What is Cluster Trading?

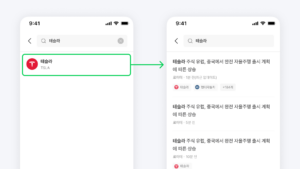

Cluster trading refers to the scenario where insiders of a company engage in similar transactions (buying or selling) within a specific period. When insiders, who have deeper knowledge of a company’s internal matters, engage in such actions, their trading behavior can provide useful insights into the company’s future prospects, potentially influencing stock prices. Furthermore, if multiple insiders simultaneously engage in transactions in the same direction, it can increase the reliability of the information from those insider trades.

This hypothesis was empirically tested using insider trading data from Waiker.

Analytical Method

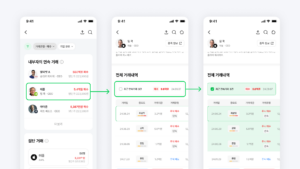

- Definition of Cluster Trading:

- A cluster trade is defined when at least 4 insiders trade in the same direction (buying or selling) within 30 days of the initial insider trade date.

- Performance Measurement:

- The performance of stock price is tracked for up to 60 trading days following the initial insider trade date to calculate cumulative returns.

- Cluster vs Non-Cluster:

- Cluster trades are compared with non-cluster trades (defined as insider trades that do not meet the 4 insiders threshold).

- Average cumulative returns for both cluster and non-cluster trades are calculated for comparison.

- Comparison of Results:

- The performance of cluster trades is compared with non-cluster trades over various timeframes (20, 40, 60 trading days) to analyze the potential benefit of cluster trading.

