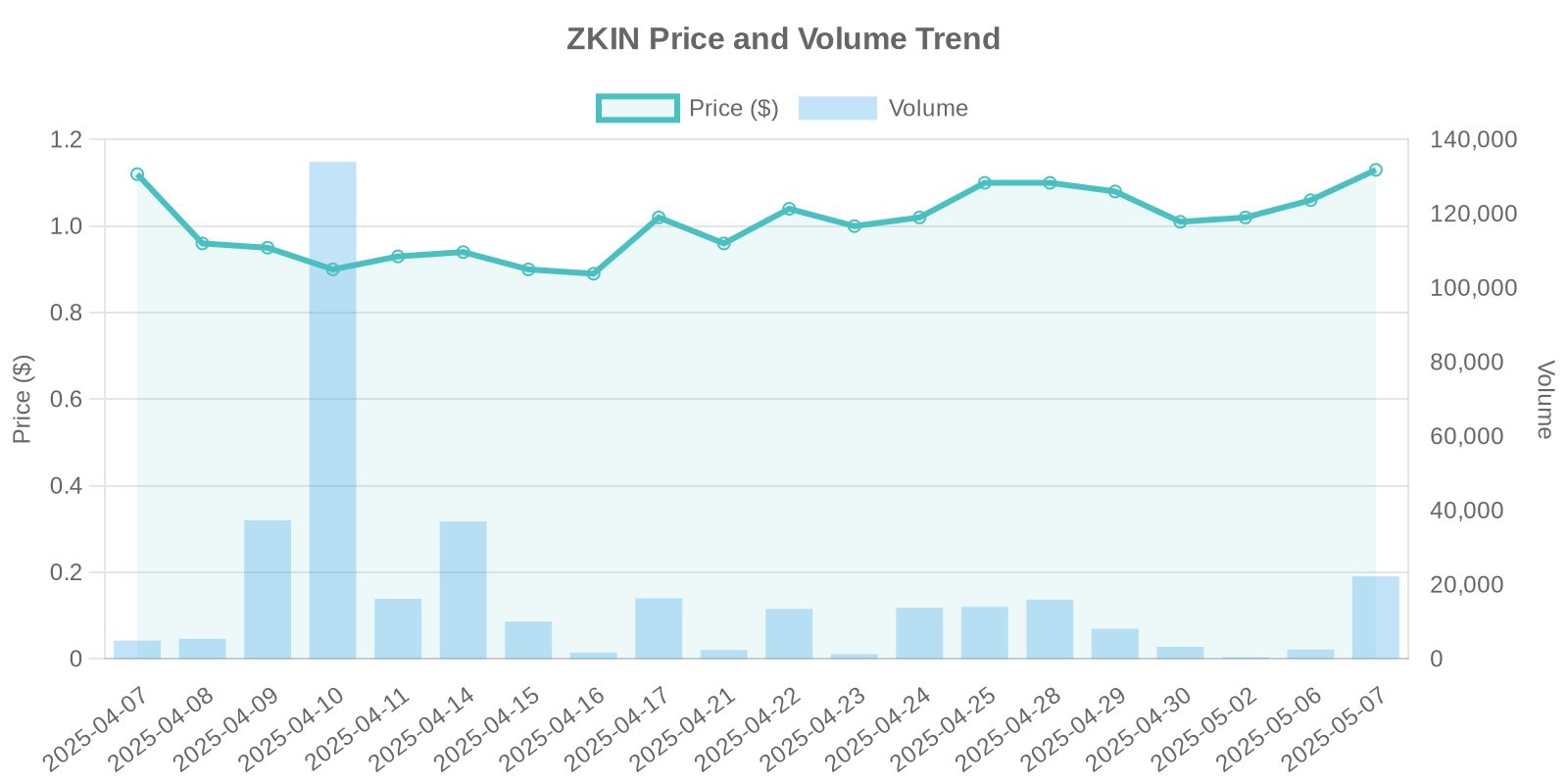

In the realm of financial markets, few events capture investor attention like a significant surge in a company’s stock price. Recently, ZK International Group Co., Ltd (NASDAQ: ZKIN) experienced a remarkable 129.09% increase in its stock price, catapulting it to $2.52. As trading volumes also soared to 74,380,535 shares, this event begs the question: What’s driving this surge?

Company Overview: ZK International Group Co., Ltd

ZK International, based in China, specializes in the engineering design and installation of stainless-steel piping systems that deliver high-quality drinking water and gas solutions. The company is known for its innovative technologies applied in large-scale projects, notably in water distribution and water purification systems. Currently, ZKIN is expanding its ventures into technology and blockchain through its subsidiary, xSigma Corporation, hoping to synergize with traditional infrastructures.

Market and Industry Trends

The surge in ZKIN’s stock price aligns with a growing trend in the market focusing on infrastructure development and sustainable technologies. With increased global attention on clean water supply and infrastructure spending, ZK International is well-positioned in a niche market that’s gaining momentum. Investors looking at ESG (Environmental, Social, Governance) criteria have also been inclined to invest in companies that promise environmental sustainability, potentially contributing to ZKIN’s attractiveness.

Exploring the Recent Stock Price Surge

The 129% surge in ZKIN stock is notably dramatic, especially in the absence of any significant company announcements or disclosures. Such a spike can often be attributed to several factors, including speculative trading, short squeezes, or institutional maneuvers. This increase was accompanied by an unprecedented trading volume, reaching over 74 million shares, which is several times higher than ZKIN’s usual daily average.

Insider Trading and Stock Buybacks

As of now, there are no substantial records of insider trading activities or planned stock buyback programs. The absence of insider selling could imply that those most familiar with the company’s operations are holding tight, indicating confidence in long-term prospects. However, transparency regarding insider trades and buyback intentions would be beneficial for further insight.

Potential Institutional Trading Patterns

The lack of clear news leading to ZKIN’s price surge suggests a possible engagement of institutional traders. Institutions often move large volumes, causing substantial shifts in stock prices. Additionally, strategies such as high-frequency trading and algorithmic models designed to bet on volatility could be at play. Investors should be aware of the liquidity risks associated with these patterns, which can lead to rapid reversals.

Historical Comparison and Buying Force Patterns

Historically, ZKIN has experienced volatility, especially during its transitions into emerging sectors like blockchain. Similar bursts in stock price have often been followed by corrections, underscoring the importance of cautious investment strategies. Today’s surge mirrors those patterns, possibly fueled by the collective buying power of retail investors influenced by social media trends or trading forums.

Balancing Opportunities with Risks

For retail investors, the opportunity to capitalize on rapid gains is attractive, yet it also comes with substantial risks. Potential investors should consider market volatility and the speculative nature of such investments. ZKIN’s involvement in emerging technologies and traditional infrastructure positions it uniquely, but as with any growth sector, the risk of overvaluation and market corrections warrants attention.

Conclusion: Strategic Considerations for Investors

While ZKIN’s recent surge presents a compelling investment narrative, due diligence remains crucial. Investors are advised to stay updated with company announcements, watch for large trades that might suggest further institutional action, and evaluate the broader market conditions impacting the industry. By balancing speculative engagements with fundamental analysis, investors can navigate the exciting yet unpredictable waters of ZK International’s stock trajectory.

Leave a Reply