Understanding the Dramatic Surge in WW Stock Price

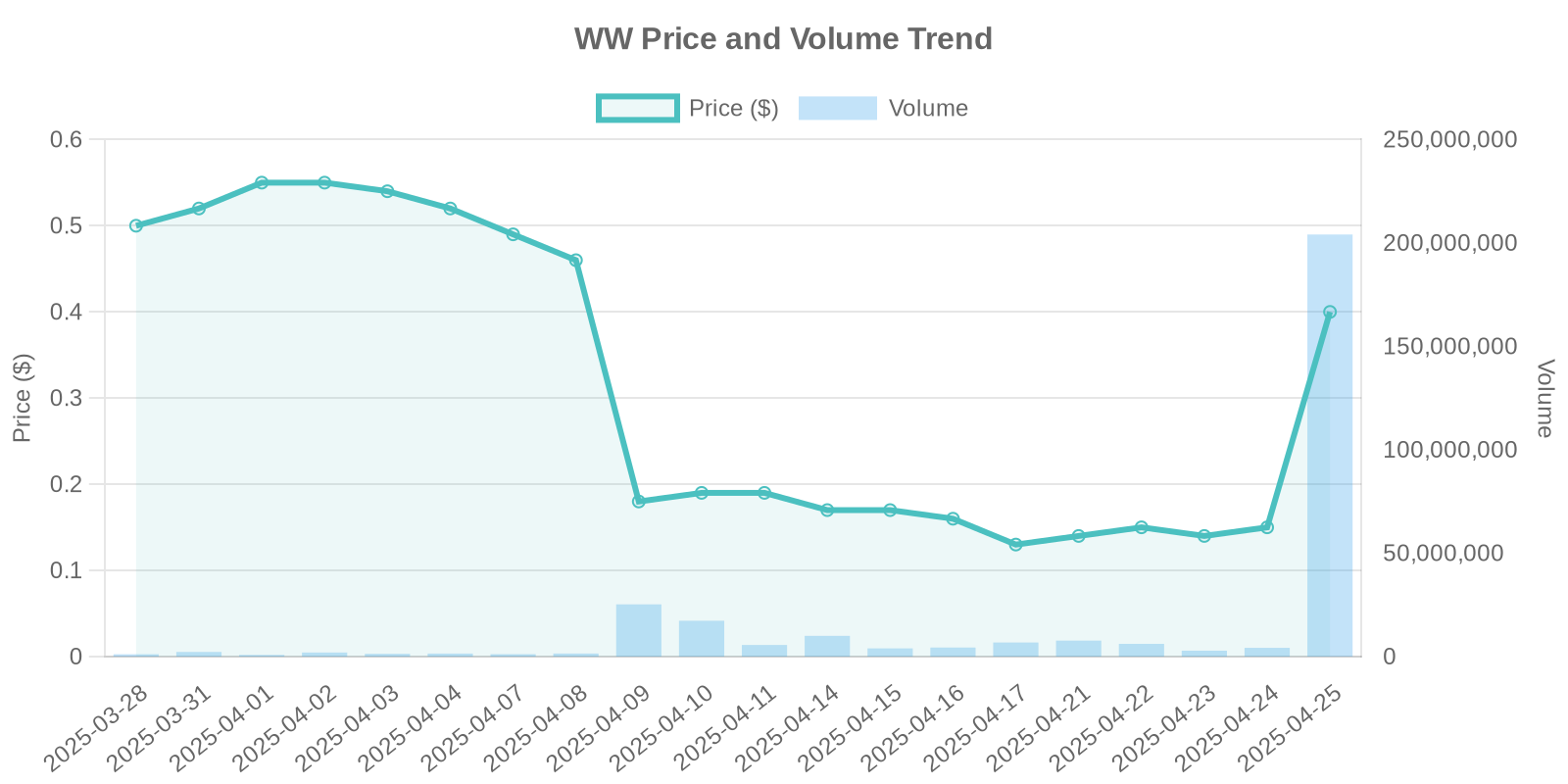

The stock market is often characterized by its volatility and its ability to surprise investors with sudden movements. A prime example of this is the recent 168.02% surge in WW International Inc. (NASDAQ: WW) stock, which has shocked both retail and institutional investors. Currently trading at $0.4 on robust volume levels peaking at 198,362,690 shares, the sudden leap in stock price warrants a detailed exploration of possible causes, implications, and risks associated with the current surge.

Company Overview: Who is WW International?

WW International Inc., formerly known as Weight Watchers, is a global wellness company and a leader in weight management services. With a comprehensive approach to health, WW offers a range of products and services that have helped millions worldwide. Despite the transformative rebranding efforts and embracing new digital strategies, the company has faced stiff competition and fluctuating market conditions, which have historically influenced its stock performance.

Examining the Factors Behind WW’s Stock Surge

The dramatic increase in WW’s stock price to $0.4, up by 168.02%, is not accompanied by any apparent news, insider trading disclosures, or confirmed stock buyback activities. This absence of concrete catalysts typically prompts speculation on underlying institutional trading strategies and investor sentiment. High volume trading of 198,362,690 shares suggests significant institutional or speculative actions driving the surge.

Potential Institutional Trading Patterns

With no insider trading records or buyback announcements coinciding with the current surge, attention turns to the possibility of institutional trading. Large institutional trades can often create significant price movements, especially in stocks with relatively lower market capitalizations. The heightened trading volume may reflect repositioning by hedge funds or institutional investors taking advantage of perceived undervaluation or future growth potential despite market uncertainties.

Insights into Market Trends and Impact on WW

The health and wellness industry is undergoing rapid transformation, pivoting towards digital solutions amid shifting consumer demands. WW International has invested in enhancing its digital platforms, potentially positioning itself well to capture growth from health-conscious and technology-driven consumer bases. However, the intensity of competition from tech-based wellness startups could present ongoing challenges.

Risks Associated with Investing in WW Stock

Despite the attractive valuation following the stock’s recent surge, potential investors should be wary of the inherent risks. The lack of substantial news or strategic disclosures raises questions about the sustainability of this growth. Additionally, market volatility and competitive pressures could impact the stock’s long-term performance. Investors should also consider broader macroeconomic factors and changes in consumer preferences that could influence the company’s future trajectory.

Historical Comparison and Future Outlook

To better understand the recent price activity, it’s important to compare it with similar historical patterns. Past instances of unexplained stock price increases often involve speculative bubbles or insider trading activities, which subsequently stabilize. For WW, the outlook will depend largely on its ability to innovate and maintain relevant in the competitive wellness space.

Conclusion: Cautious Optimism for Investors

While WW’s sudden stock price surge is an exciting development, it invites a cautious approach from potential investors. Without explicit news or strategic initiatives to justify the increase, evaluating company fundamentals and ongoing market conditions becomes crucial. Investors should remain vigilant of possible market corrections and ensure portfolio diversity to mitigate risks associated with singular stock investments. As WW navigates the complex landscape of wellness and digital transformation, its growth prospects will depend on strategic execution and market adaptability.

Leave a Reply