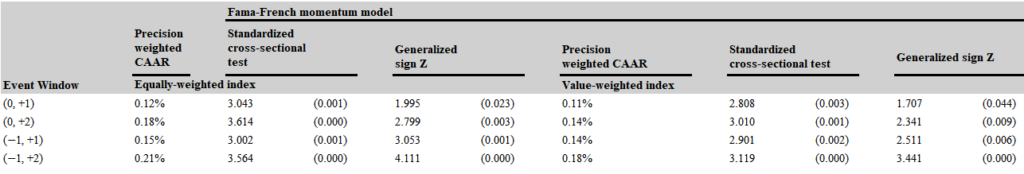

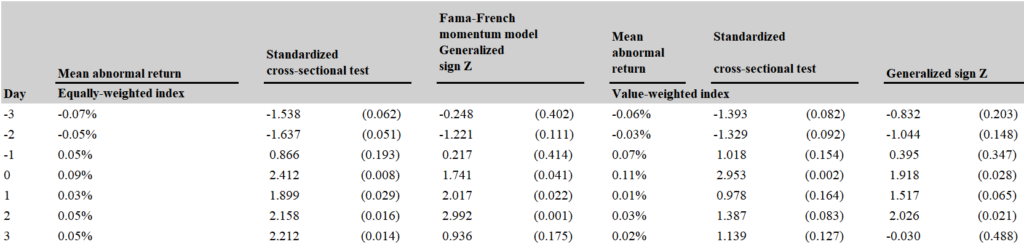

Results of the Analysis

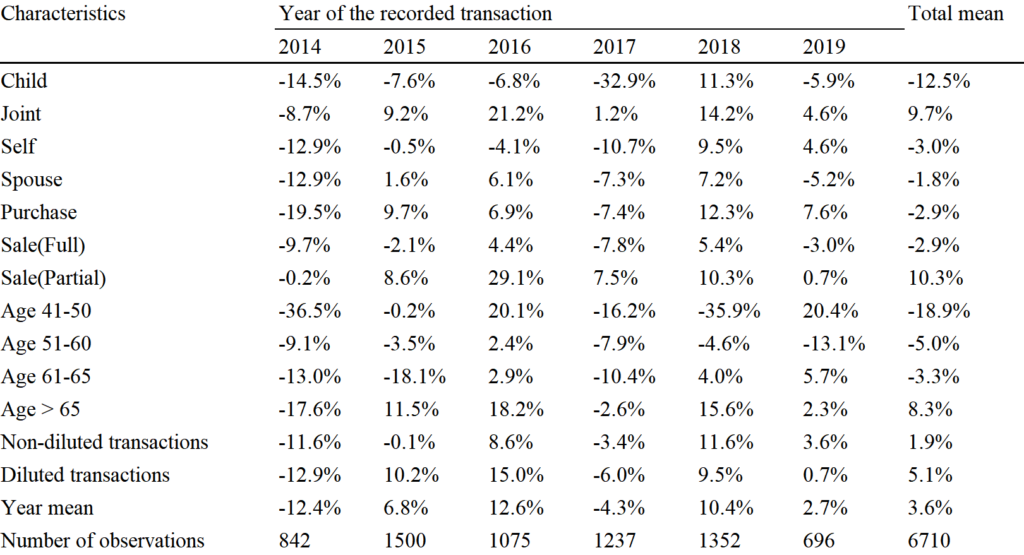

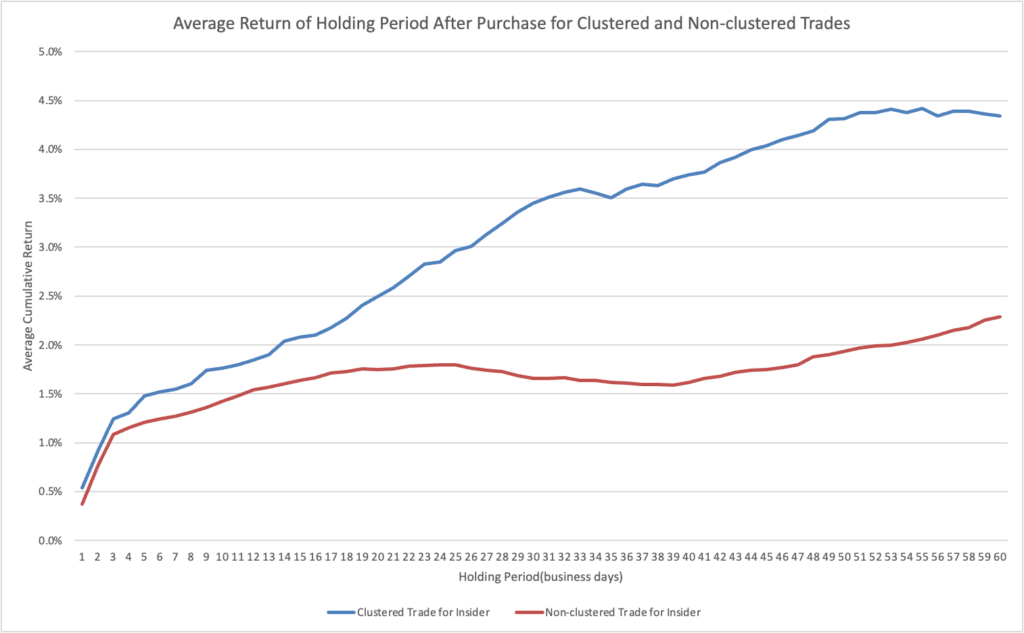

- Cluster Trading Outperforms Non-Cluster Trading:

- Non-cluster trades exhibit lower returns compared to cluster trades at 20, 40, and 60 trading day intervals (as seen in the blue-highlighted cells in the table below).

- Annualized Returns:

- At the 20 trading-day mark, cluster trading yields 11.31% higher returns than non-cluster trading.

- At the 40 trading-day mark, cluster trading outperforms by 14.53%.

- At the 60 trading-day mark, cluster trades result in 9.05% higher returns.

- Cluster Trades Show Consistent Performance Over Time:

- Cluster trades demonstrate a steady performance over time, while non-cluster trades do not show similar long-term results.

