Introduction: The Stunning 96% Surge in MODV Stock Price

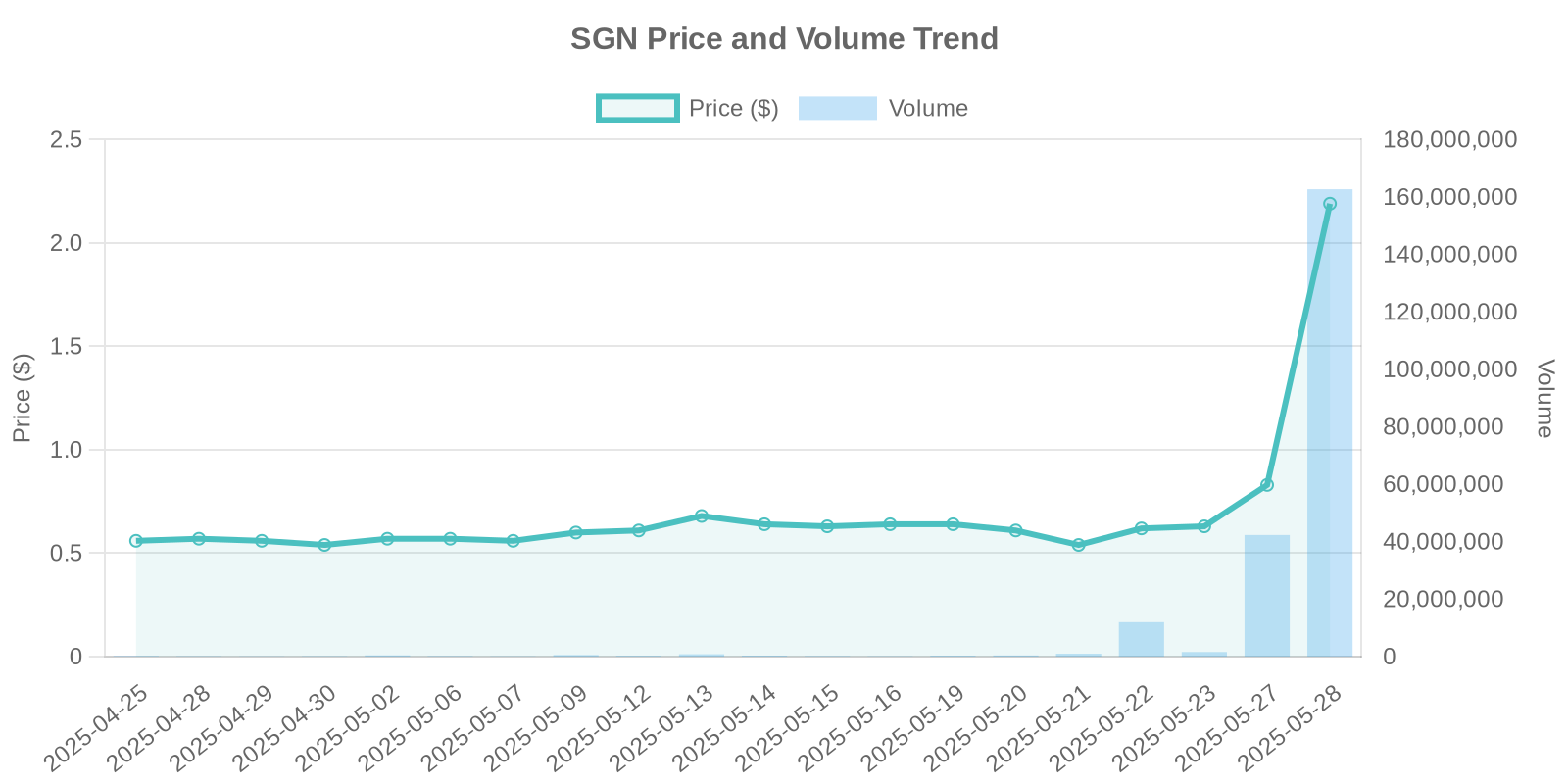

In a remarkable turn of events, MODV stock has experienced an unprecedented surge of 96.43%, propelling its current price to $2.2. This phenomenal increase has piqued the interest of investors and analysts alike, drawing attention to potential underlying factors driving this surge.

Company Overview: What Drives MODV?

MODV, a key player in its sector, operates within the technology industry, offering diverse products and services. Understanding its market position is crucial for investors seeking to capitalize on the recent stock movement. Despite the surge, the absence of any notable insider trading activity or official stock buybacks raises intriguing questions.

Trading Volume as a Key Indicator

The surge in MODV stock was accompanied by an extraordinary trading volume of 99,009,454, a substantial increase from its average. Such a dramatic uptick in volume typically suggests heightened market interest potentially initiated by institutional investors who maintain the power to influence stock price movements significantly.

Potential Institutional Trading Patterns

Without concrete news or disclosures to attribute the surge, the possibility of institutional trading patterns emerges as a likely catalyst. Institutional investors often engage in strategic transactions that can overshadow typical retail trading activities. This influence is even more pronounced when large hedge funds or investment firms express substantial interest in acquiring bulk shares.

Analyzing Correlations: Insider Trading and Stock Buybacks

While insider trading is often a strong indicator of expected stock performance, MODV shows no such activity. Similarly, there are no recent stock buyback programs announced. The absence of these activities may imply that the stock surge is primarily driven by external market dynamics rather than internal confidence.

Sector Trends Influencing MODV Stock

Examining broader industry trends provides context for MODV’s price increase. The technology sector has seen varied performance, with certain segments experiencing heightened demand. Innovations and tech advancements continue to attract investment, providing a fertile ground for stocks like MODV to surge unexpectedly.

Investment Risks and Considerations

While the surge in MODV stock price is enticing, potential investors should remain cautious. Rapid increases often lead to volatility, posing significant risks, especially without clear disclosures or transparent reasons behind the rise. We encourage investors to conduct due diligence and consider the implications of a potential market correction.

Conclusion: Balancing Opportunity with Caution

MODV’s stock surge presents an interesting case study of market dynamics. The stock’s significant volume and unexplained rise point towards possible institutional trading, urging investors to exercise a balanced approach. By considering industry knowledge, sector trends, and conducting thorough research, investors can navigate this surge with informed strategies.