- Optimal Holding Period:

- The best performance for cluster trades occurs with a 20 trading-day holding period, which indicates that the value of the insider information from cluster trading diminishes over time.

Key Findings

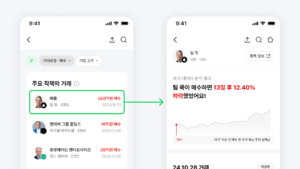

- Cluster Trading Signals:

- When 4 or more insiders engage in buying transactions within the past month and there are no selling trades, the likelihood of a positive performance is high.

- Cluster Trading Stability:

- Cluster trades tend to provide more stable and consistent returns than non-cluster trades.

Performance Summary:

| Cluster Period | Number of Insiders | Sample Size | Buy/Sell | 20-Day Avg. Return (Annualized) | 40-Day Avg. Return (Annualized) | 60-Day Avg. Return (Annualized) |

|---|---|---|---|---|---|---|

| Cluster Trading | 4 Insiders | 32,524 | Buy | 2.49% (34.4%) | 3.74% (24.65%) | 4.34% (18.52%) |

| Non-Cluster | – | 68,429 | Buy | 1.75% (23.09%) | 1.62% (10.12%) | 2.29% (9.47%) |

Note: The table presents both the cumulative returns and their annualized values for comparison.

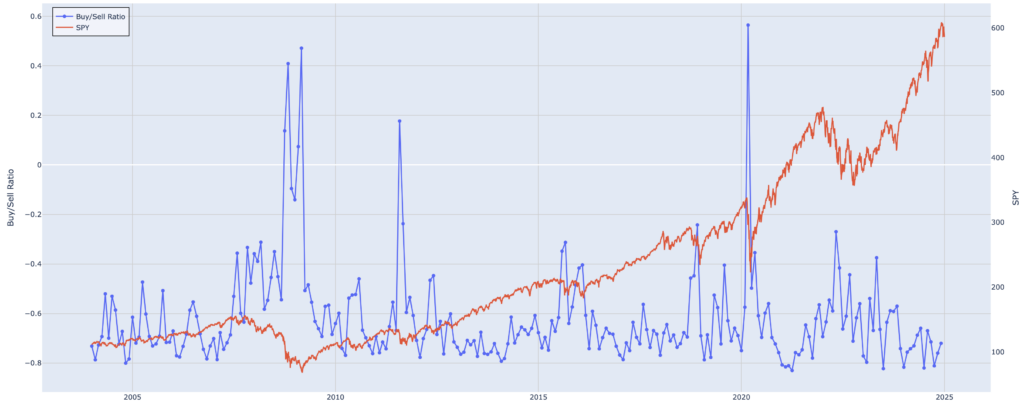

Time-series Changes in Average Return

Conclusion

- Cluster Trading’s Advantage:

- Insider transactions that occur in clusters (with 4 or more insiders trading in the same direction) significantly outperform non-cluster trades in terms of return.

- Cluster trading tends to provide more consistent and stable returns, especially when compared to non-cluster trades.

- Optimal Holding Period: The ideal holding period for cluster trades is 20 trading days, beyond which the value of the insider information tends to decrease.

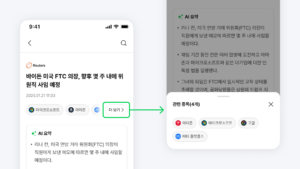

- Insights for Investors:

- Cluster trades offer a strong signal for investors looking for stable returns and insider-driven insights into stock price movements.

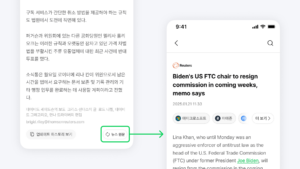

- Data Availability:

- Detailed cluster trading data is provided by Weikher’s Insider Trading Database, allowing investors to access valuable insights on insider trading patterns and trends.